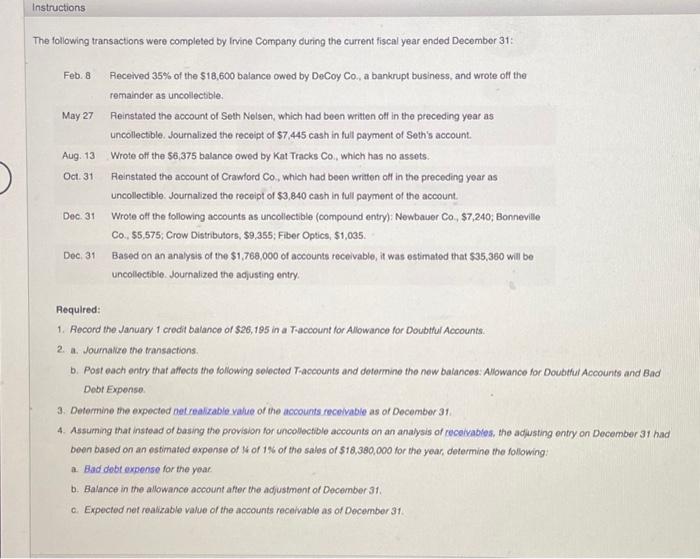

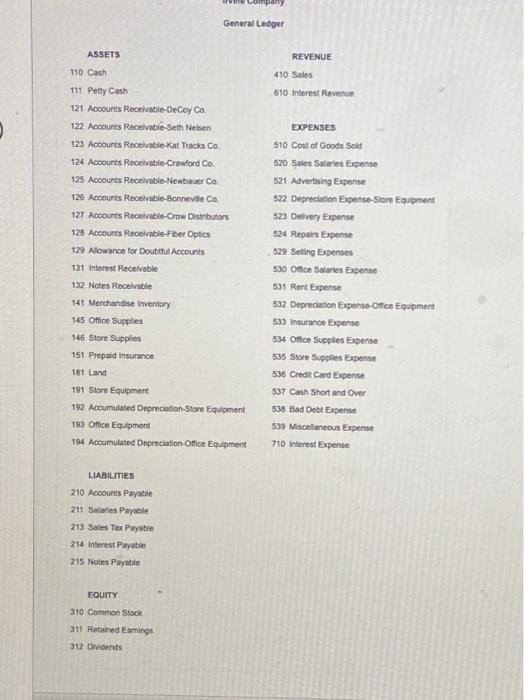

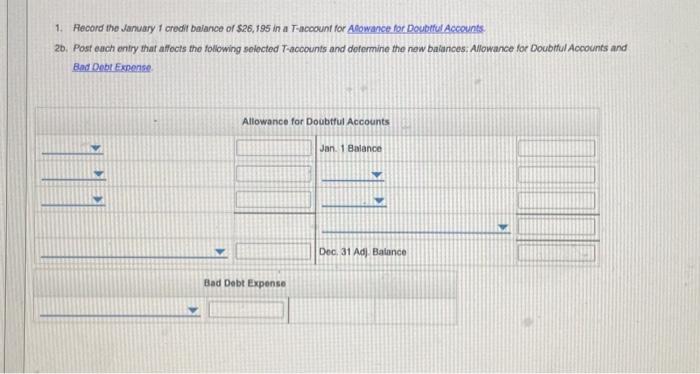

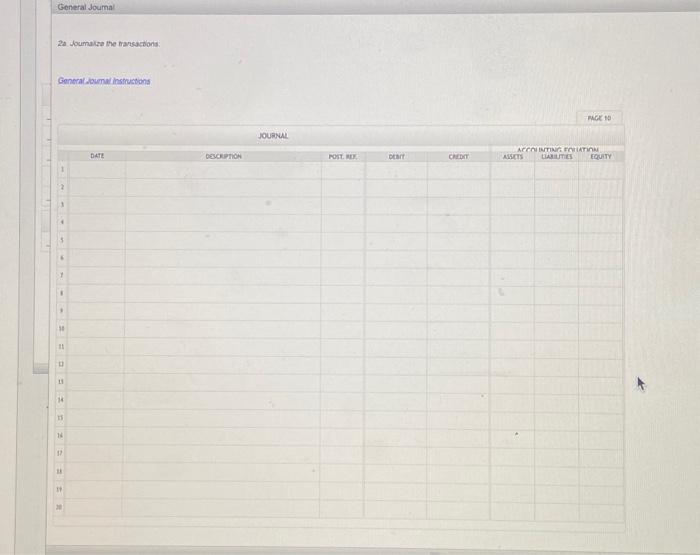

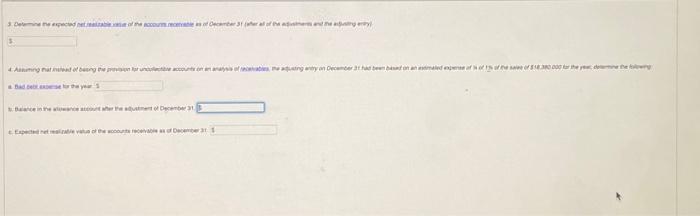

The following transactions were completed by Invine Company during the current fiscal year ended December 31: Feb. 8 Received 35% of the $18,600 balance owed by DeCoy Co, a bankrupt business, and wrote off the remainder as uncollectble. May 27 Feinstated the account of Seth Nolsen, which had boen written oft in the preceding yeat as uncollectble. Journalized the recelpt of $7,445 cash in full payment of Seth's account. Aug. 13 Wrote off the $6,375 balance owed by Kat Tracks Co, which has no assots. Oct.31 Feinstated the account of Crawlord Co, which had been written off in the preceding yoar as uncolloctible. Joumalized the recoipt of $3,840 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncolloctible (compound entry): Nowbauer Co, \$7,240; Bonnevile Co. $5,575; Crow Distributors, \$9,355; Fiber Optics, $1,035. Dec, 31 Based on an analysis of the $1,768,000 of accounts recelvable, it was estimated that $35,360 will be uncollectible. Journalized the adjusting entry. Aequired: 1. Record the January 1 crodit balance of $26,195 in a Tacoount for Allowance for Doubtful Accounts. 2. a. Journakre the transactions. b. Post each enty that affects the following solected Tacacounts and determine the now balances: Allowance for Doubtful Accounts and Bad Dobt Expenso 3. Determine the expected netrealizabie value of the accounts recelvable as of December 31 4. Assuming that instead of basing the provision for uncolectible accounts on an analsis of receivables, the ad/usting onty on December 31 had been based on an estimated expense of 14 of 1% of the sales of $18.380,000 for the year, determine the following: a. Bad dobt expense for the year b. Balance in the allowance account afer the adjustment of December St. c. Expected net realizable value of the accounts receivable as of December 31 . General Ledger ASSETS REVENUE 110 Cach 410 Sales 111 Pelly Cish 610 interest Raverue 121 Acocurts Recelvable-DeCoy Co 122 Acoounts Recelvable-Sest Neken EXPENSES 123 Accounts Rocelhble-Kat Tracks Co. 510 Cost of Goods Sold 124 Accounts Rocelvable-Crawford Co 520. Sales Salares Expense 125 Acoounts Rocelvble-Newbauer Co 521 Advertising Expense 12. Mccounts Recelvabio-Bonnevite Co 522 Depreciation Expense-Store Equipment 127 Accounts Recelvable-Crow Dstrbutors 523 Debvery Expense 125 Accounts Recetrable-Fiber Oples 524 Repairs Expense 129 Alowance for Doutdul Accounts 5.9 Selling Expenses 131 Interest Receivable 530 Onice Salares Expense 132 Notes Recelrable 531 Rent Expense 141 Merchandse imventory 532 Depreciation Exponse-Otice Equpmect 145 ottice Supples 533 Insurance Expense 146 Store Supplies 534 Oftice Supples Experse 151 Propaid insumance 535 Store Supples Eipense 181 Land 536 Credt Card Expense 181 Siore Equipment 537 Cash Short and Over 192 Accumuated Depreciation-Store Equloment 533 Bad Dobt Expense 193 Oitice Equipmont 537 Micelaneous Expense 194 Accumulated Depreciation-Office Equpment 710 intorest Expense LABILTIES 210 Aocounts Payabin 211 Salaries Payable 213 Sales Tax Payable 214 interest Pixable 215 Notes Parable EQuITY 310 Common Stock 311 Retained Eamings 312 Dilends 1. Aecord the January t credit balance of $26,195 in a Tancocunt for Acowance for Doubrful Aceeunts. 2b. Post each entry that affocts the following solocted T-acoounts and dotermine the new balances: Allowance for Doubtful Accounts and 2a doumaite the trarsestons: 3