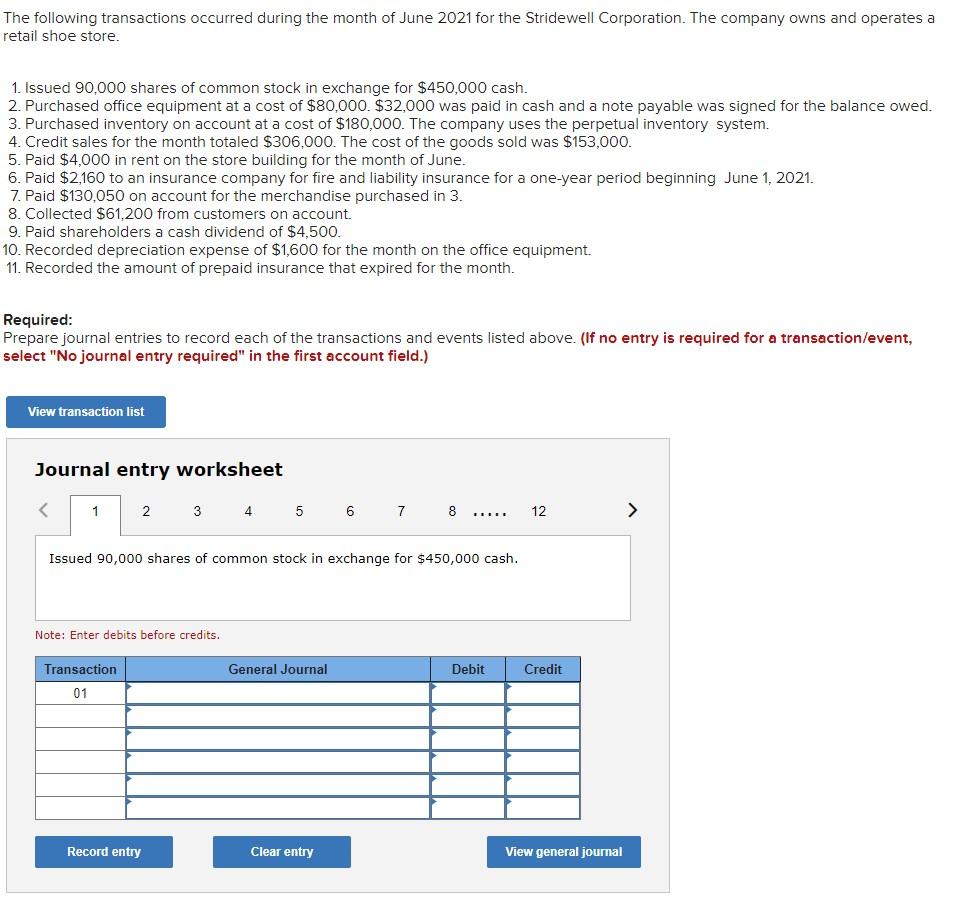

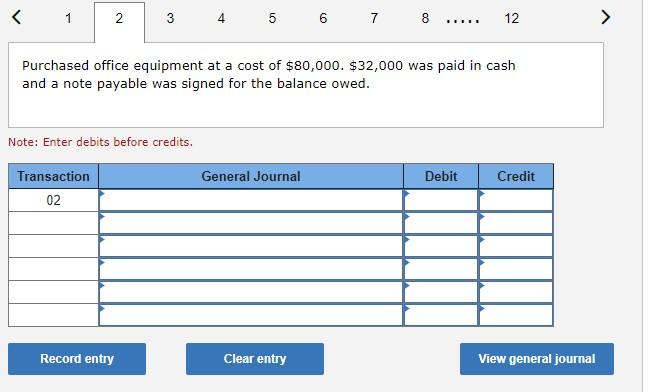

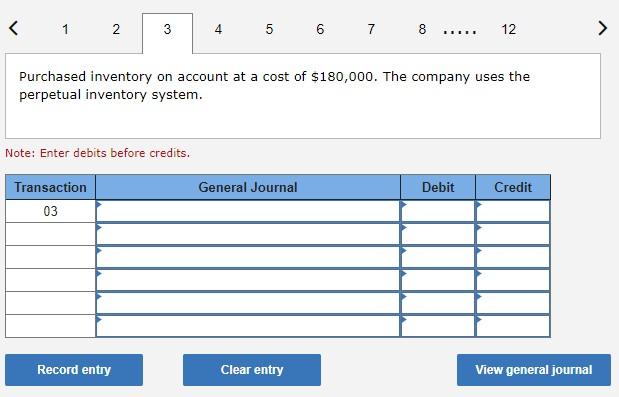

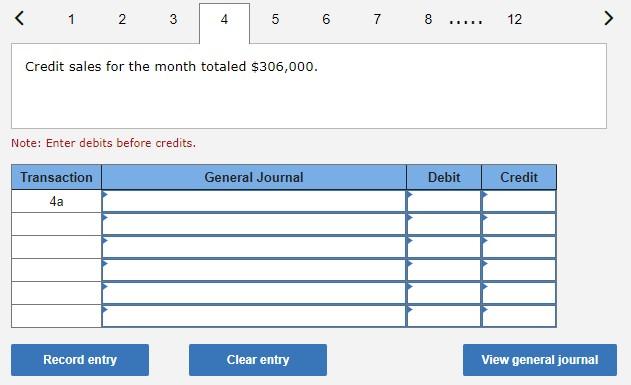

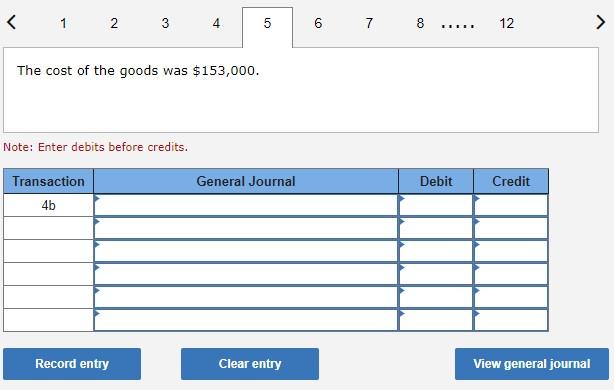

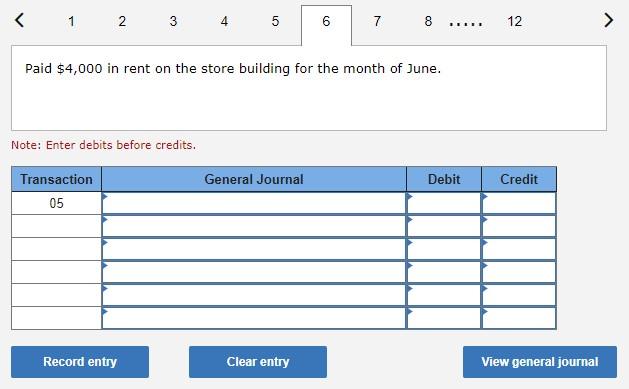

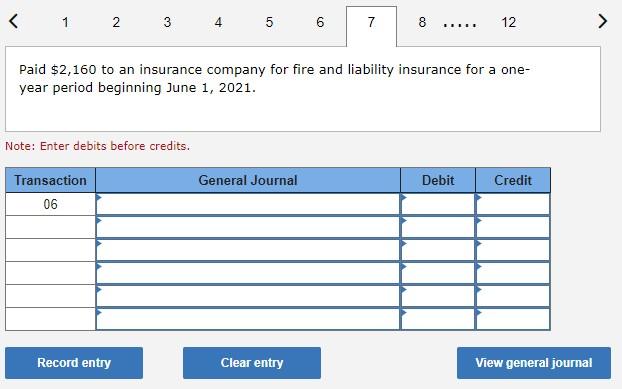

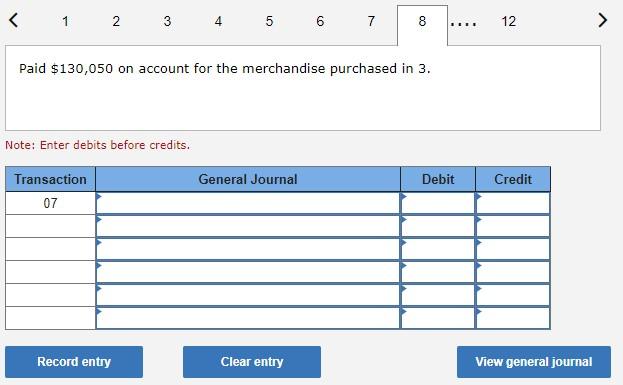

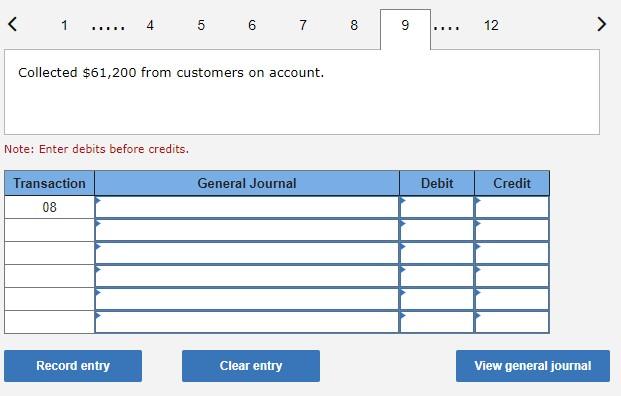

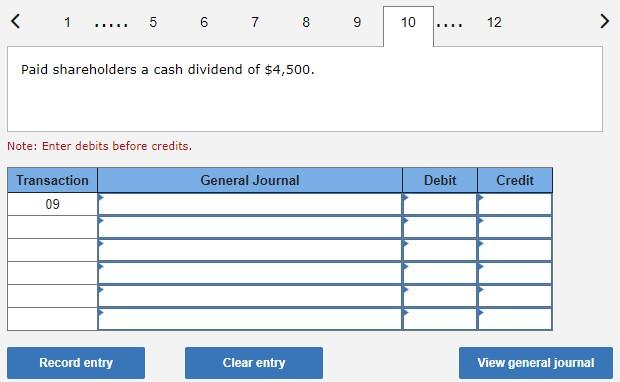

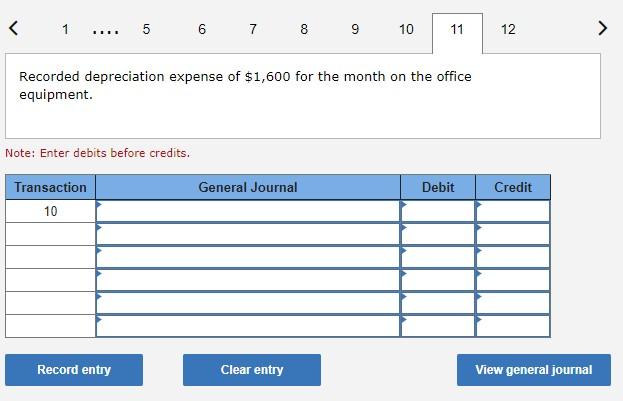

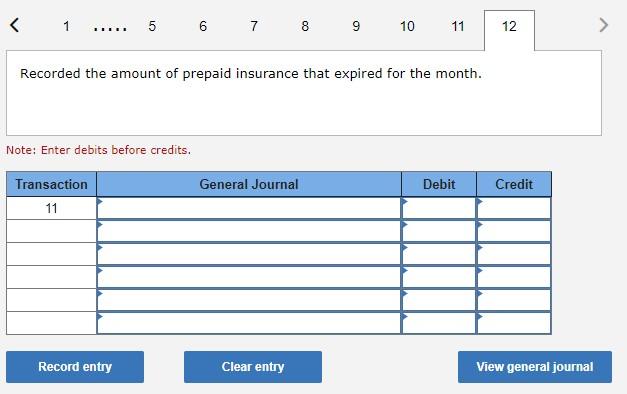

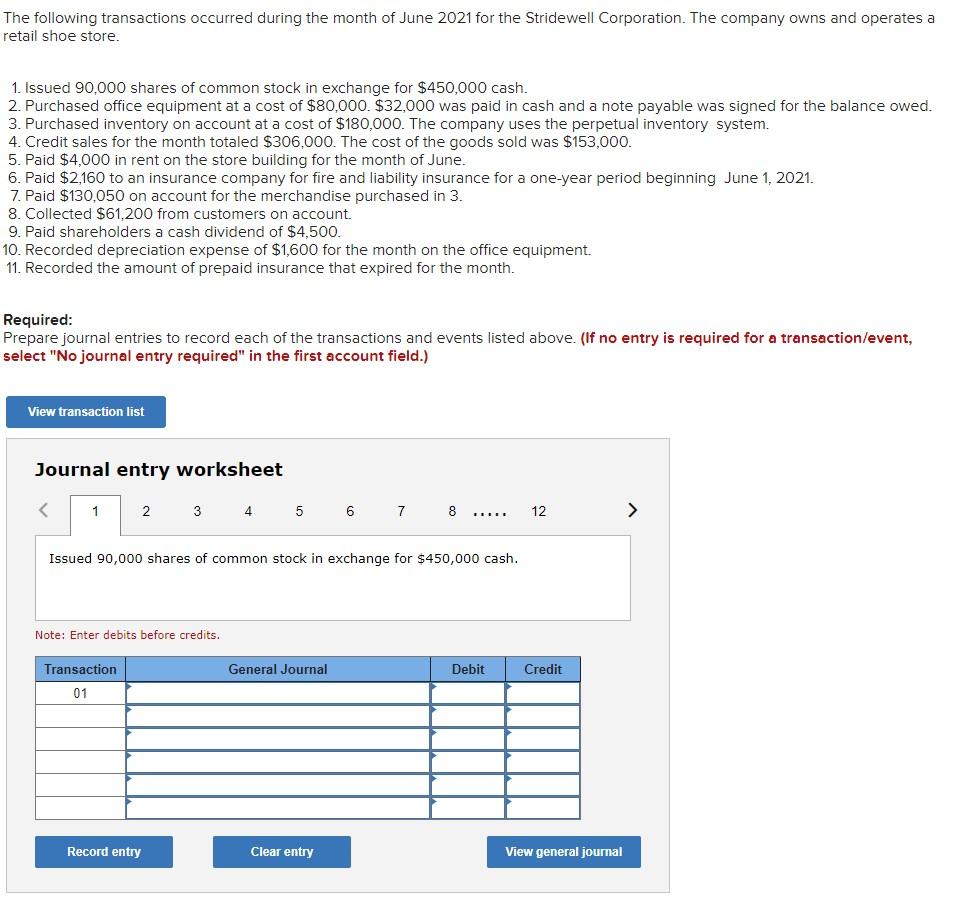

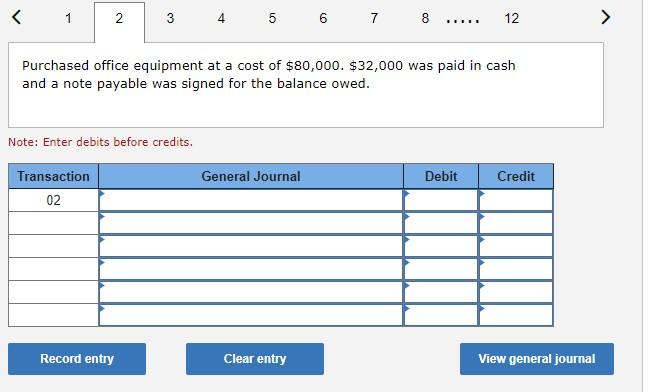

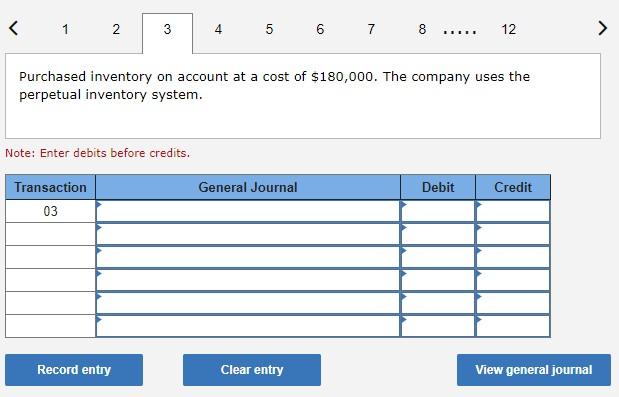

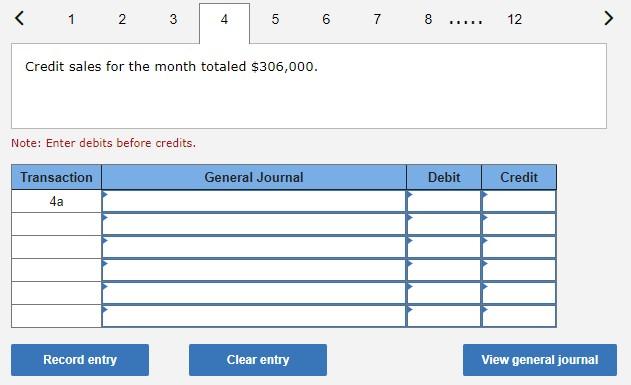

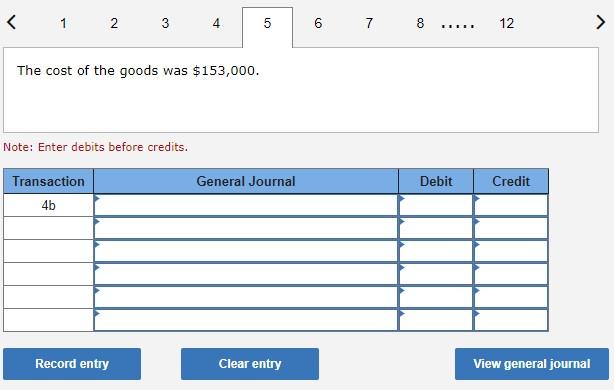

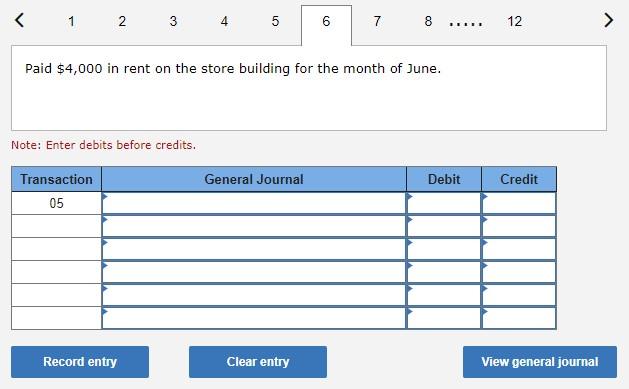

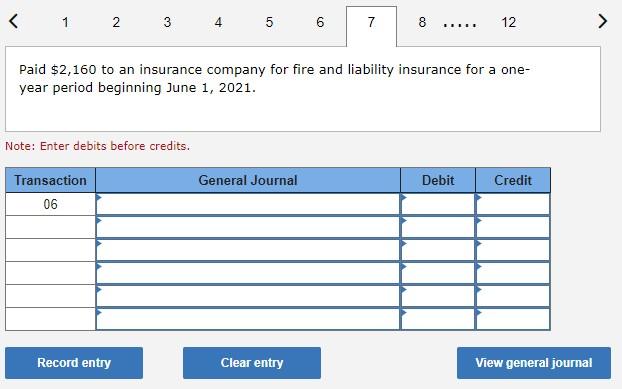

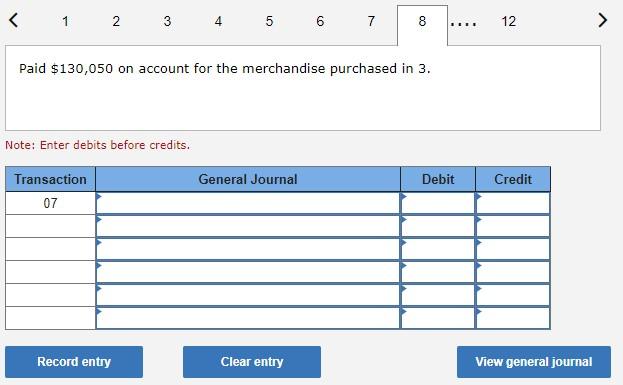

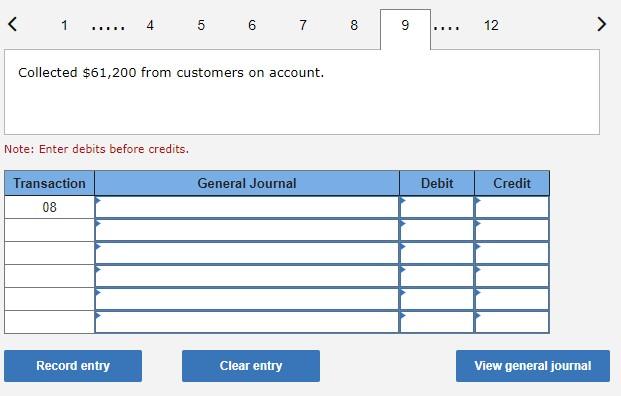

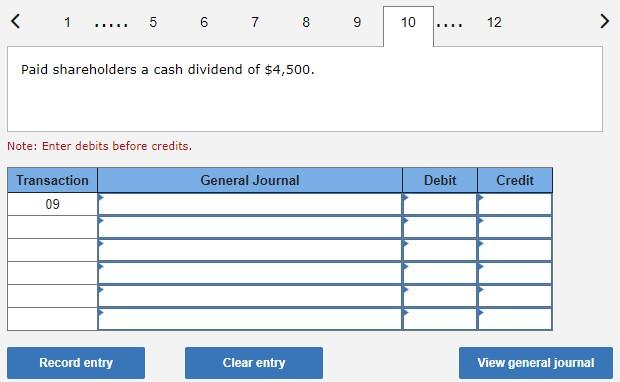

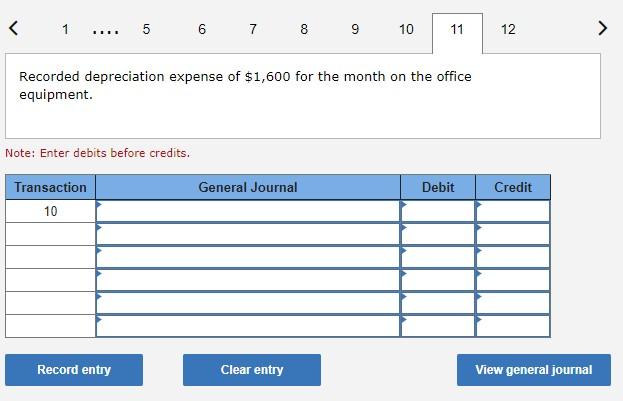

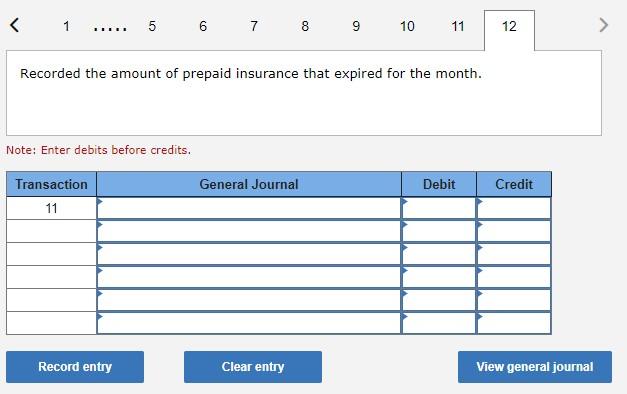

The following transactions occurred during the month of June 2021 for the Stridewell Corporation. The company owns and operates a retail shoe store. 1. Issued 90,000 shares of common stock in exchange for $450,000 cash. 2. Purchased office equipment at a cost of $80,000. $32,000 was paid in cash and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $180,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $306,000. The cost of the goods sold was $153,000. 5. Paid $4,000 in rent on the store building for the month of June. 6. Paid $2,160 to an insurance company for fire and liability insurance for a one-year period beginning June 1, 2021. 7. Paid $130,050 on account for the merchandise purchased in 3. 8. Collected $61,200 from customers on account. 9. Paid shareholders a cash dividend of $4,500. 10. Recorded depreciation expense of $1,600 for the month on the office equipment. 11. Recorded the amount of prepaid insurance that expired for the month. Required: Prepare journal entries to record each of the transactions and events listed above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 234567812> Issued 90,000 shares of common stock in exchange for $450,000 cash. Note: Enter debits before credits. Purchased office equipment at a cost of $80,000.$32,000 was paid in cash and a note payable was signed for the balance owed. Note: Enter debits before credits. Purchased inventory on account at a cost of $180,000. The company uses the perpetual inventory system. Note: Enter debits before credits. Credit sales for the month totaled $306,000. Note: Enter debits before credits. The cost of the goods was $153,000. Note: Enter debits before credits. Paid $4,000 in rent on the store building for the month of June. Note: Enter debits before credits. Paid $2,160 to an insurance company for fire and liability insurance for a oneyear period beginning June 1, 2021. Note: Enter debits before credits. Paid $130,050 on account for the merchandise purchased in 3. Note: Enter debits before credits. Collected $61,200 from customers on account. Note: Enter debits before credits. Paid shareholders a cash dividend of $4,500. Note: Enter debits before credits. Recorded depreciation expense of $1,600 for the month on the office equipment. Note: Enter debits before credits. Recorded the amount of prepaid insurance that expired for the month. Note: Enter debits before credits