Answered step by step

Verified Expert Solution

Question

1 Approved Answer

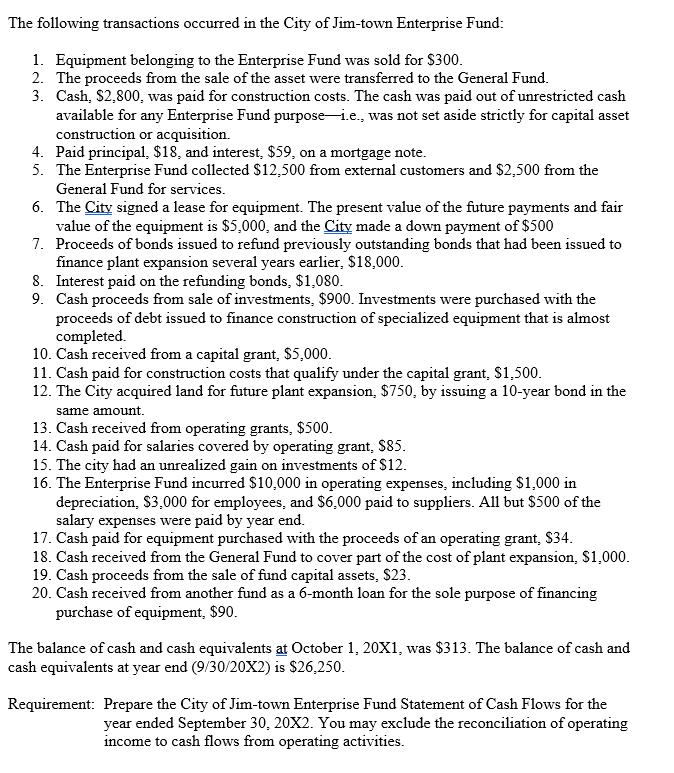

The following transactions occurred in the City of Jim-town Enterprise Fund: 1. Equipment belonging to the Enterprise Fund was sold for $300. 2. The

The following transactions occurred in the City of Jim-town Enterprise Fund: 1. Equipment belonging to the Enterprise Fund was sold for $300. 2. The proceeds from the sale of the asset were transferred to the General Fund. 3. Cash, $2,800, was paid for construction costs. The cash was paid out of unrestricted cash available for any Enterprise Fund purpose i.e., was not set aside strictly for capital asset construction or acquisition. 4. Paid principal, $18, and interest, $59, on a mortgage note. 5. The Enterprise Fund collected $12,500 from external customers and $2,500 from the General Fund for services. 6. The City signed a lease for equipment. The present value of the future payments and fair value of the equipment is $5,000, and the City made a down payment of $500 7. Proceeds of bonds issued to refund previously outstanding bonds that had been issued to finance plant expansion several years earlier, $18,000. 8. Interest paid on the refunding bonds, $1,080. 9. Cash proceeds from sale of investments, $900. Investments were purchased with the proceeds of debt issued to finance construction of specialized equipment that is almost completed. 10. Cash received from a capital grant, $5,000. 11. Cash paid for construction costs that qualify under the capital grant, $1,500. 12. The City acquired land for future plant expansion, $750, by issuing a 10-year bond in the same amount. 13. Cash received from operating grants, $500. 14. Cash paid for salaries covered by operating grant, $85. 15. The city had an unrealized gain on investments of $12. 16. The Enterprise Fund incurred $10,000 in operating expenses, including $1,000 in depreciation, $3,000 for employees, and $6,000 paid to suppliers. All but $500 of the salary expenses were paid by year end. 17. Cash paid for equipment purchased with the proceeds of an operating grant, $34. 18. Cash received from the General Fund to cover part of the cost of plant expansion, $1,000. 19. Cash proceeds from the sale of fund capital assets, $23. 20. Cash received from another fund as a 6-month loan for the sole purpose of financing purchase of equipment, $90. The balance of cash and cash equivalents at October 1, 20X1, was $313. The balance of cash and cash equivalents at year end (9/30/20X2) is $26,250. Requirement: Prepare the City of Jim-town Enterprise Fund Statement of Cash Flows for the year ended September 30, 20X2. You may exclude the reconciliation of operating income to cash flows from operating activities.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Cash Flows for the Jimtown Enterprise Fund we need to classify the transactions into three categories Cash Flows from Operating Activities Cash Flows from Investing Activit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started