Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions relate to Newport City's special revenue fund. 1. In 2020, Newport City created a special revenue fund to help fund the

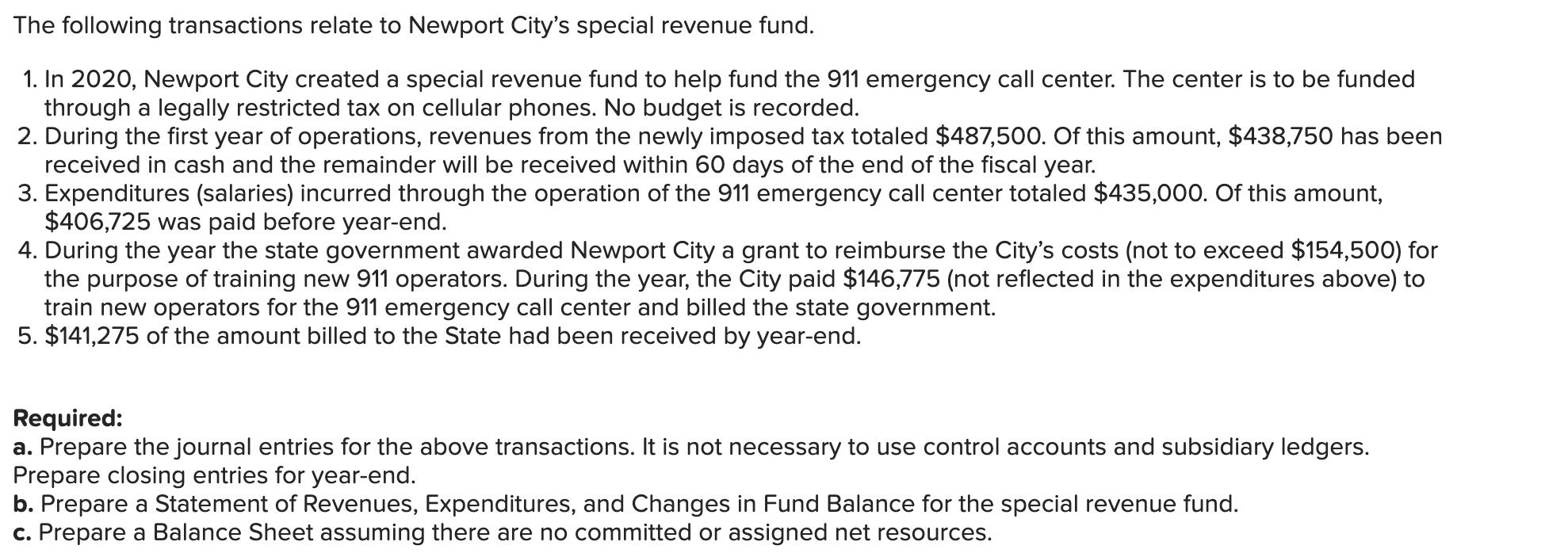

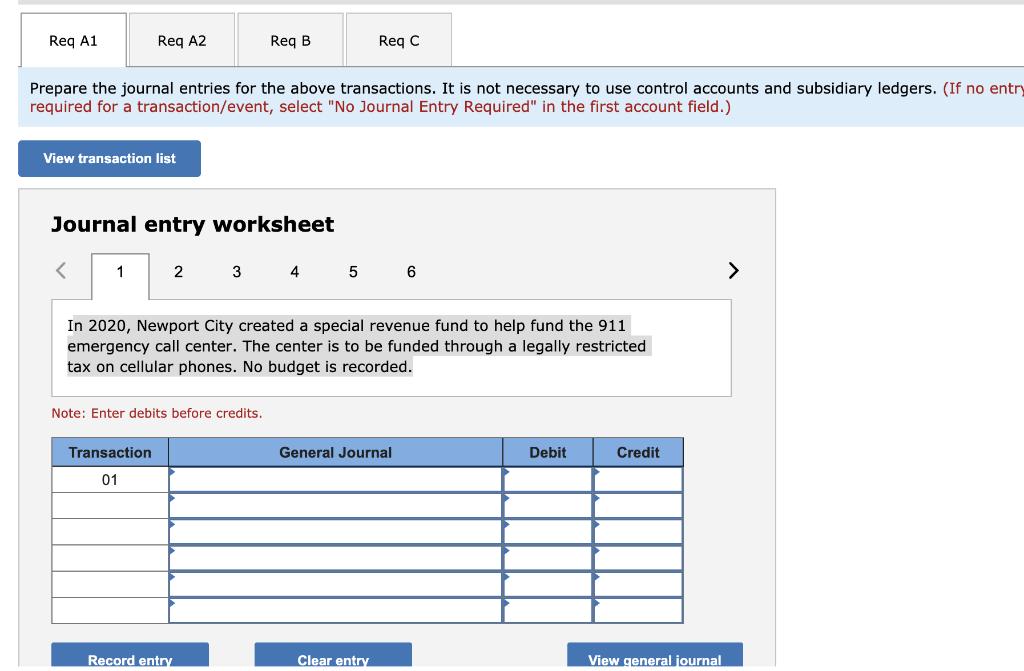

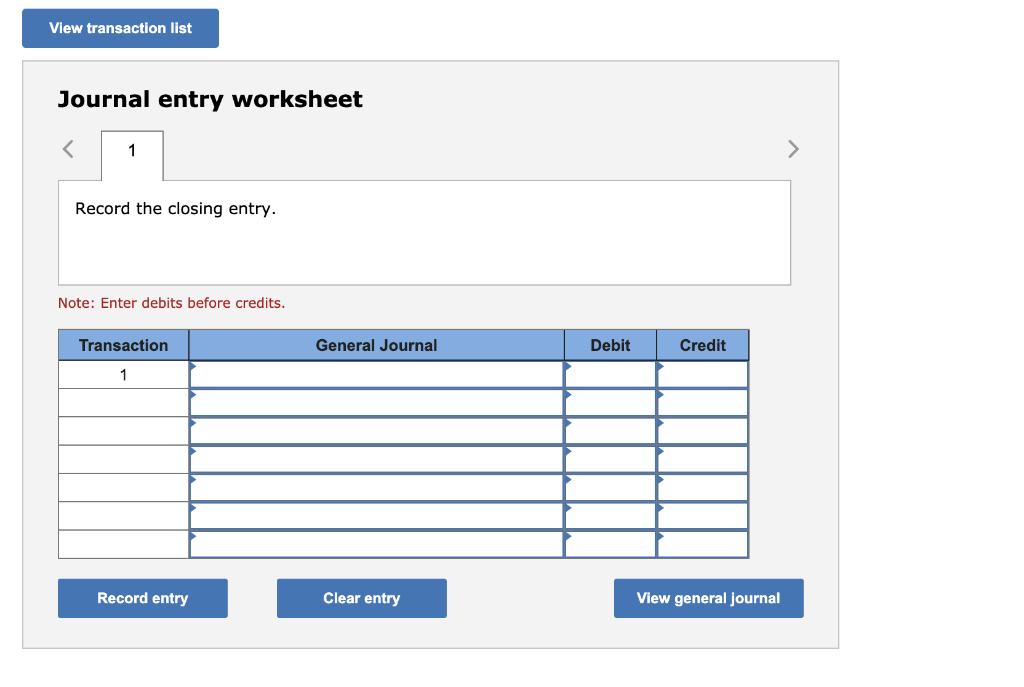

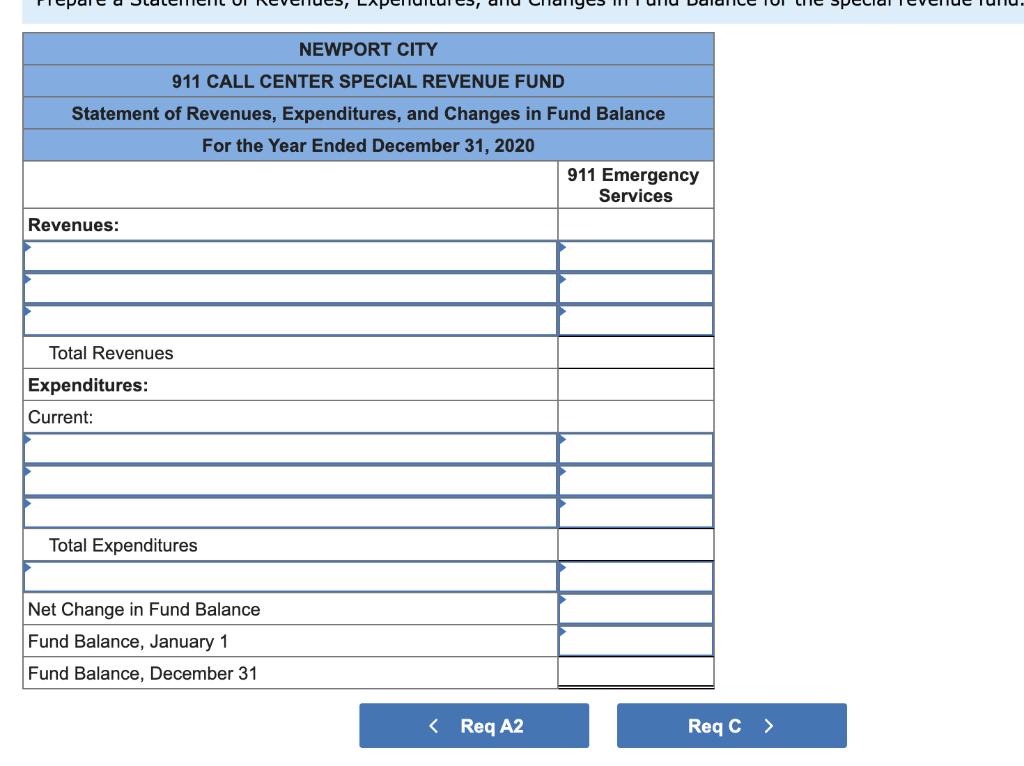

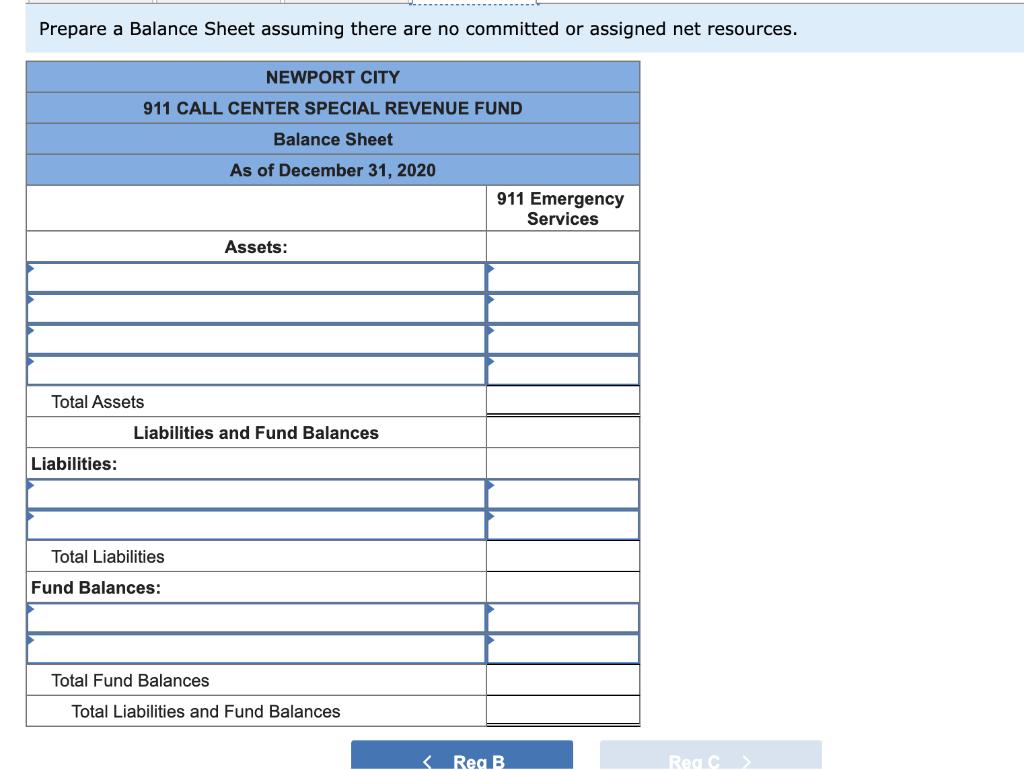

The following transactions relate to Newport City's special revenue fund. 1. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. 2. During the first year of operations, revenues from the newly imposed tax totaled $487,500. Of this amount, $438,750 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. 3. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $435,000. Of this amount, $406,725 was paid before year-end. 4. During the year the state government awarded Newport City a grant to reimburse the City's costs (not to exceed $154,500) for the purpose of training new 911 operators. During the year, the City paid $146,775 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state government. 5. $141,275 of the amount billed to the State had been received by year-end. Required: a. Prepare the journal entries for the above transactions. It is not necessary to use control accounts and subsidiary ledgers. Prepare closing entries for year-end. b. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the special revenue fund. c. Prepare a Balance Sheet assuming there are no committed or assigned net resources. Req A1 Req A2 Req B Req C Prepare the journal entries for the above transactions. It is not necessary to use control accounts and subsidiary ledgers. (If no entry required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. Note: Enter debits before credits. Transaction 01 General Journal Debit Credit Record entry Clear entry View general journal > View transaction list Journal entry worksheet 1 Record the closing entry. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit View general journal Record entry Clear entry NEWPORT CITY 911 CALL CENTER SPECIAL REVENUE FUND Statement of Revenues, Expenditures, and Changes in Fund Balance For the Year Ended December 31, 2020 Revenues: Total Revenues Expenditures: Current: Total Expenditures Net Change in Fund Balance Fund Balance, January 1 Fund Balance, December 31 911 Emergency Services < Req A2 Req C > Prepare a Balance Sheet assuming there are no committed or assigned net resources. NEWPORT CITY 911 CALL CENTER SPECIAL REVENUE FUND Balance Sheet As of December 31, 2020 Assets: Total Assets Liabilities and Fund Balances Liabilities: Total Liabilities Fund Balances: Total Fund Balances Total Liabilities and Fund Balances 911 Emergency Services < Rea B Reg C >

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Revenues Calculation 1 Revenues from the newly imposed tax 438750 received in cash 48750 rema...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started