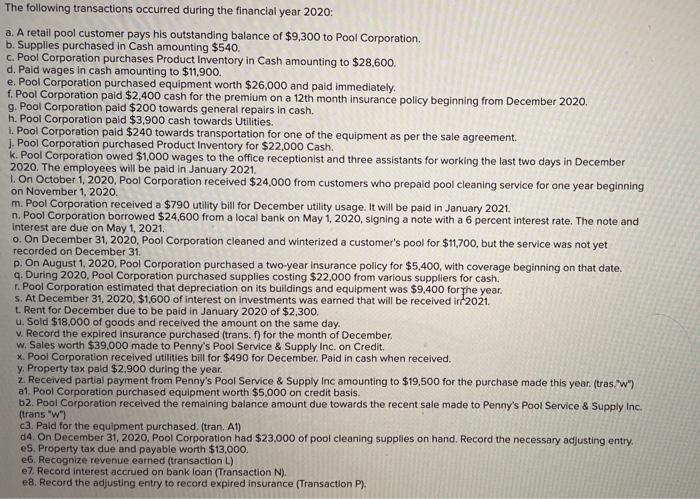

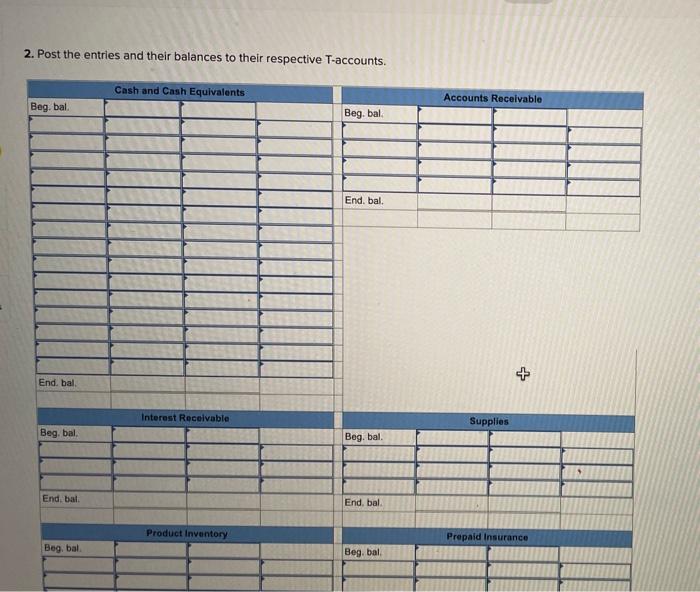

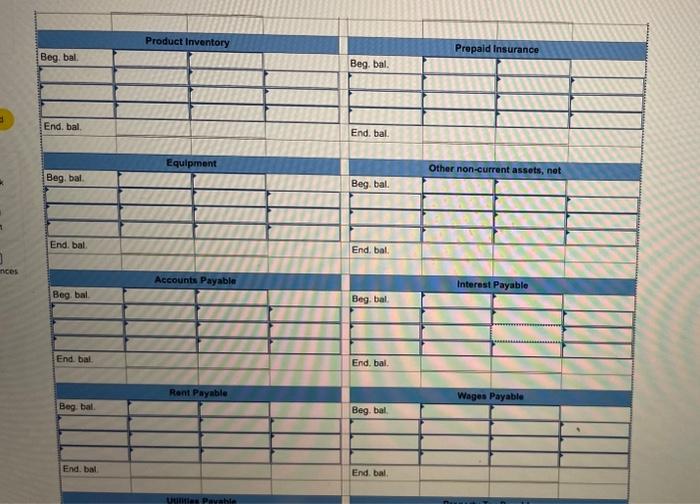

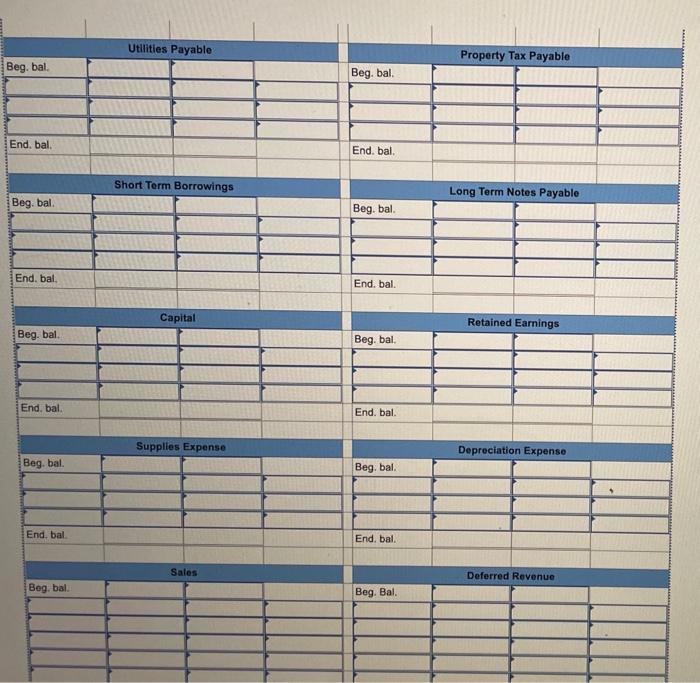

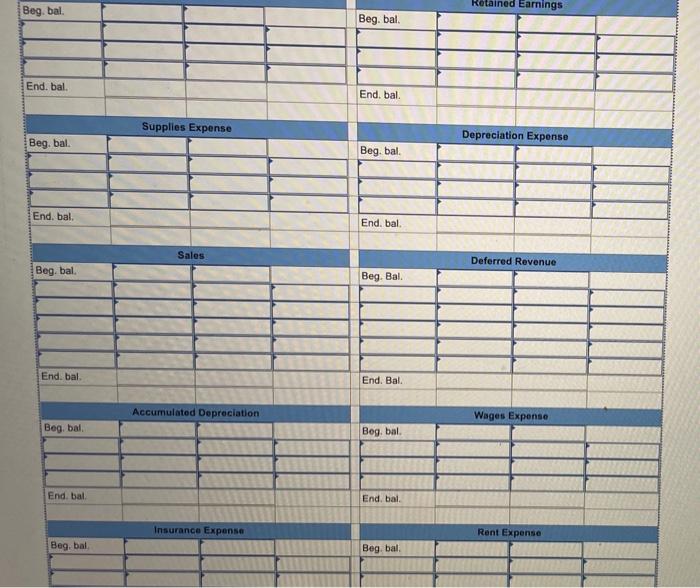

The following transactions occurred during the financial year 2020 : a. A retail pool customer pays his outstanding balance of $9,300 to Pool Corporation. b. Supplles purchased in Cash amounting $540. c. Pool Corporation purchases Product Inventory in Cash amounting to $28,600. d. Paid wages in cash amounting to $11,900. e. Pool Corporation purchased equipment worth $26,000 and paid immedlately. f. Pool Corporation paid $2,400 cash for the premium on a 12 th month insurance policy beginning from December 2020 . 9. Pool Corporation paid $200 towards general repairs in cash. h. Pool Corporation paid $3,900 cash towards Utilities. 1. Pool Corporation paid $240 towards transportation for one of the equipment as per the sale agreement. 1. Pool Corporation purchased Product Inventory for $22,000 Cash. k. Pool Corporation owed $1,000 wages to the office receptionist and three assistants for working the last two days in December 2020. The employees will be paid in January 2021. 1. On October 1, 2020. Pool Corporation received $24,000 from customers who prepaid pool cleaning service for one year beginning on November 1,2020. m. Pool Corporation received a $790 utility bill for December utility usage. It will be paid in January 2021. n. Pool Corporation borrowed $24,600 from a local bank on May 1,2020 , signing a note with a 6 percent interest rate. The note and interest are due on May 1,2021. 0. On December 31, 2020, Pool Corporation cleaned and winterized a customer's pool for $11,700, but the service was not yet recorded on December 31 . p. On August 1, 2020, Pool Corporation purchased a two-year insurance pollcy for $5,400, with coverage beginning on that date. q. During 2020, Pool Corporation purchased supplies costing $22,000 from various suppllers for cash. r. Pool Corporation estimated that depreciation on its bulldings and equipment was $9.400 for fhe year. 5. At December 31, 2020, $1,600 of interest on investments was earned that will be recelved irr 2021 . L. Rent for December due to be paid in January 2020 of $2,300. u. Sold $18,000 of goods and received the amount on the same day. v. Record the expired insurance purchased (trans. f ) for the month of December. w. Sales worth $39.000 made to Penny's Pool Service \& Supply Inc. on Credit. x. Pool Corporation received utilities bill for $490 for December. Paid in cash when received. y. Property tax paid $2,900 during the year. 2. Received partial payment from Penny's Pool Service \& Supply inc amounting to $19,500 for the purchase made this year. (tras. "w") a1. Pool Corporation purchased equipment worth $5,000 on credit basis. b2. Pool Corporation received the remaining balance amount due towards the recent sale made to Penny's Pool Service \& Supply Inc. (trans "w") c3. Paid for the equipment purchased, (tran. A1) d4. On December 31, 2020, Pool Corporation had $23,000 of pool cleaning supplies on hand. Record the necessary adjusting entry. e5. Property tax due and payable worth $13,000. e6. Recognize revenue earned (transaction L) e7. Record interest accrued on bank loan (Transaction N ). e8. Record the adjusting entry to record expired insurance (Transaction P). 2. Post the entries and their balances to their respective T-accounts