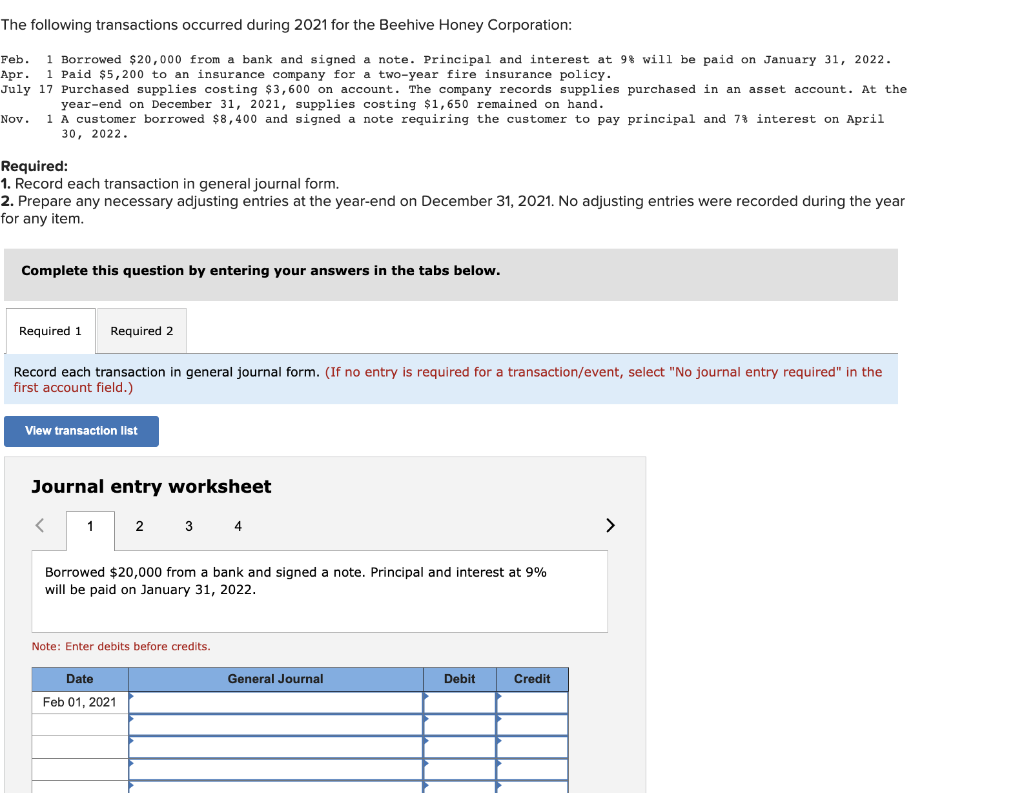

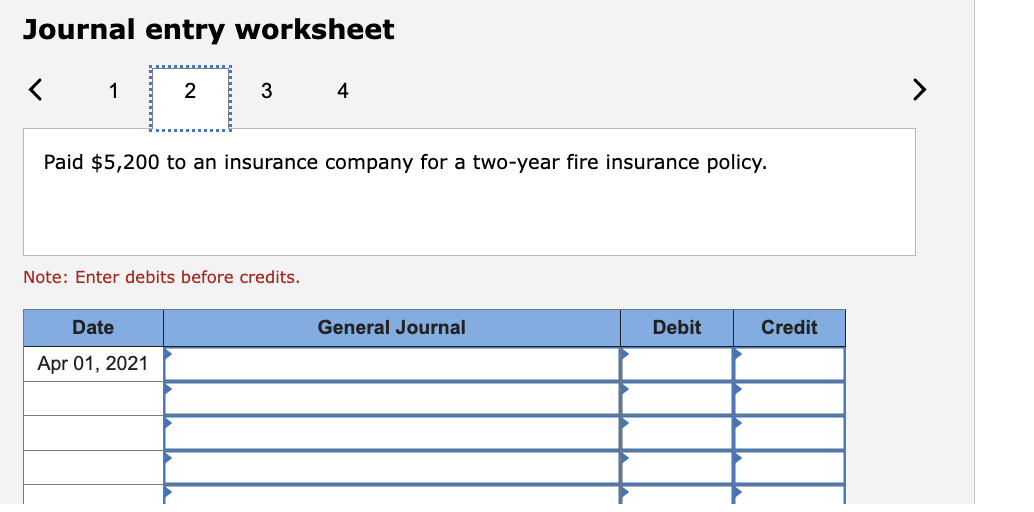

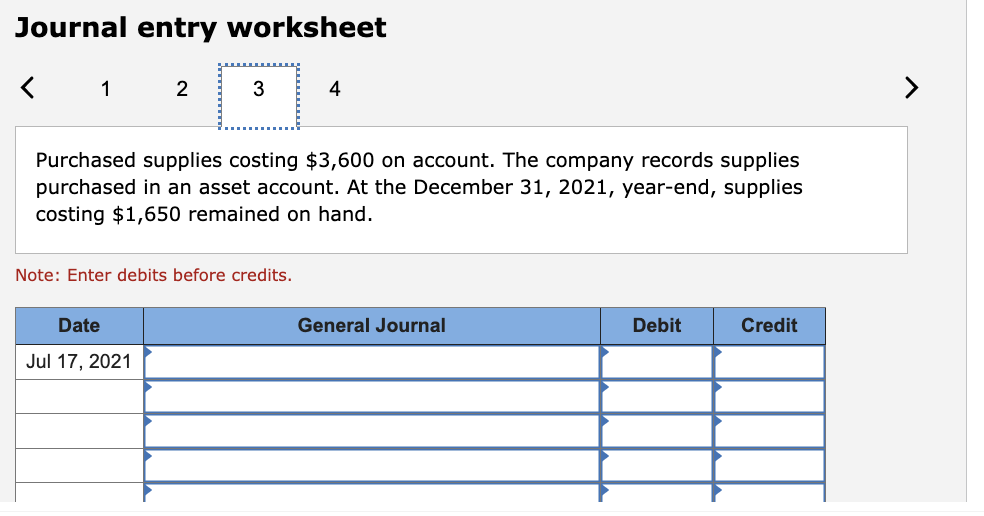

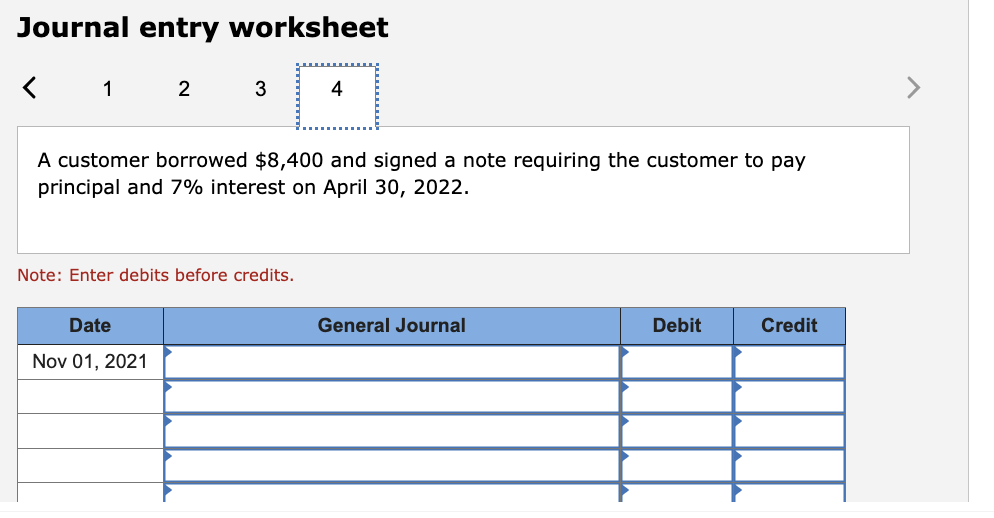

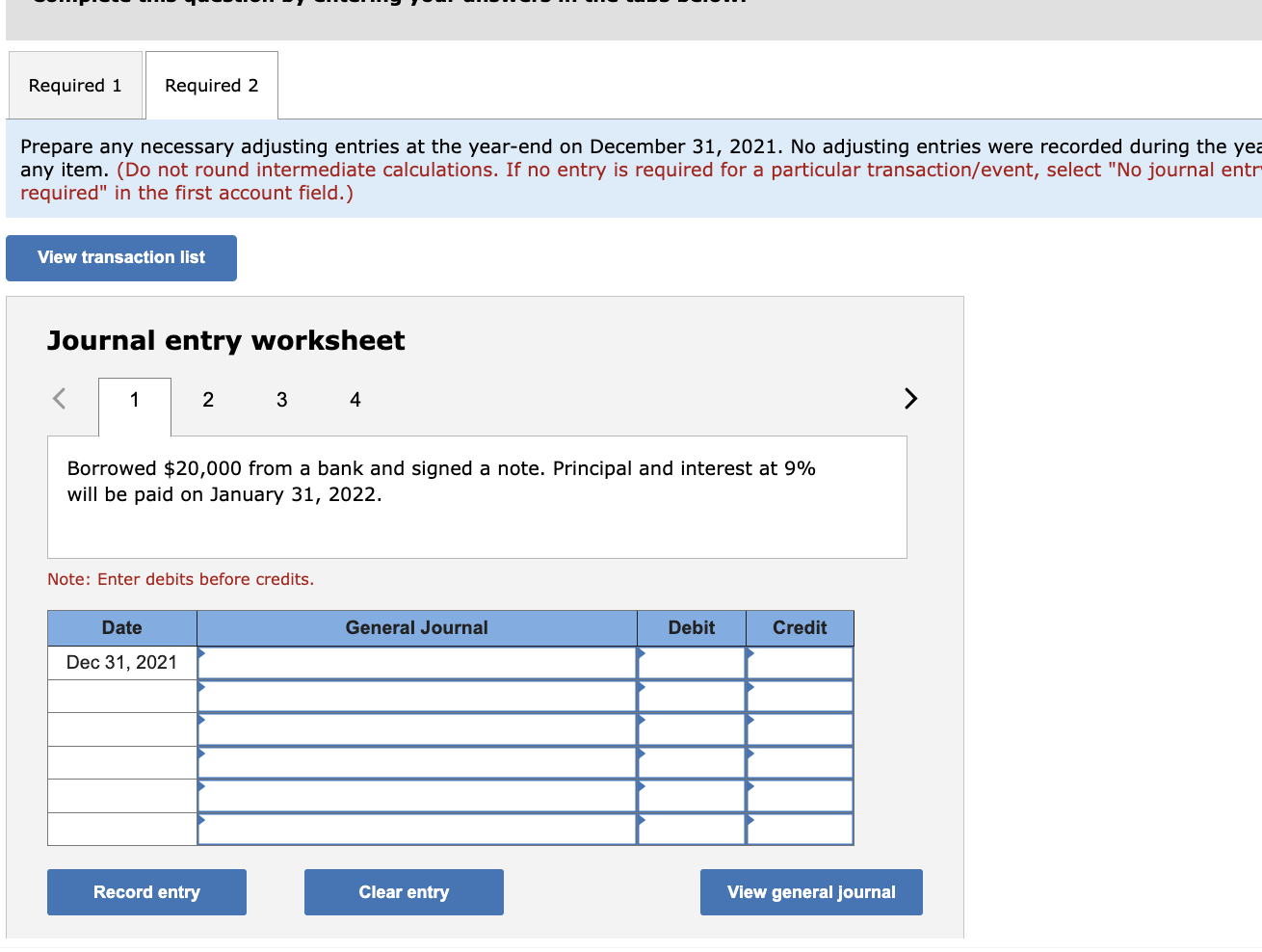

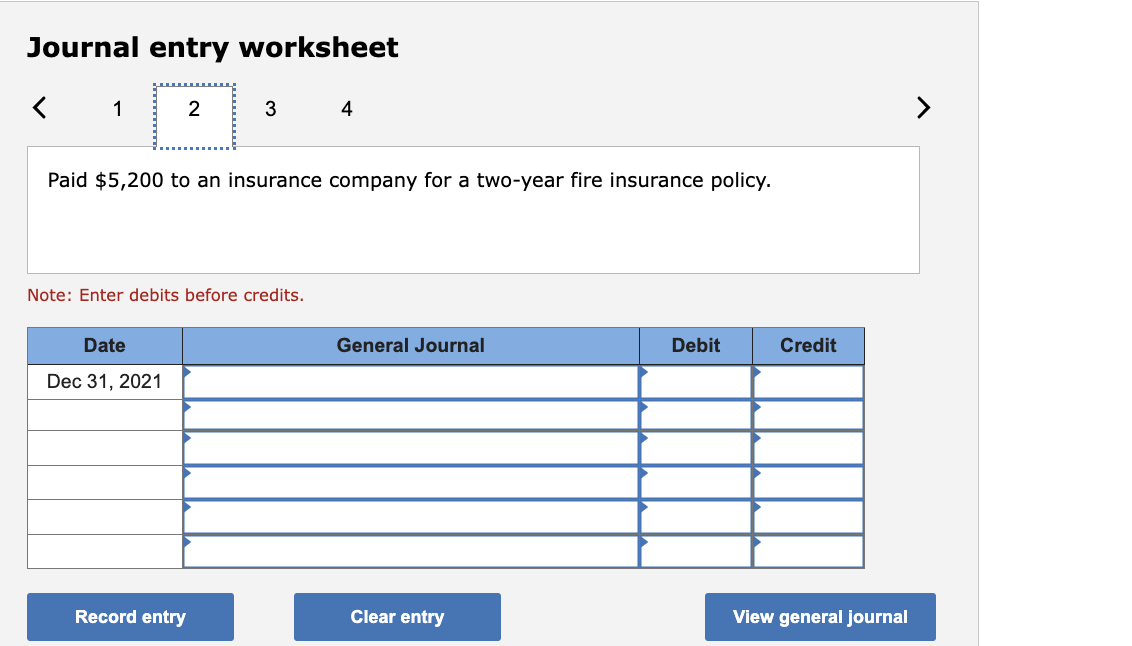

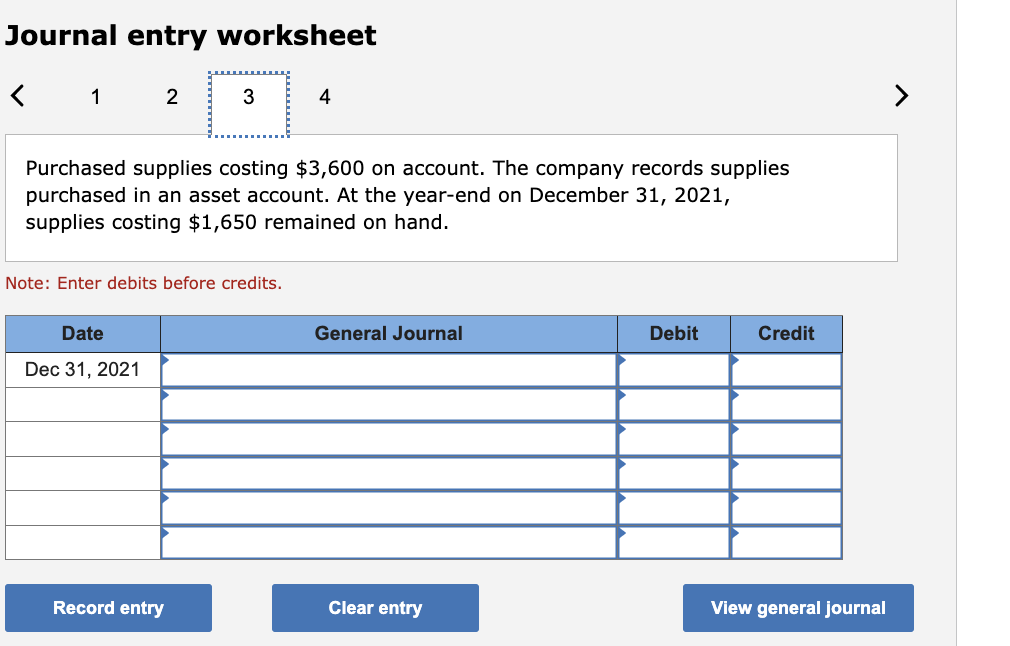

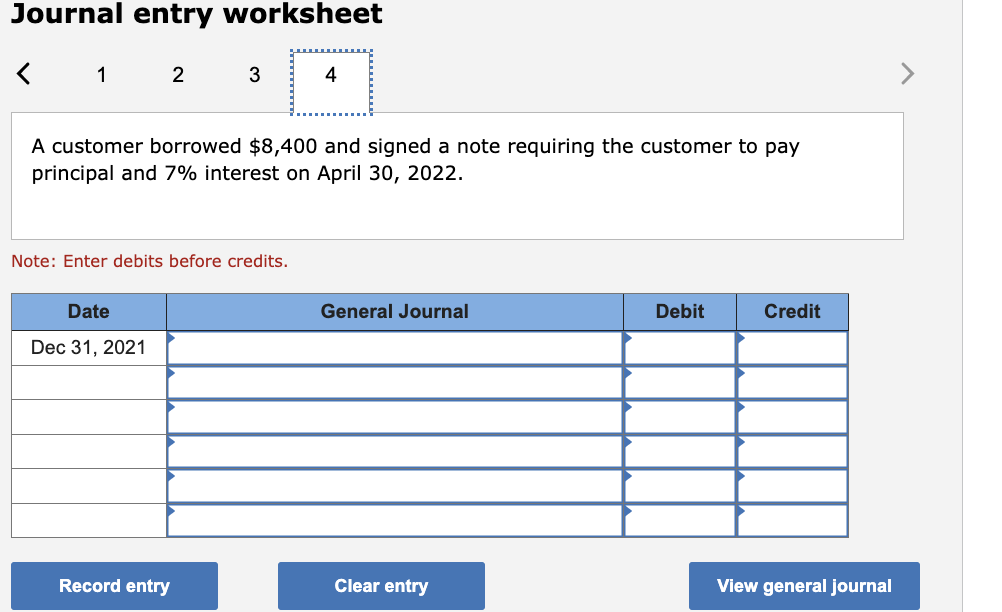

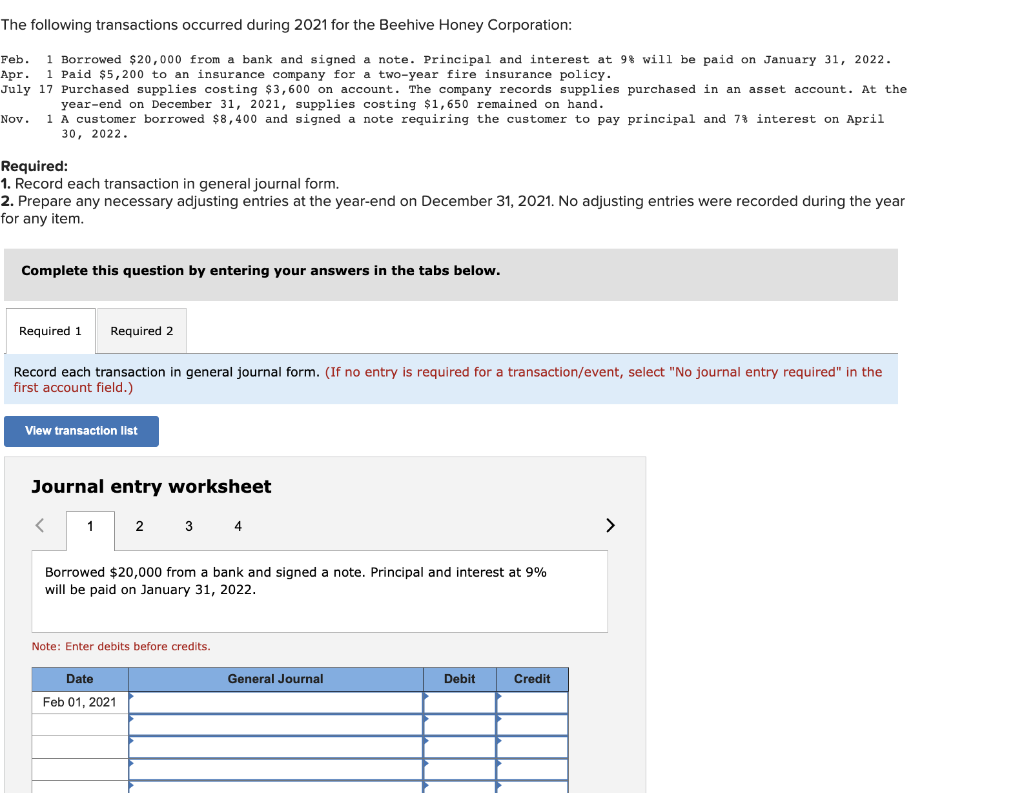

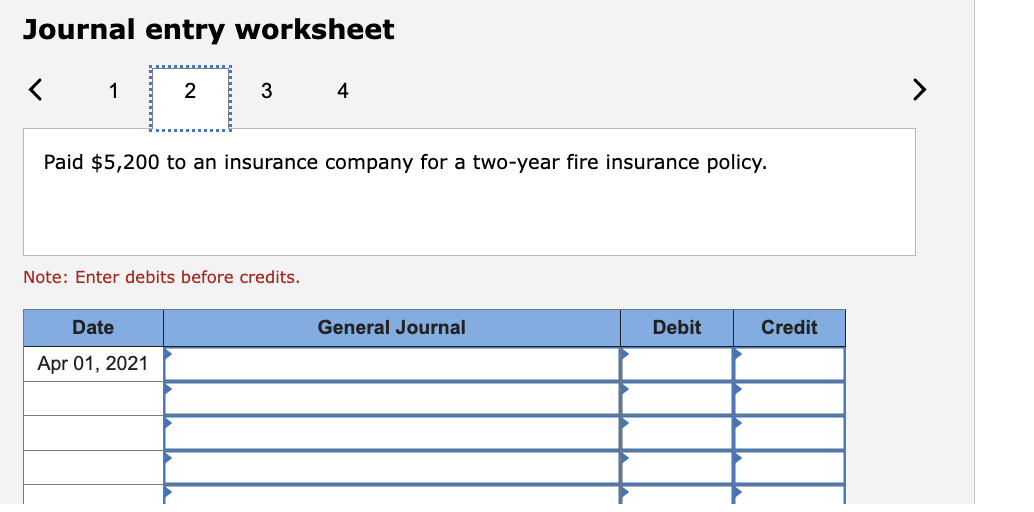

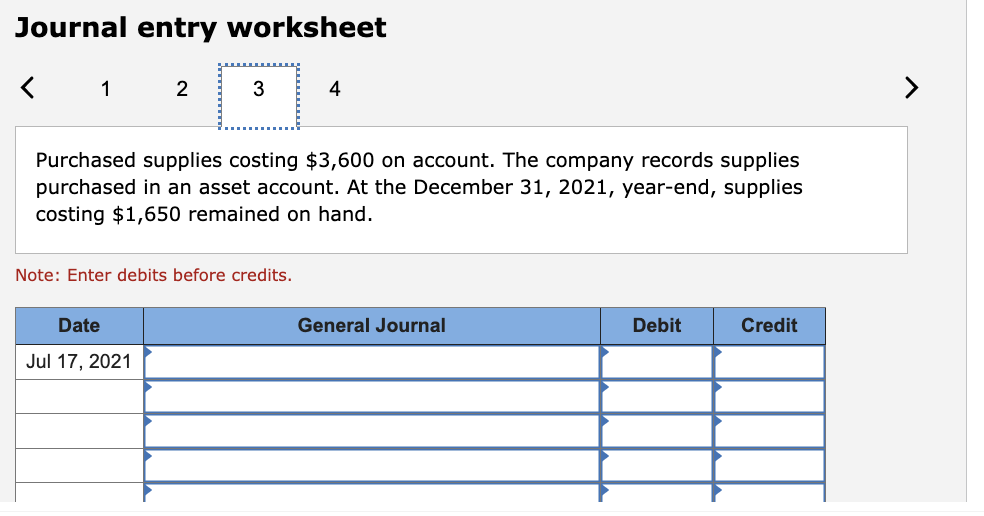

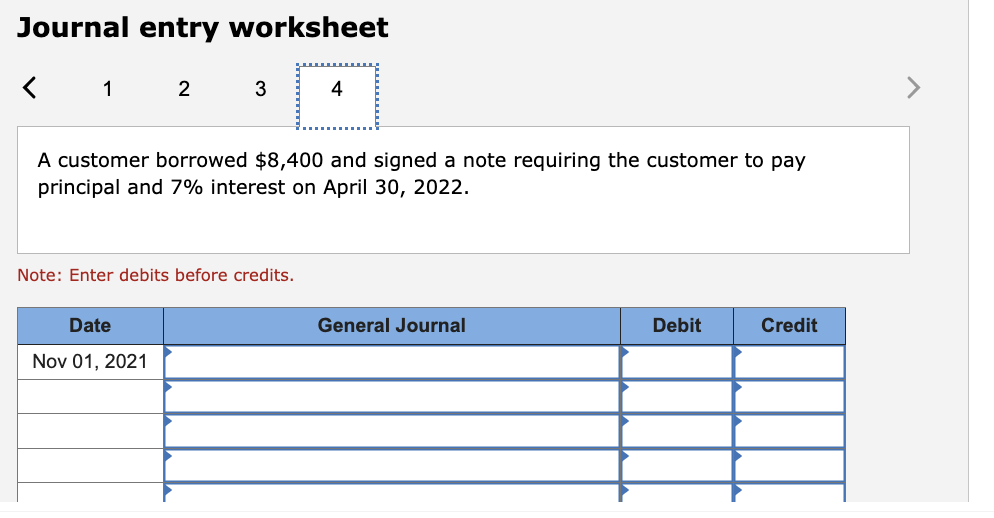

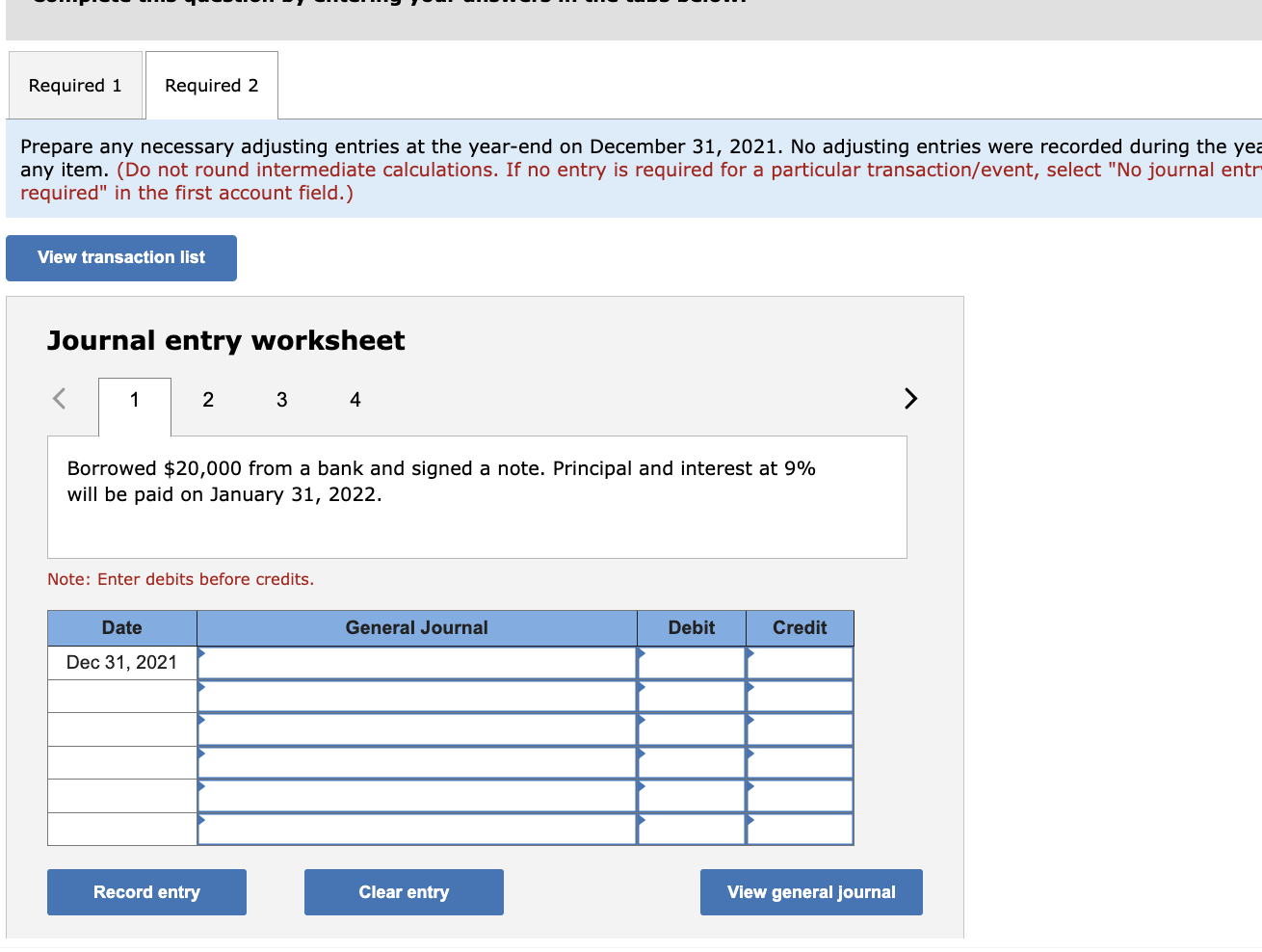

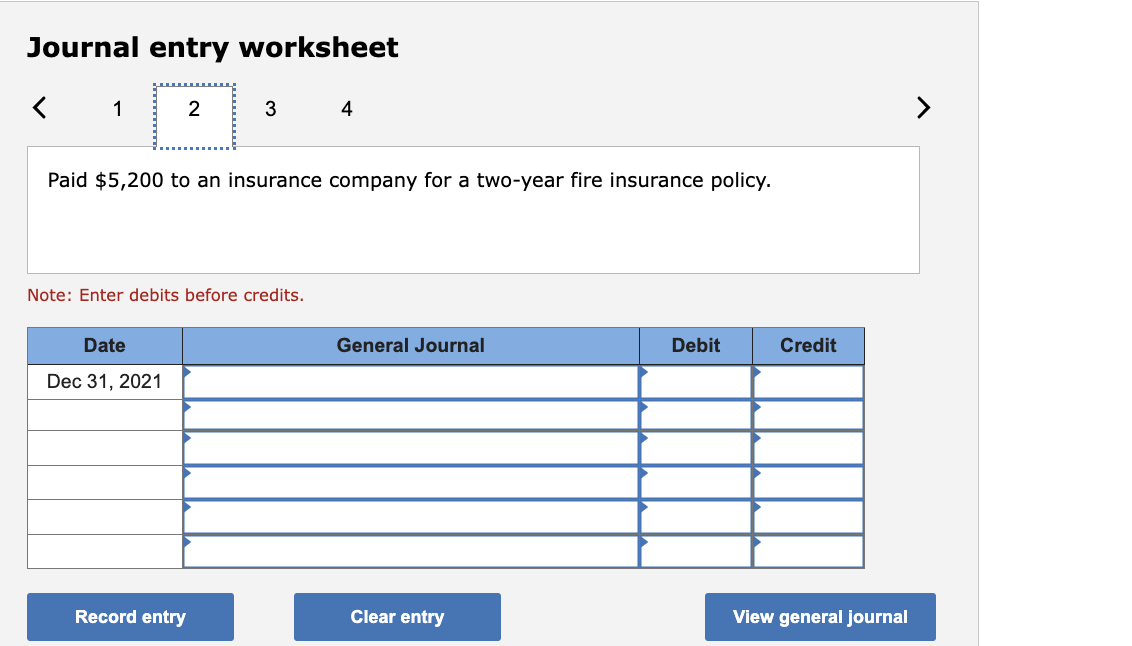

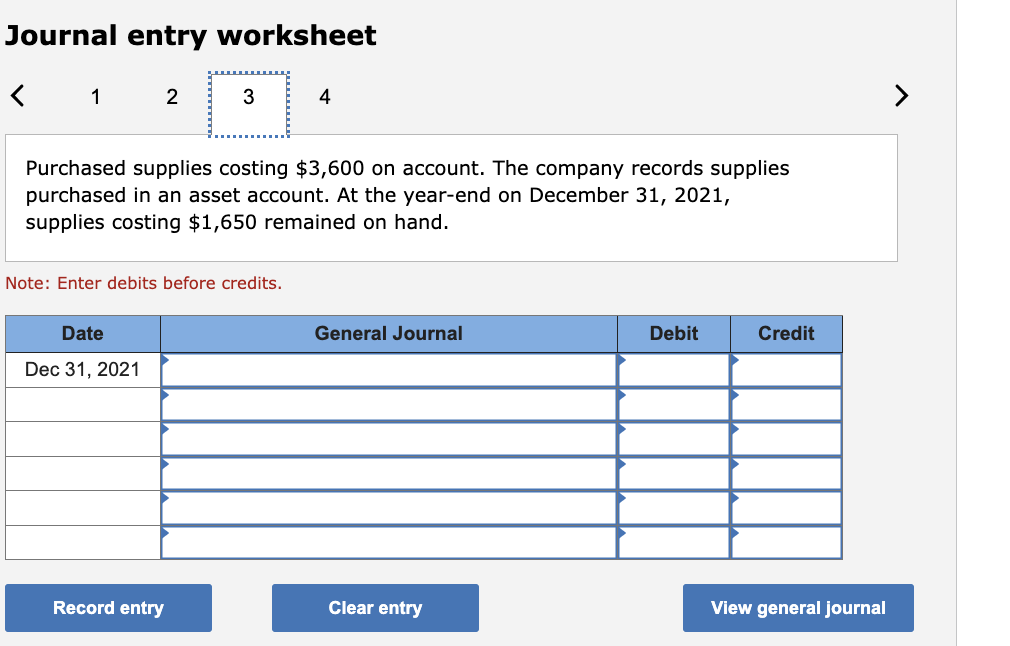

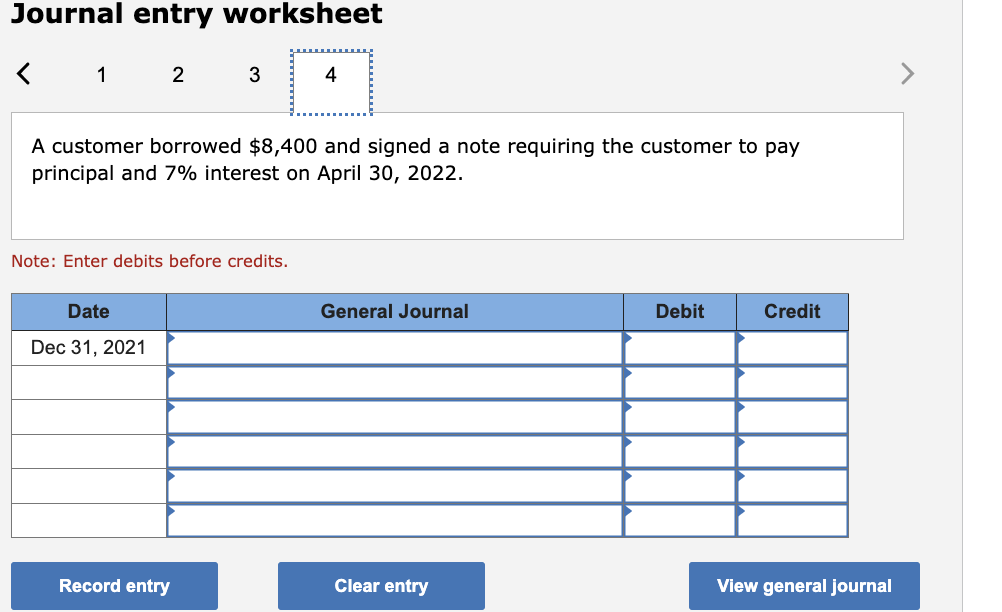

The following transactions occurred during 2021 for the Beehive Honey Corporation: Feb. 1 Borrowed $20,000 from a bank and signed a note. Principal and interest at 98 will be paid on January 31 , 2022. apr. 1 Paid $5,200 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $3,600 on account. The company records supplies purchased in an asset account. At the year-end on December 31,2021 , supplies costing $1,650 remained on hand. Nov. 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 78 interest on April 30,2022 . Required: 1. Record each transaction in general journal form. 2. Prepare any necessary adjusting entries at the year-end on December 31, 2021. No adjusting entries were recorded during the year or any item. Complete this question by entering your answers in the tabs below. Record each transaction in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31, 2022. Note: Enter debits before credits. Journal entry worksheet Paid $5,200 to an insurance company for a two-year fire insurance policy. Note: Enter debits before credits. Journal entry worksheet Purchased supplies costing $3,600 on account. The company records supplies purchased in an asset account. At the December 31, 2021, year-end, supplies costing $1,650 remained on hand. Note: Enter debits before credits. Journal entry worksheet A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2022. Note: Enter debits before credits. Prepare any necessary adjusting entries at the year-end on December 31,2021 . No adjusting entries were recorded during the yea any item. (Do not round intermediate calculations. If no entry is required for a particular transaction/event, select "No journal entr required" in the first account field.) Journal entry worksheet Borrowed $20,000 from a bank and signed a note. Principal and interest at 9% will be paid on January 31,2022. Note: Enter debits before credits. Journal entry worksheet Paid \$5,200 to an insurance company for a two-year fire insurance policy. Note: Enter debits before credits. Journal entry worksheet Purchased supplies costing $3,600 on account. The company records supplies purchased in an asset account. At the year-end on December 31, 2021, supplies costing $1,650 remained on hand. Note: Enter debits before credits. Journal entry worksheet 1 A customer borrowed $8,400 and signed a note requiring the customer to pay principal and 7% interest on April 30, 2022. Note: Enter debits before credits