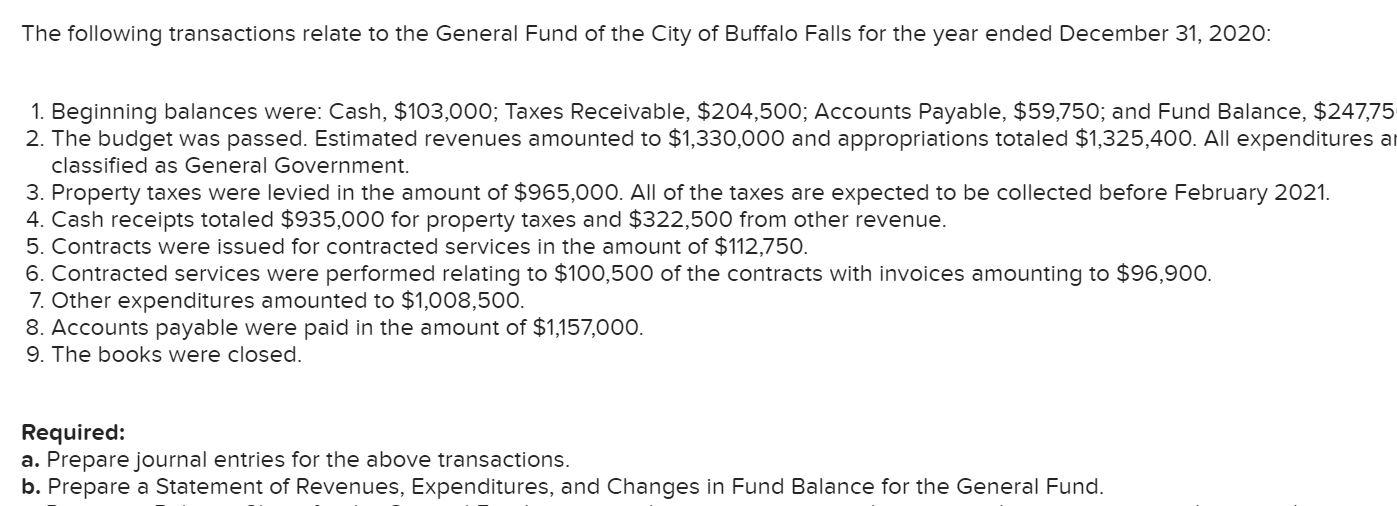

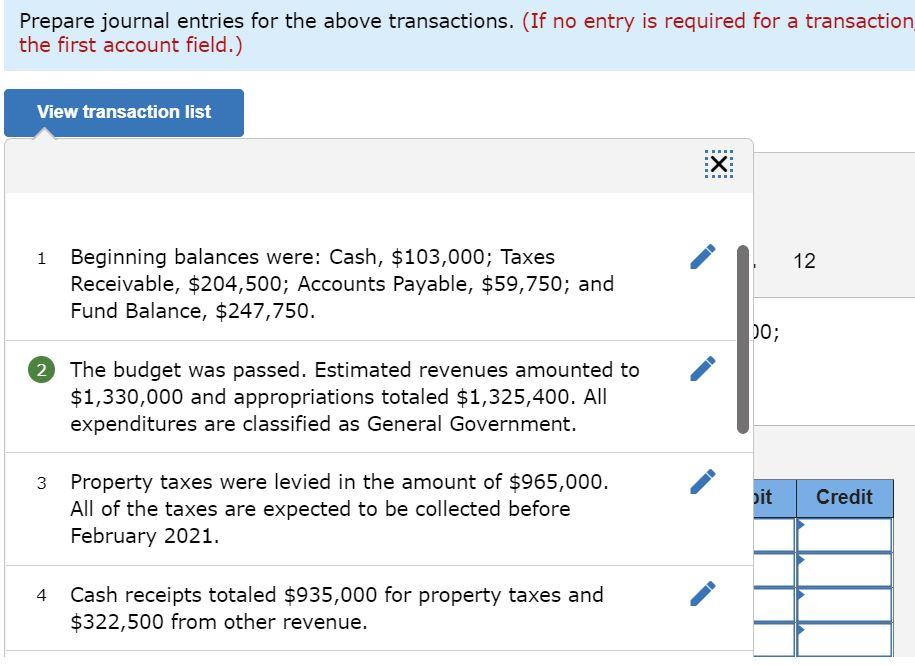

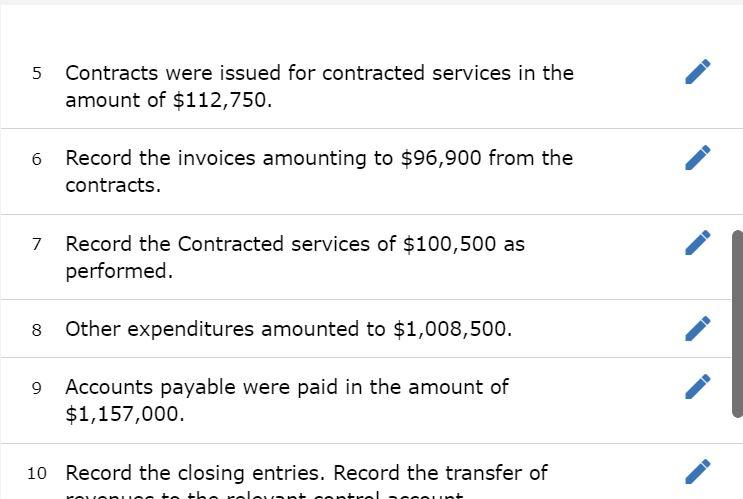

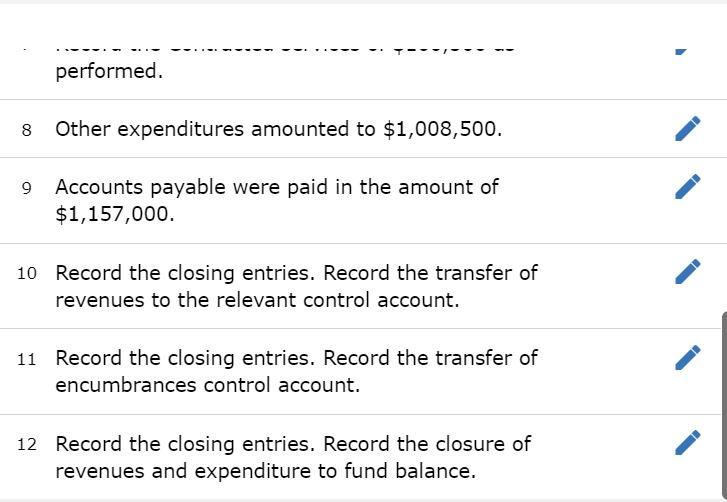

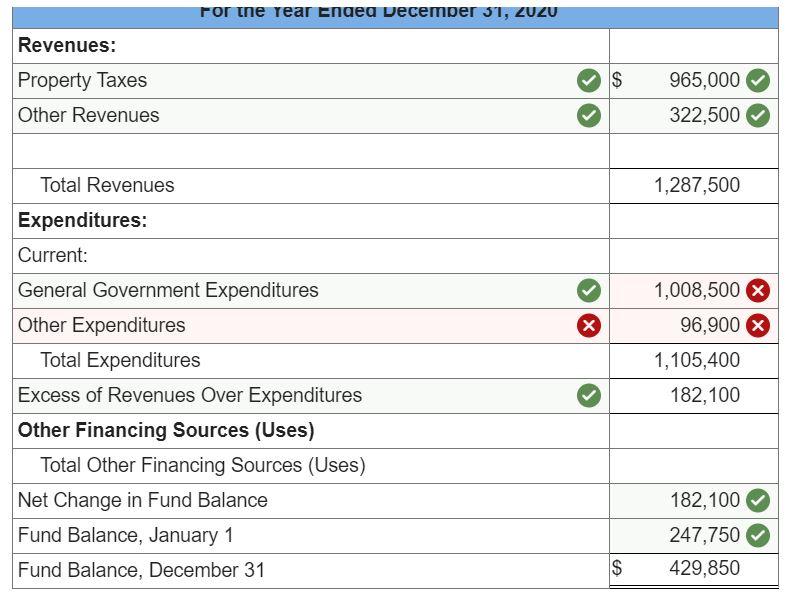

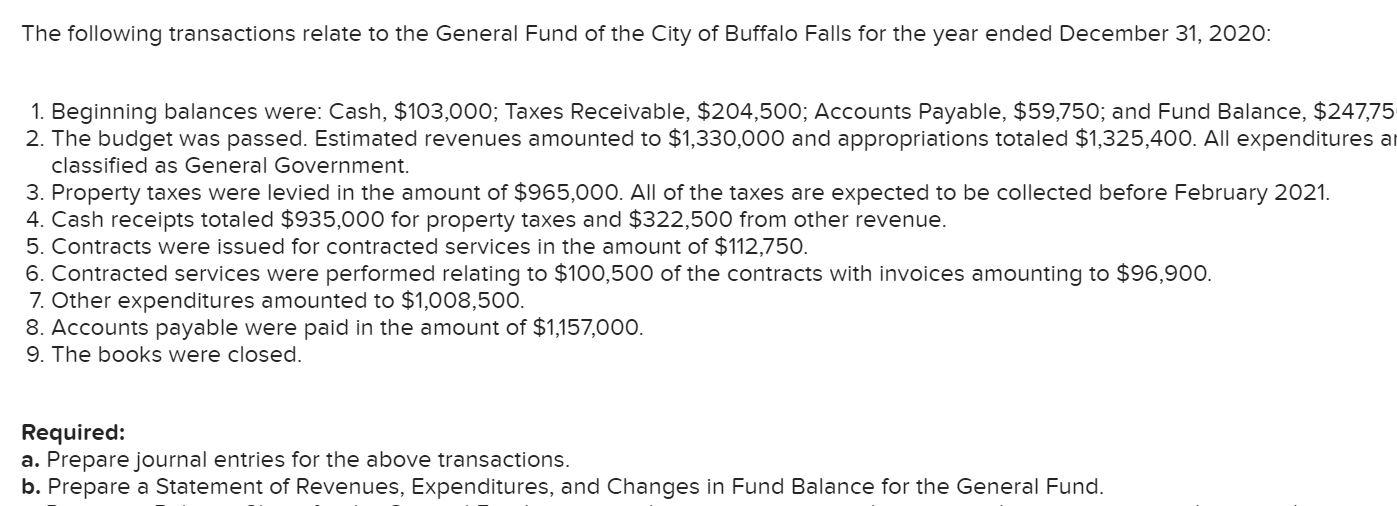

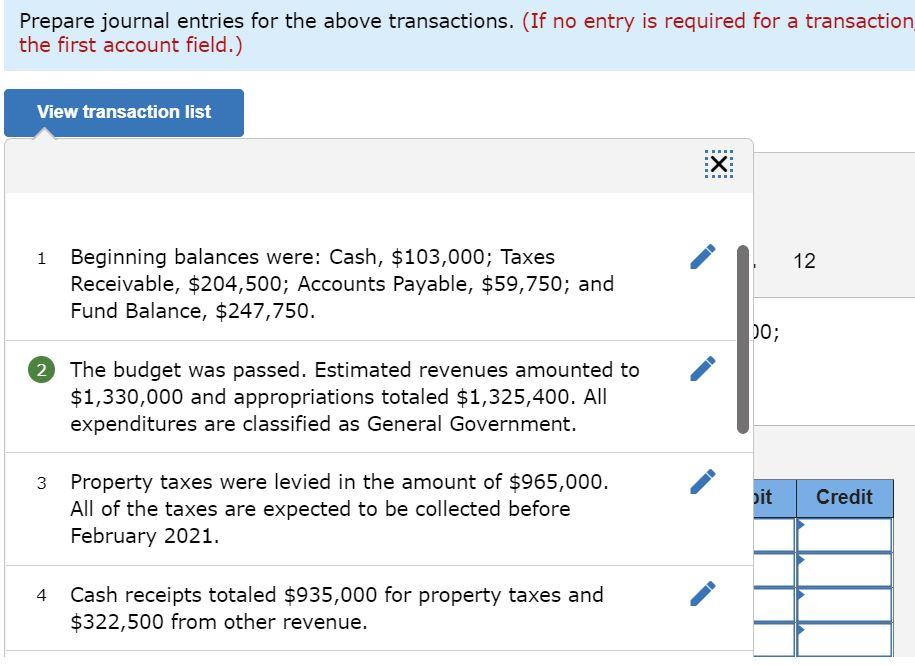

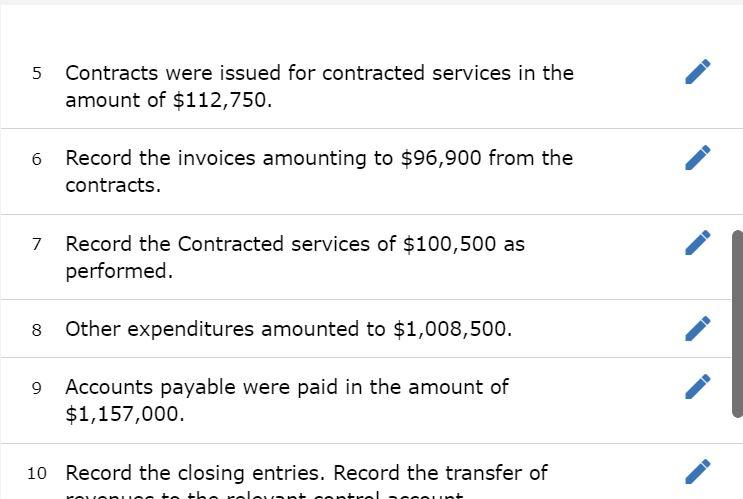

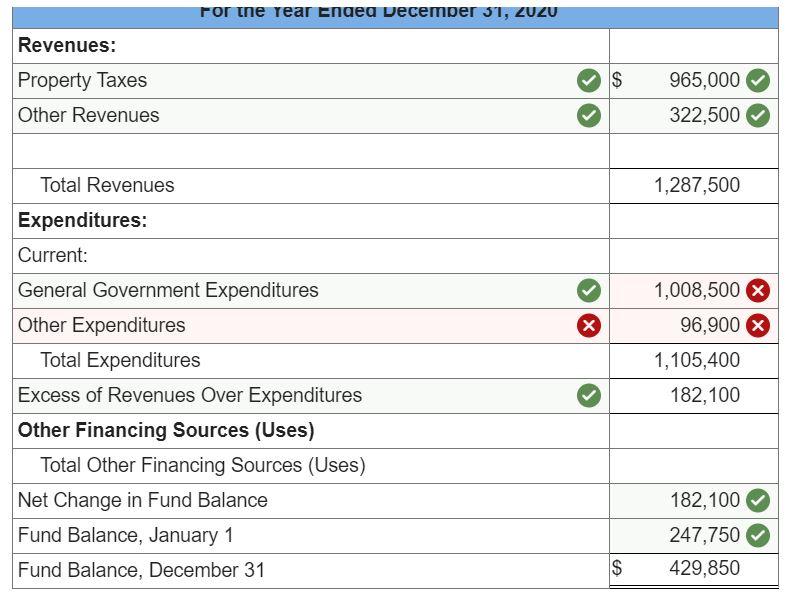

The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: 1. Beginning balances were: Cash, $103,000; Taxes Receivable, $204,500; Accounts Payable, $59,750; and Fund Balance, $247,75 2. The budget was passed. Estimated revenues amounted to $1,330,000 and appropriations totaled $1,325,400. All expenditures ar classified as General Government. 3. Property taxes were levied in the amount of $965,000. All of the taxes are expected to be collected before February 2021. 4. Cash receipts totaled $935,000 for property taxes and $322,500 from other revenue. 5. Contracts were issued for contracted services in the amount of $112,750. 6. Contracted services were performed relating to $100,500 of the contracts with invoices amounting to $96,900. 7. Other expenditures amounted to $1,008,500. 8. Accounts payable were paid in the amount of $1,157,000. 9. The books were closed. Required: a. Prepare journal entries for the above transactions. b. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the General Fund. Prepare journal entries for the above transactions. (If no entry is required for a transaction the first account field.) View transaction list . X: . 12 Beginning balances were: Cash, $103,000; Taxes Receivable, $204,500; Accounts Payable, $59,750; and Fund Balance, $247,750. DO; The budget was passed. Estimated revenues amounted to $1,330,000 and appropriations totaled $1,325,400. All expenditures are classified as General Government. pit Credit 3 Property taxes were levied in the amount of $965,000. All of the taxes are expected to be collected before February 2021. 4 Cash receipts totaled $935,000 for property taxes and $322,500 from other revenue. Contracts were issued for contracted services in the amount of $112,750. Record the invoices amounting to $96,900 from the contracts. Record the Contracted services of $100,500 as performed. 8 Other expenditures amounted to $1,008,500. Accounts payable were paid in the amount of $1,157,000. 10 Record the closing entries. Record the transfer of the rolouant rol performed. 8 Other expenditures amounted to $1,008,500. Accounts payable were paid in the amount of $1,157,000. 10 Record the closing entries. Record the transfer of revenues to the relevant control account. 11 Record the closing entries. Record the transfer of encumbrances control account. 12 Record the closing entries. Record the closure of revenues and expenditure to fund balance. for the rear Engea vecember 31, ZUZU Revenues: $ Property Taxes Other Revenues 965,000 322,500 1,287,500 x 1,008,500 X 96,900 X 1,105,400 Total Revenues Expenditures: Current: General Government Expenditures Other Expenditures Total Expenditures Excess of Revenues Over Expenditures Other Financing Sources (Uses) Total Other Financing Sources (Uses) Net Change in Fund Balance Fund Balance, January 1 Fund Balance. December 31 182,100 182,100 247,750 429,850 $