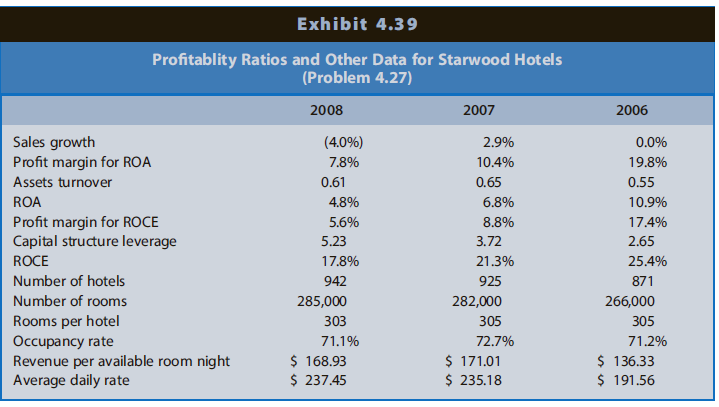

Starwood Hotels (Starwood) owns and operates many hotel properties under well-known brand names, including Sheraton, W, Westin,

Question:

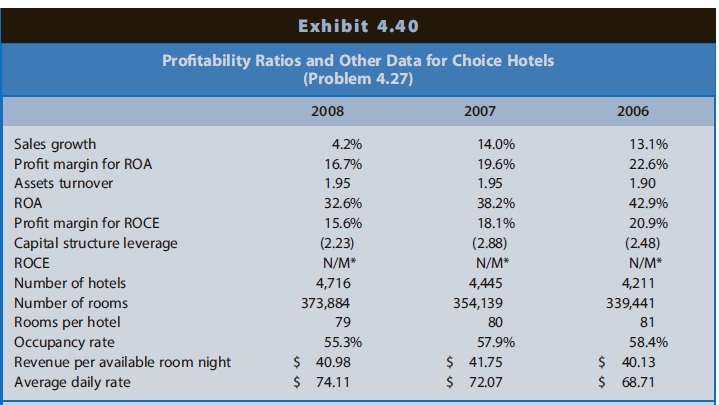

Choice Hotels (Choice) is primarily a franchisor of several hotel chains, including Comfort Inn, Sleep Inn, Clarion, EconoLodge, and Rodeway Inn. Choice properties represent primarily the mid scale and economy segments of the lodging industry. Exhibit 4.39 presents selected profitability ratios and other data for Starwood, and Exhibit 4.40 presents data for Choice. (Note that ROCE is not meaningful for Choice because of negative common shareholders' equity due to open-market share repurchases, not accumulated deficits. As of the end of 2008, Choice had repurchased over one-third of all common shares issued: 34,640,510 out of 95,345,362 shares.) One of the closely followed metrics in the lodging industry is occupancy rate, which gives an indication of the capacity utilization of available hotel rooms. A second measure is the ADR (average daily rate), which measures the amount actually collected for an average room per night. Finally, REVPAR (revenue per available room) also is an important measure, which measures period to-period growth in revenues per room for comparable properties (adjusted for properties sold or closed or otherwise not comparable across years). The interaction of occupancy rate and ADR is REVPAR.

*N/M: Not meaningful due to negative common shareholders€™ equity

REQUIRED

Analyze the changes and the differences in the profitability of these two hotel chains to the deepest levels available given the data provided. Compare and contrast the ROAs and ROCEs of both companies. Do the results match your prior expectations given the type of lodging for which each company specializes?

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw