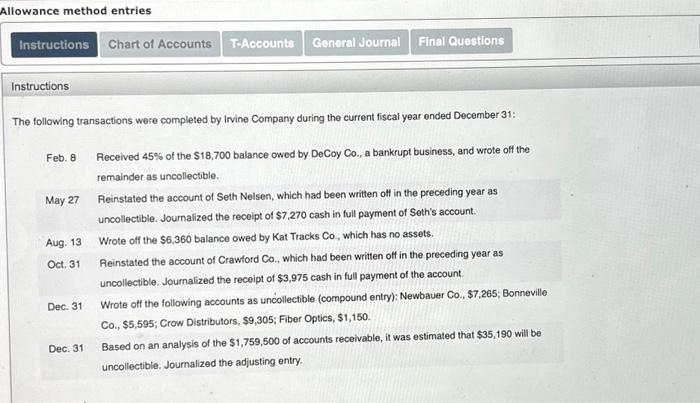

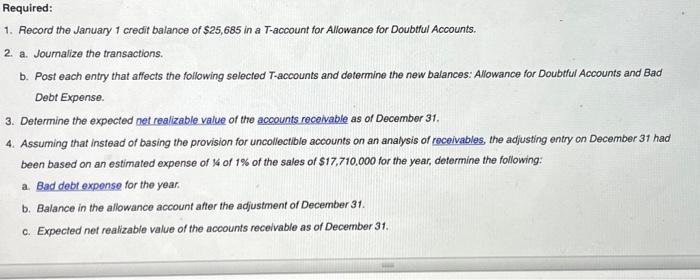

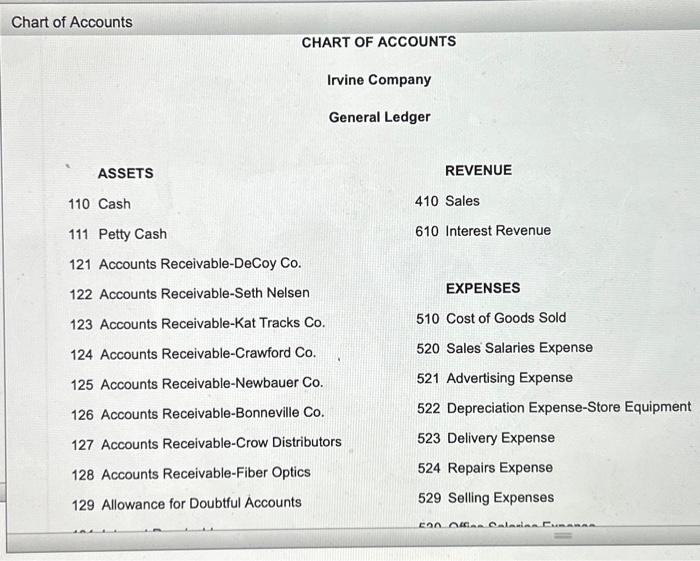

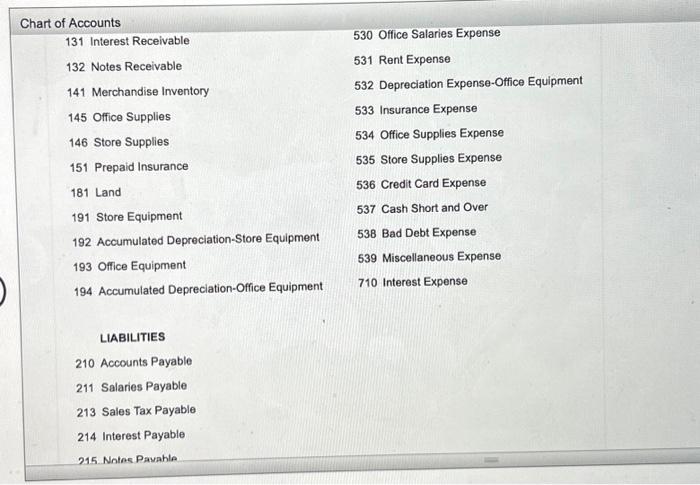

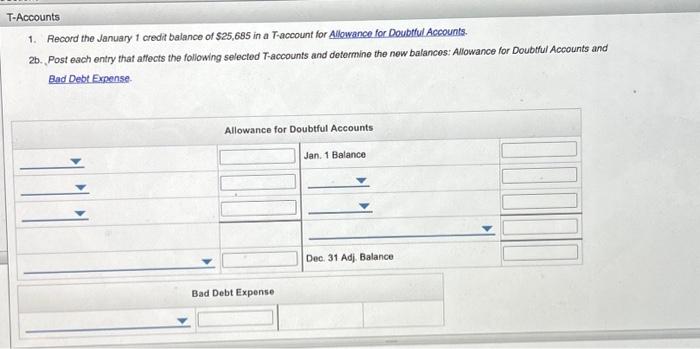

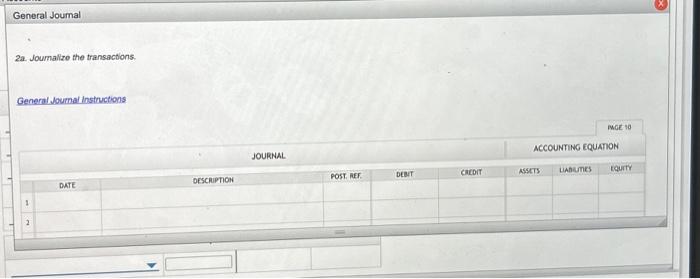

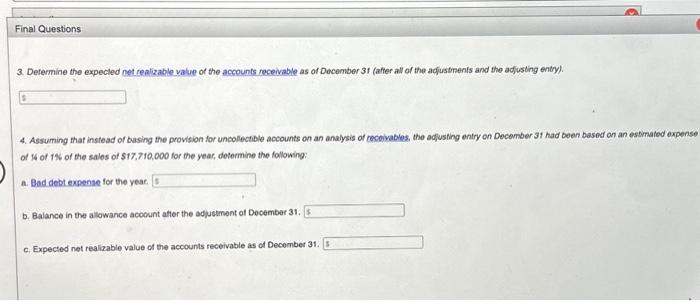

The following transactions were completed by Irvine Company during the current fiscal year ended December 31 : Feb. 8 Feceived 45% of the $18,700 balance owed by DeCoy Co., a bankrupt business, and wrote oft the remainder as uncollectible. May 27 Reinstated the account of Seth Nelsen, which had been written ott in the preceding year as uncollectible. Journalized the receipt of $7,270 cash in full payment of Seth's account. Aug. 13 Wrote off the $6,360 balance owed by Kat Tracks Co, which has no assets. Oct. 31 Reinstated the account of Crawford C., which had been written ott in the preceding year as uncollectible. Journalized the receipt of $3,975 cash in full payment of the account. Dec. 31 Wrote ofl the following accounts as uncollectible (compound entry): Newbauer Co., \$7,265; Bonneville Co., $5,595; Crow Distributors, $9,305; Fiber Optics, $1,150. Dec.31 Based on an analysis of the $1,759,500 of accounts receivable, it was estimated that $35,190 will be uncollectible. Journalized the adjusting entry. 1. Record the January 1 credit balance of $25,685 in a T-account for Allowance for Doubtful Accounts. 2. a. Joumalize the transactions. b. Post each entry that affects the following selected T-accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense. 3. Determine the expected net realizable value of the acoounts receivable as of December 31 . 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of roceivables, the adjusting entry on December 31 had been based on an estimated expense of 14 of 1% of the sales of $17,710,000 for the year, determine the following: a. Bad debt exponse for the year. b. Balance in the aliowance account after the adjustment of December 31 . c. Expected net realizable value of the accounts receivable as of December 31 . Chart of Accounts CHART OF ACCOUNTS Irvine Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable-DeCoy Co. 122 Accounts Receivable-Seth Nelsen EXPENSES 123 Accounts Receivable-Kat Tracks Co. 510 Cost of Goods Sold 124 Accounts Receivable-Crawford Co. 520 Sales Salaries Expense 125 Accounts Receivable-Newbauer Co. 521 Advertising Expense 126 Accounts Receivable-Bonneville Co. 522 Depreciation Expense-Store Equipment 127 Accounts Receivable-Crow Distributors 523 Delivery Expense 128 Accounts Receivable-Fiber Optics 524 Repairs Expense 129 Allowance for Doubtful Accounts 529 Selling Expenses Chart of Accounts 131 Interest Receivable 530 Office Salaries Expense 132 Notes Receivable 531 Rent Expense 141 Merchandise Inventory 532 Depreciation Expense-Office Equipment 145 Office Supplies 533 Insurance Expense 146 Store Supplies 534 Office Supplies Expense 151 Prepaid Insurance 535 Store Supplies Expense 181 Land 536 Credit Card Expense 191 Store Equipment 537 Cash Short and Over 192 Accumulated Depreciation-Store Equipment 538 Bad Debt Expense 193 Office Equipment 539 Miscellaneous Expense 194 Accumulated Depreciation-Office Equipment 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215. Nntes Payahle 1. Record the January 1 credit balance of $25,685 in a T-account for Alowance for Doubtful Accounts. 2b. Post each entry that affocts the following selected T-accounts and determine the new balances: Allowance for Doubtrul Accounts and Bad Debt Expense. 2a. Joumalize the transactions. 3. Determine the expected net realizable vatue of the accounts receivable as of Docember 3f (afrer all of the aciustinents and the adiusting entry). 4. Assuming that instead of busing the provision for uncolectible accounts on an analysis of cecoivables, the adjusting entry on December 31 had been based on an estimated expens. of 14 of 1N of the sales of $17.710,000 for the year, determine the following: for the yeat. b. Balance in the allowance acoount after the adjuctmont of Docember 31. c. Expected net realizable value of the accounts receivable as of December 31