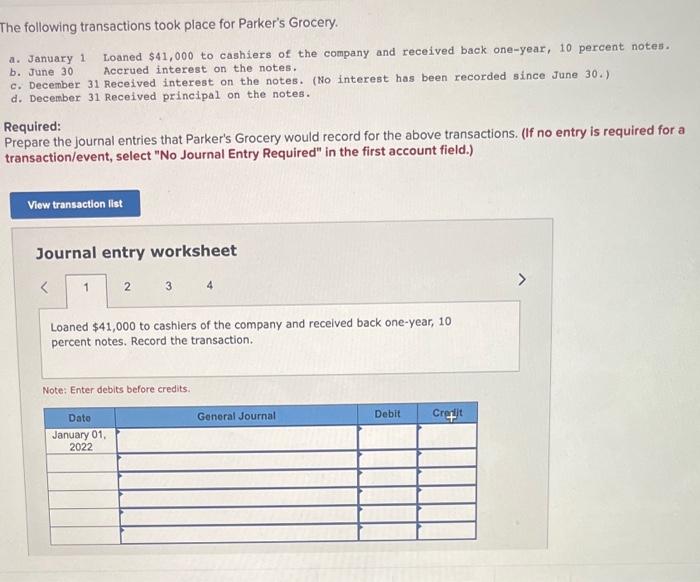

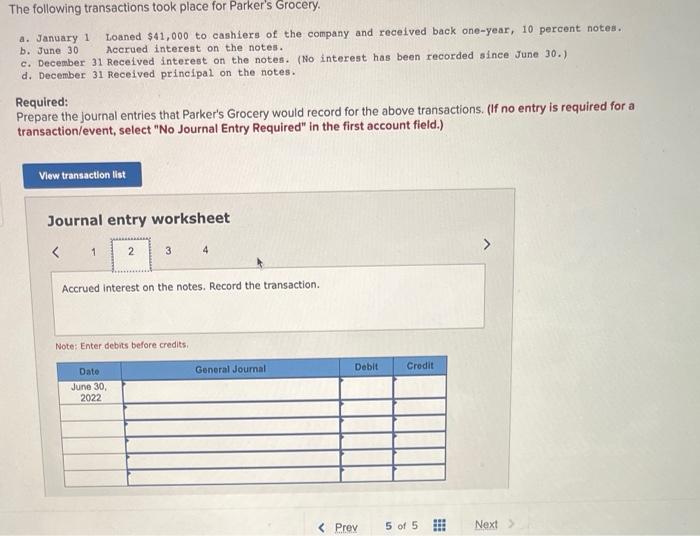

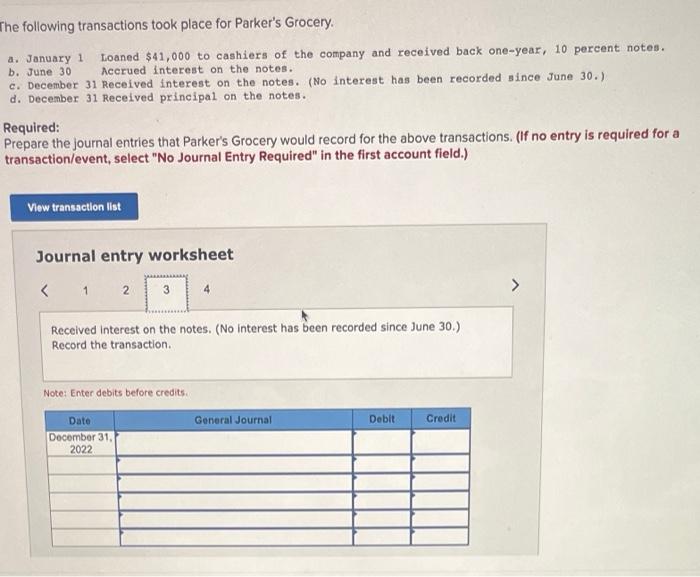

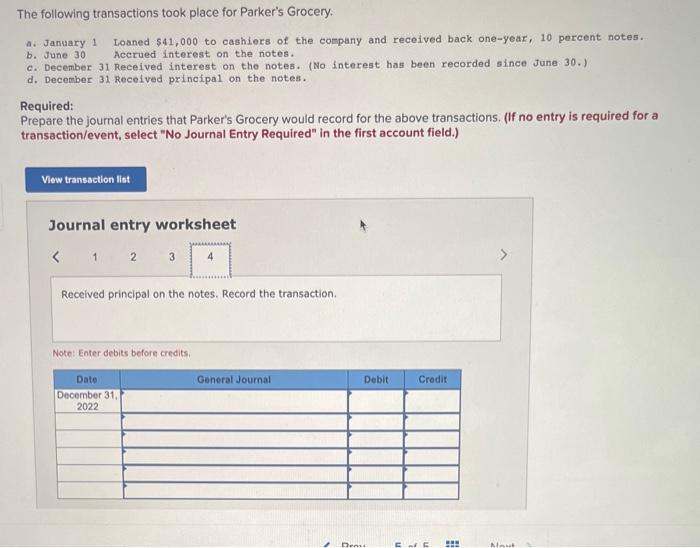

The following transactions took place for Parker's Grocery. a. January 1 Loaned $41,000 to cashiers of the company and received back one-year, 10 percent notes. b. June 30 Accrued interest on the notes. c. December 31 Received interest on the notes. (No interest has been recorded since June 30.) d. December 31 Received principal on the notes. Required: Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Loaned $41,000 to cashlers of the company and recelved back one-year, 10 percent notes. Record the transaction. Note: Enter debits before credits. The following transactions took place for Parker's Grocery. a. January 1 Loaned $41,000 to cashiers of the company and received back one-year, 10 percent notes. b. June 30 Accrued interest on the notes. c. December 31 Received interest on the notes. (No interest has been recorded since June 30.) d. December 31 Received principal on the notes. Required: Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Accrued interest on the notes. Record the transaction. Note: Enter debits before credits The following transactions took place for Parker's Grocery. a. January 1 Loaned $41,000 to cashiers of the company and received back one-year, 10 percent notes. b. June 30 Accrued interest on the notes. c. December 31 Received interest on the notes. (No interest has been recorded since June 30.) d. December 31 Received principal on the notes. Required: Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Received interest on the notes. (No interest has been recorded since June 30.) Record the transaction. Note: Enter debits before credits. The following transactions took place for Parker's Grocery. a. January 1 Loaned $41,000 to cashiers of the company and received back one-year, 10 percent notes. b. June 30 Accrued interest on the notes. c. December 31 Received interest on the notes. (No interest has been recorded since June 30.) d. December 31 Recelved principal on the notes. Required: Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Received principal on the notes. Record the transaction. Notet Enter debits before credits