Answered step by step

Verified Expert Solution

Question

1 Approved Answer

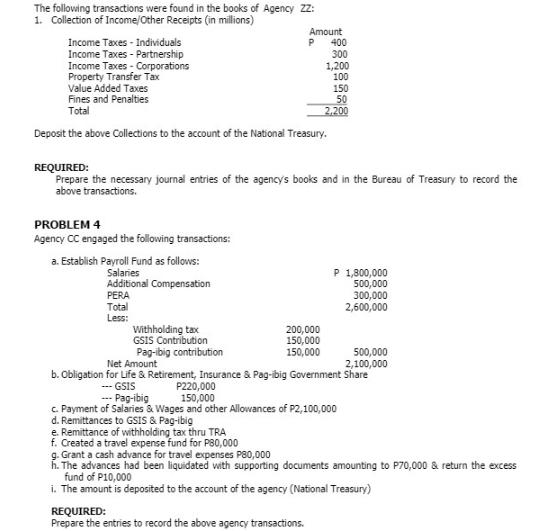

The following transactions were found in the books of Agency ZZ: 1. Collection of Income/Other Receipts (in millions) Income Taxes - Individuals Income Taxes

The following transactions were found in the books of Agency ZZ: 1. Collection of Income/Other Receipts (in millions) Income Taxes - Individuals Income Taxes - Partnership Income Taxes-Corporations Property Transfer Tax Value Added Taxes PROBLEM 4 Agency CC engaged the following transactions: Fines and Penalties Total Deposit the above Collections to the account of the National Treasury. a. Establish Payroll Fund as follows: Salaries Additional Compensation PERA Total Less: REQUIRED: Prepare the necessary journal entries of the agency's books and in the Bureau of Treasury to record the above transactions. Withholding tax GSIS Contribution Pag-ibig contribution 1******* Amount e. Remittance of withholding tax thru TRA f. Created a travel expense fund for P80,000 1,200 200,000 150,000 150,000 2.200 REQUIRED: Prepare the entries to record the above agency transactions. P 1,800,000 500,000 300,000 2,600,000 Net Amount b. Obligation for Life & Retirement, Insurance & Pag-ibig Government Share --- GSIS P220,000 Pag-ibig 150,000 c. Payment of Salaries & Wages and other Allowances of P2,100,000 d. Remittances to GSIS & Pag-ibig 500,000 2,100,000 g. Grant a cash advance for travel expenses P80,000 h. The advances had been liquidated with supporting documents amounting to P70,000 & return the excess fund of P10,000 i. The amount is deposited to the account of the agency (National Treasury)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Collection of IncomeOther Receipts Journal Entry in Agency ZZs Books Date Particulars Debit P Credit P Income Taxes Individuals 400 Income Taxes Partn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started