Answered step by step

Verified Expert Solution

Question

1 Approved Answer

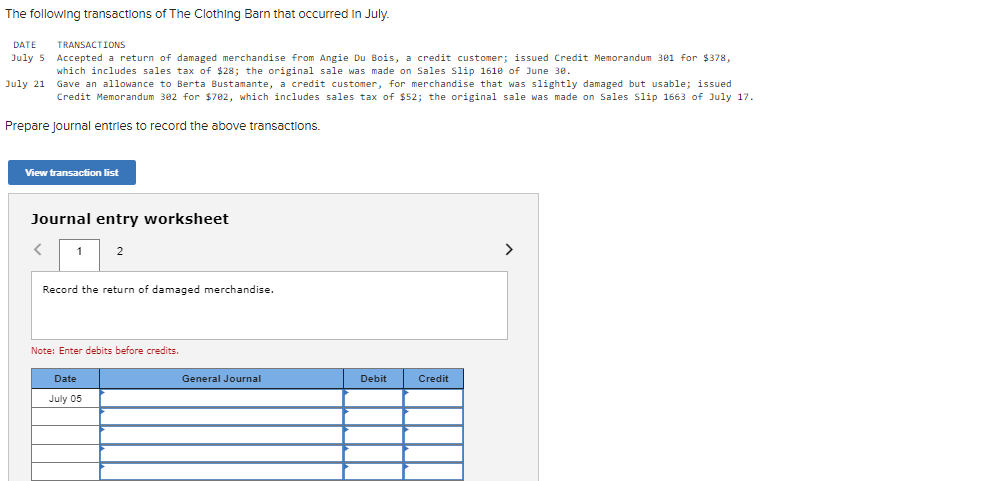

The following transactions of The Clothing Barn that occurred in July. DATE TRANSACTIONS July 5 Accepted a return of damaged merchandise from Angie Du

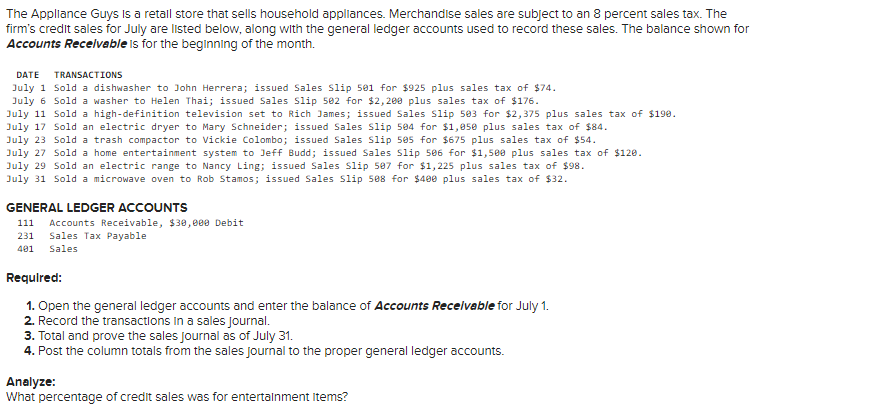

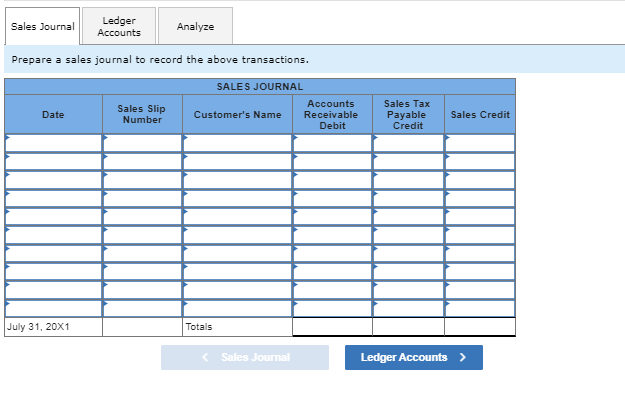

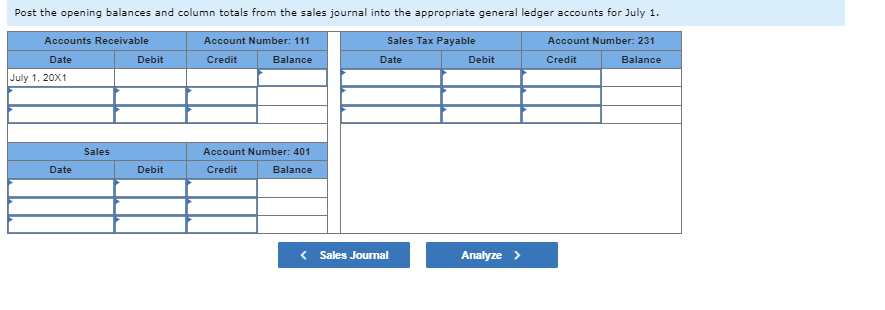

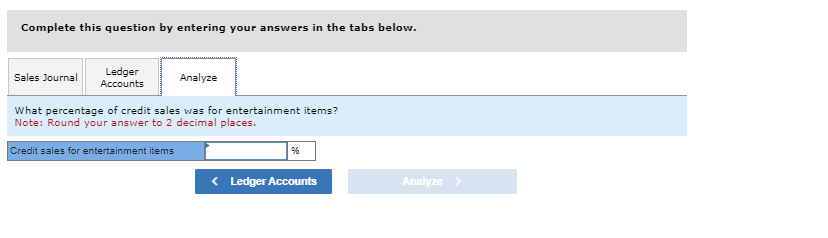

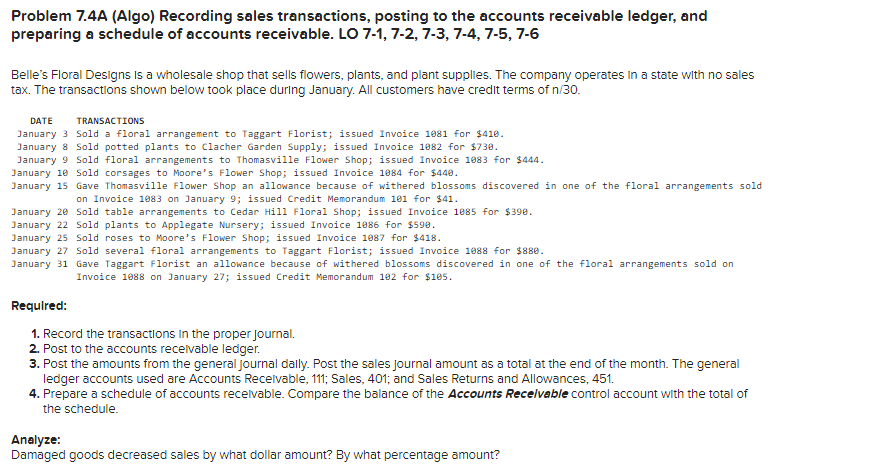

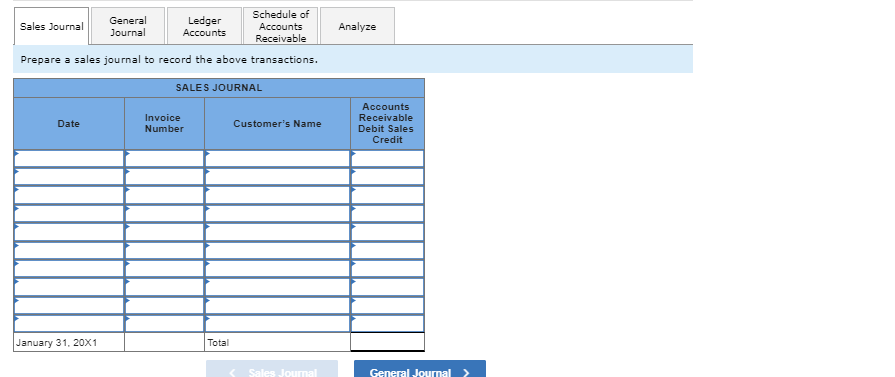

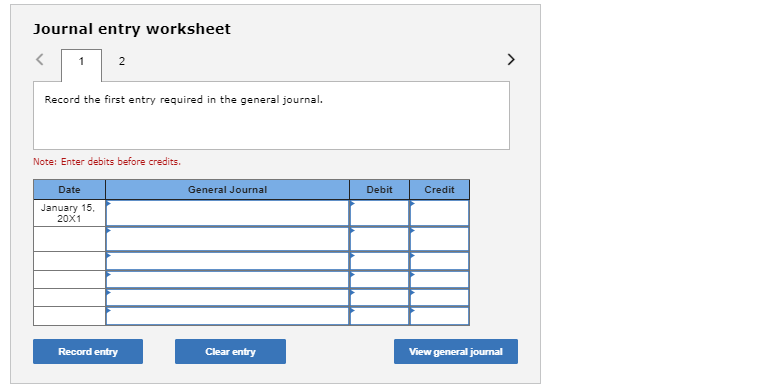

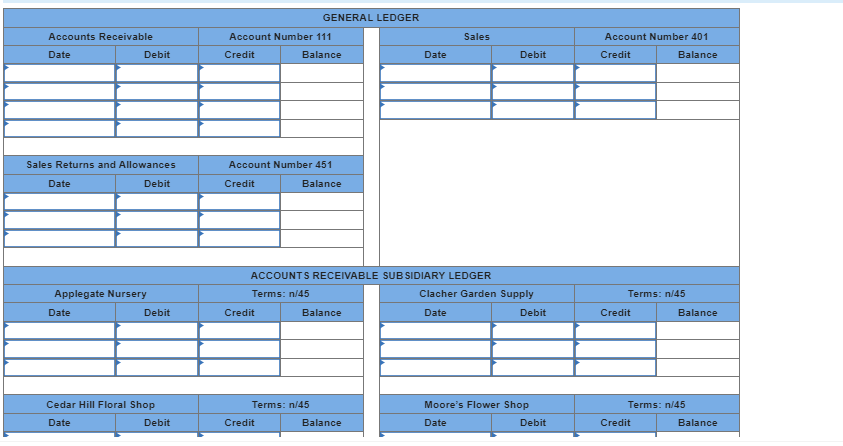

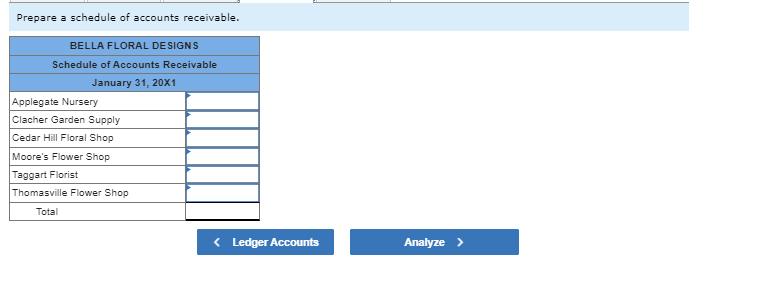

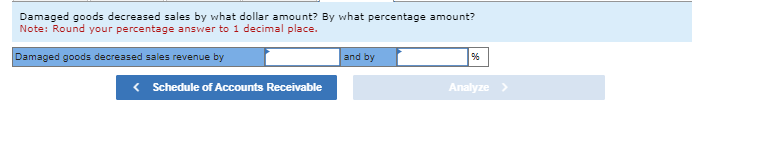

The following transactions of The Clothing Barn that occurred in July. DATE TRANSACTIONS July 5 Accepted a return of damaged merchandise from Angie Du Bois, a credit customer; issued Credit Memorandum 301 for $378, which includes sales tax of $28; the original sale was made on Sales Slip 1610 of June 30. July 21 Gave an allowance to Berta Bustamante, a credit customer, for merchandise that was slightly damaged but usable; issued Credit Memorandum 302 for $782, which includes sales tax of $52; the original sale was made on Sales Slip 1663 of July 17. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet < 1 2 Record the return of damaged merchandise. Note: Enter debits before credits. Date July 05 General Journal Debit Credit The Appliance Guys is a retail store that sells household appliances. Merchandise sales are subject to an 8 percent sales tax. The firm's credit sales for July are listed below, along with the general ledger accounts used to record these sales. The balance shown for Accounts Receivable is for the beginning of the month. DATE TRANSACTIONS July 1 Sold a dishwasher to John Herrera; issued Sales Slip 501 for $925 plus sales tax of $74. July 6 Sold a washer to Helen Thai; issued Sales Slip 502 for $2,200 plus sales tax of $176. July 11 Sold a high-definition television set to Rich James; issued Sales Slip 503 for $2,375 plus sales tax of $190. July 17 Sold an electric dryer to Mary Schneider; issued Sales Slip 504 for $1,050 plus sales tax of $84. July 23 Sold a trash compactor to Vickie Colombo; issued Sales Slip 505 for $675 plus sales tax of $54. July 27 Sold a home entertainment system to Jeff Budd; issued Sales Slip 506 for $1,500 plus sales tax of $120. July 29 Sold an electric range to Nancy Ling; issued Sales Slip 507 for $1,225 plus sales tax of $98. July 31 Sold a microwave oven to Rob Stamos; issued Sales Slip 508 for $400 plus sales tax of $32. GENERAL LEDGER ACCOUNTS 111 Accounts Receivable, $30,000 Debit 231 Sales Tax Payable 401 Sales Required: 1. Open the general ledger accounts and enter the balance of Accounts Receivable for July 1. 2. Record the transactions in a sales journal. 3. Total and prove the sales journal as of July 31. 4. Post the column totals from the sales journal to the proper general ledger accounts. Analyze: What percentage of credit sales was for entertainment Items? Sales Journal Ledger Accounts Analyze Prepare a sales journal to record the above transactions. SALES JOURNAL Date Sales Slip Number Customer's Name Accounts Receivable Debit Sales Tax Payable Credit Sales Credit July 31, 20X1 Totals Sales Journal Ledger Accounts > Post the opening balances and column totals from the sales journal into the appropriate general ledger accounts for July 1. Accounts Receivable Date July 1, 20X1 Account Number: 111 Debit Credit Balance Sales Tax Payable Date Account Number: 231 Debit Credit Balance Sales Date Debit Credit Account Number: 401 Balance < Sales Journal Analyze > Complete this question by entering your answers in the tabs below. Sales Journal Ledger Accounts Analyze What percentage of credit sales was for entertainment items? Note: Round your answer to 2 decimal places. Credit sales for entertainment items % < Ledger Accounts Analyze > Problem 7.4A (Algo) Recording sales transactions, posting to the accounts receivable ledger, and preparing a schedule of accounts receivable. LO 7-1, 7-2, 7-3, 7-4, 7-5, 7-6 Belle's Floral Designs is a wholesale shop that sells flowers, plants, and plant supplies. The company operates in a state with no sales tax. The transactions shown below took place during January. All customers have credit terms of n/30. DATE TRANSACTIONS January 3 Sold a floral arrangement to Taggart Florist; issued Invoice 1081 for $410. January 8 Sold potted plants to Clacher Garden Supply; issued Invoice 1082 for $730. January 9 Sold floral arrangements to Thomasville Flower Shop; issued Invoice 1083 for $444. January 10 Sold corsages to Moore's Flower Shop; issued Invoice 1984 for $440. January 15 Gave Thomasville Flower Shop an allowance because of withered blossoms discovered in one of the floral arrangements sold on Invoice 1083 on January 9; issued Credit Memorandum 101 for $41. January 20 Sold table arrangements to Cedar Hill Floral Shop; issued Invoice 1085 for $390. January 22 Sold plants to Applegate Nursery; issued Invoice 1086 for $590. January 25 Sold roses to Moore's Flower Shop; issued Invoice 1087 for $418. January 27 Sold several floral arrangements to Taggart Florist; issued Invoice 1088 for $880. January 31 Gave Taggart Florist an allowance because of withered blossoms discovered in one of the floral arrangements sold on Invoice 1088 on January 27; issued Credit Memorandum 102 for $105. Required: 1. Record the transactions in the proper Journal. 2. Post to the accounts receivable ledger. 3. Post the amounts from the general journal dally. Post the sales journal amount as a total at the end of the month. The general ledger accounts used are Accounts Receivable, 111; Sales, 401; and Sales Returns and Allowances, 451. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule. Analyze: Damaged goods decreased sales by what dollar amount? By what percentage amount? Schedule of Sales Journal General Journal Ledger Accounts Accounts Analyze Receivable Prepare a sales journal to record the above transactions. SALES JOURNAL Invoice Date Customer's Name Number January 31, 20X1 Total Accounts Receivable Debit Sales Credit Sales Journal General Journal > Journal entry worksheet 1 2 Record the first entry required in the general journal. Note: Enter debits before credits. Date January 15, 20X1 General Journal Debit Credit Record entry Clear entry View general journal Accounts Receivable Date GENERAL LEDGER Account Number 111 Debit Credit Balance Sales Returns and Allowances Date Applegate Nursery Date Account Number 451 Debit Credit Balance Sales Account Number 401 Date Debit Credit Balance ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Terms: n/45 Clacher Garden Supply Terms: n/45 Debit Credit Balance Date Debit Credit Balance Cedar Hill Floral Shop Date Terms: n/45 Moore's Flower Shop Terms: n/45 Debit Credit Balance Date Debit Credit Balance Prepare a schedule of accounts receivable. BELLA FLORAL DESIGNS Schedule of Accounts Receivable January 31, 20X1 Applegate Nursery Clacher Garden Supply Cedar Hill Floral Shop Moore's Flower Shop Taggart Florist Thomasville Flower Shop Total < Ledger Accounts Analyze > Damaged goods decreased sales by what dollar amount? By what percentage amount? Note: Round your percentage answer to 1 decimal place. Damaged goods decreased sales revenue by and by % < Schedule of Accounts Receivable Analyze

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started