Question

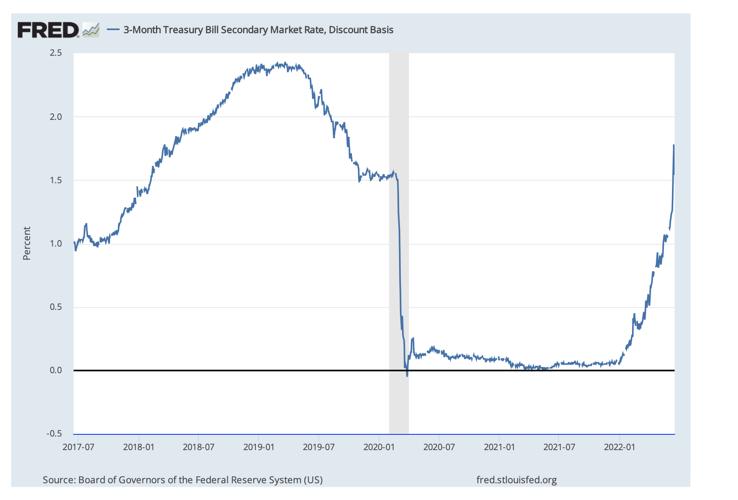

We discussed in the class that the value of a financial asset must be non-negative. The following figure shows the 90-day Treasury Bill Yield-to-Maturity (YTM)

We discussed in the class that the value of a financial asset must be non-negative. The following figure shows the 90-day Treasury Bill Yield-to-Maturity (YTM) from the U.S.

Federal Reserve Bank of St. Louis. You can see that sometime during December 2020 interest rate became negative for a brief period of time. It is rate to see negative interest rate and it happened only a few times in history.Now consider a simple asset pricing model such as the Dividend Discounting Model (DDM)

with growth, where the price is a function of future dividend (D), interest rate (r) and

future cash-flow growth (g) and is given by: P0 = D1 . When the interest rate is negative, r−g

this model will give you a negative price which does not really make any economic sense. Does this mean that the Dividend Discounting Model (DDM) is an incorrect model of stock price?

How would you modify or build a new model of stock price so that the revised model would be robust to the phenomenon we observed on December 2020?

FRED - 3-Month Treasury Bill Secondary Market Rate, Discount Basis 2.5 Percent 2.0 1.5 1.0 0.5 0.0 -0.5 2018-01 2018-07 Source: Board of Governors of the Federal Reserve System (US) 2017-07 2019-01 2019-07 2020-01 2020-07 2021-01 2021-07 fred.stlouisfed.org 2022-01 FRED - 3-Month Treasury Bill Secondary Market Rate, Discount Basis 2.5 Percent 2.0 1.5 1.0 0.5 0.0 -0.5 2018-01 2018-07 Source: Board of Governors of the Federal Reserve System (US) 2017-07 2019-01 2019-07 2020-01 2020-07 2021-01 2021-07 fred.stlouisfed.org 2022-01 FRED - 3-Month Treasury Bill Secondary Market Rate, Discount Basis 2.5 Percent 2.0 1.5 1.0 0.5 0.0 -0.5 2018-01 2018-07 Source: Board of Governors of the Federal Reserve System (US) 2017-07 2019-01 2019-07 2020-01 2020-07 2021-01 2021-07 fred.stlouisfed.org 2022-01

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

No the existence of negative interest rates does not necessarily mean that the Dividend Discounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started