Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions took place during fiscal 2029 (all dollar amounts are in millions): 1. During fiscal 2029, Starbucks Jr. recognized gross revenues from

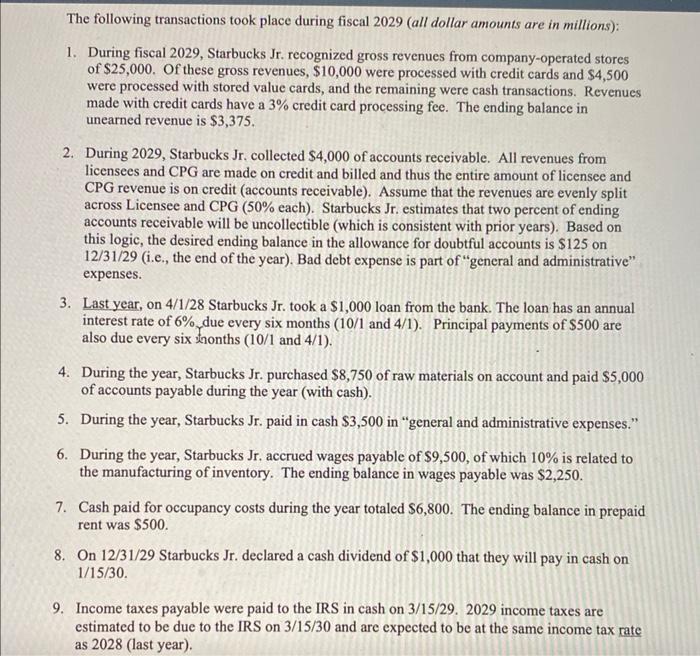

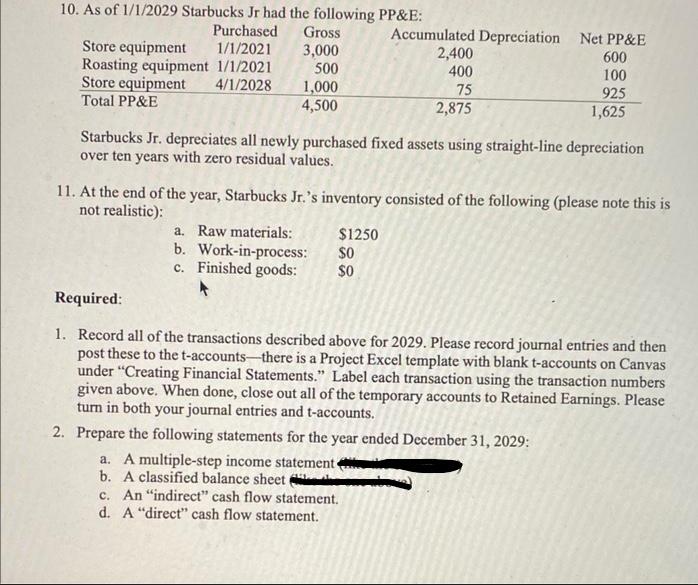

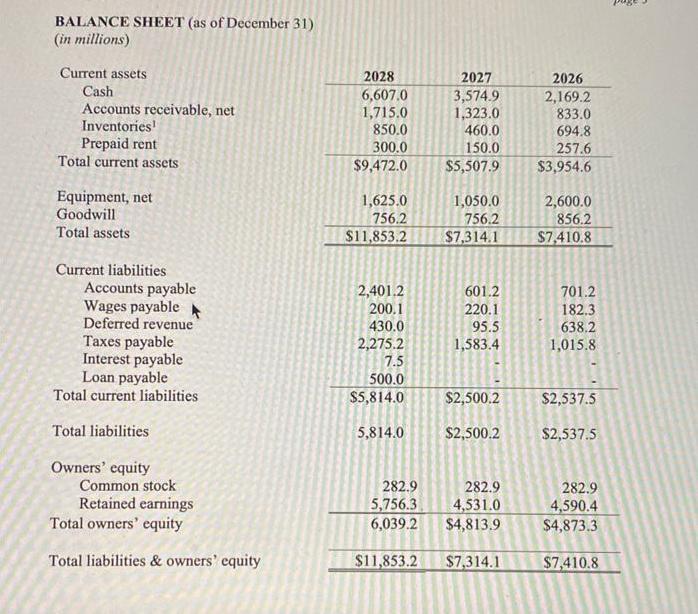

The following transactions took place during fiscal 2029 (all dollar amounts are in millions): 1. During fiscal 2029, Starbucks Jr. recognized gross revenues from company-operated stores of $25,000. Of these gross revenues, $10,000 were processed with credit cards and $4,500 were processed with stored value cards, and the remaining were cash transactions. Revenues made with credit cards have a 3% credit card processing fee. The ending balance in unearned revenue is $3,375. 2. During 2029, Starbucks Jr. collected $4,000 of accounts receivable. All revenues from licensees and CPG are made on credit and billed and thus the entire amount of licensee and CPG revenue is on credit (accounts receivable). Assume that the revenues are evenly split across Licensee and CPG (50% each). Starbucks Jr. estimates that two percent of ending accounts receivable will be uncollectible (which is consistent with prior years). Based on this logic, the desired ending balance in the allowance for doubtful accounts is $125 on 12/31/29 (i.e., the end of the year). Bad debt expense is part of "general and administrative" expenses. 3. Last year, on 4/1/28 Starbucks Jr. took a $1,000 loan from the bank. The loan has an annual interest rate of 6% due every six months (10/1 and 4/1). Principal payments of $500 are also due every six months (10/1 and 4/1). 4. During the year, Starbucks Jr. purchased $8,750 of raw materials on account and paid $5,000 of accounts payable during the year (with cash). 5. During the year, Starbucks Jr. paid in cash $3,500 in "general and administrative expenses." 6. During the year, Starbucks Jr. accrued wages payable of $9,500, of which 10% is related to the manufacturing of inventory. The ending balance in wages payable was $2,250. 7. Cash paid for occupancy costs during the year totaled $6,800. The ending balance in prepaid rent was $500. 8. On 12/31/29 Starbucks Jr. declared a cash dividend of $1,000 that they will pay in cash on 1/15/30. 9. Income taxes payable were paid to the IRS in cash on 3/15/29. 2029 income taxes are estimated to be due to the IRS on 3/15/30 and are expected to be at the same income tax rate as 2028 (last year). 10. As of 1/1/2029 Starbucks Jr had the following PP&E: Purchased Store equipment 1/1/2021 Roasting equipment 1/1/2021 Store equipment 4/1/2028 Total PP&E Gross 3,000 500 1,000 4,500 Accumulated Depreciation Net PP&E 600 100 925 1,625 Starbucks Jr. depreciates all newly purchased fixed assets using straight-line depreciation over ten years with zero residual values. a. Raw materials: b. Work-in-process: c. Finished goods: 2,400 400 75 2,875 11. At the end of the year, Starbucks Jr.'s inventory consisted of the following (please note this is not realistic): $1250 SO $0 Required: 1. Record all of the transactions described above for 2029. Please record journal entries and then post these to the t-accounts-there is a Project Excel template with blank t-accounts on Canvas under "Creating Financial Statements." Label each transaction using the transaction numbers given above. When done, close out all of the temporary accounts to Retained Earnings. Please turn in both your journal entries and t-accounts. 2. Prepare the following statements for the year ended December 31, 2029: a. A multiple-step income statement b. A classified balance sheet c. An "indirect" cash flow statement. d. A "direct" cash flow statement. BALANCE SHEET (as of December 31) (in millions) Current assets Cash Accounts receivable, net Inventories Prepaid rent Total current assets Equipment, net Goodwill Total assets Current liabilities Accounts payable Wages payable Deferred revenue Taxes payable Interest payable Loan payable Total current liabilities Total liabilities Owners' equity Common stock Retained earnings Total owners' equity Total liabilities & owners' equity 2028 6,607.0 1,715.0 850.0 300.0 $9,472.0 1,625.0 756.2 $11,853.2 2,401.2 200.1 430.0 2,275.2 7.5 500.0 $5,814.0 5,814.0 2027 3,574.9 1,323.0 460.0 150.0 $5,507.9 $11,853.2 1,050.0 756.2 $7,314.1 601.2 220.1 95.5 1,583.4 $2,500.2 $2,500.2 282.9 5,756.3 6,039.2 $4,813.9 282.9 4,531.0 $7,314.1 2026 2,169.2 833.0 694.8 257.6 $3,954.6 2,600.0 856.2 $7,410.8 701.2 182.3 638.2 1,015.8 $2,537.5 $2,537.5 282.9 4,590.4 $4,873.3 $7,410.8 Entla

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each question and provide the workings for recording the transactions and preparing the financial statements 1 Recording the Transacti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started