Answered step by step

Verified Expert Solution

Question

1 Approved Answer

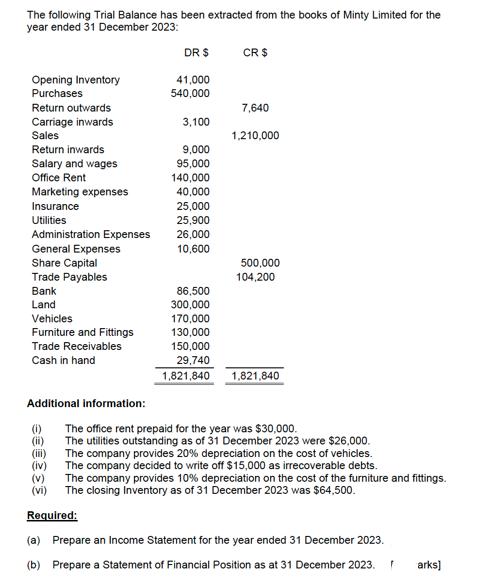

The following Trial Balance has been extracted from the books of Minty Limited for the year ended 31 December 2023: DR $ CR $

The following Trial Balance has been extracted from the books of Minty Limited for the year ended 31 December 2023: DR $ CR $ Opening Inventory 41,000 Purchases 540,000 Return outwards 7,640 Carriage inwards 3,100 Sales 1,210,000 Return inwards 9,000 Salary and wages 95,000 Office Rent 140,000 Marketing expenses 40,000 Insurance 25,000 Utilities 25,900 Administration Expenses 26,000 General Expenses 10,600 Share Capital 500,000 Trade Payables 104,200 Bank 86,500 Land 300,000 Vehicles 170,000 Furniture and Fittings 130,000 Trade Receivables 150,000 Cash in hand 29,740 1,821,840 1,821,840 Additional information: (i) The office rent prepaid for the year was $30,000. (ii) (iii) The utilities outstanding as of 31 December 2023 were $26,000. The company provides 20% depreciation on the cost of vehicles. (iv) The company decided to write off $15,000 as irrecoverable debts. (V) The company provides 10% depreciation on the cost of the furniture and fittings. (vi) The closing Inventory as of 31 December 2023 was $64,500. Required: (a) Prepare an Income Statement for the year ended 31 December 2023. (b) Prepare a Statement of Financial Position as at 31 December 2023. arks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started