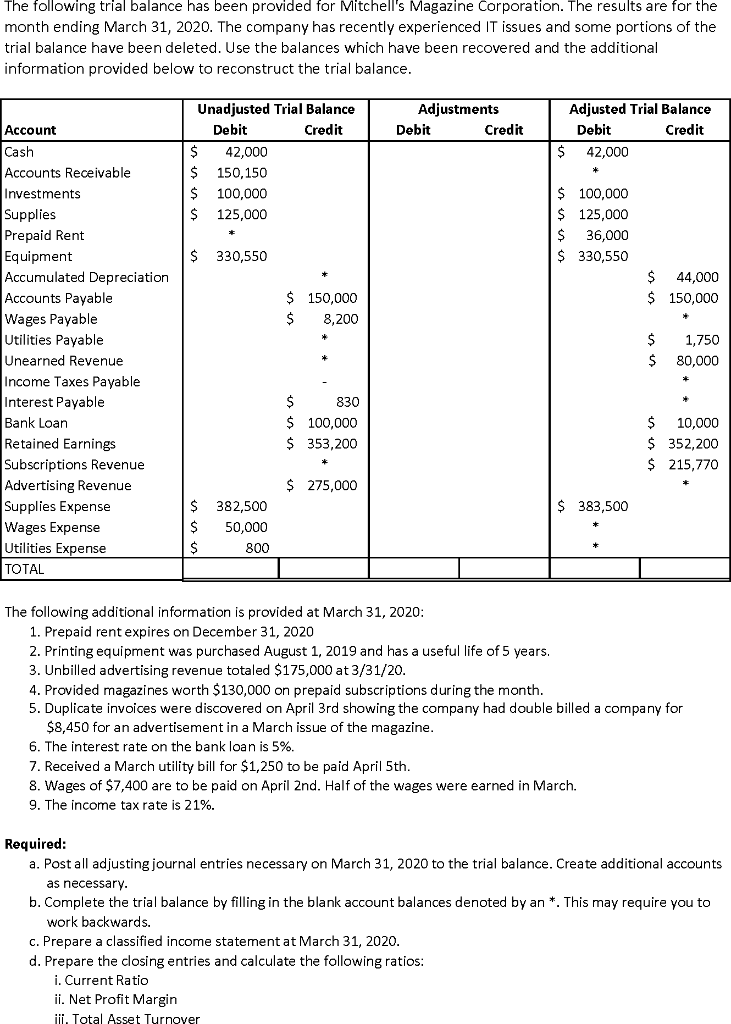

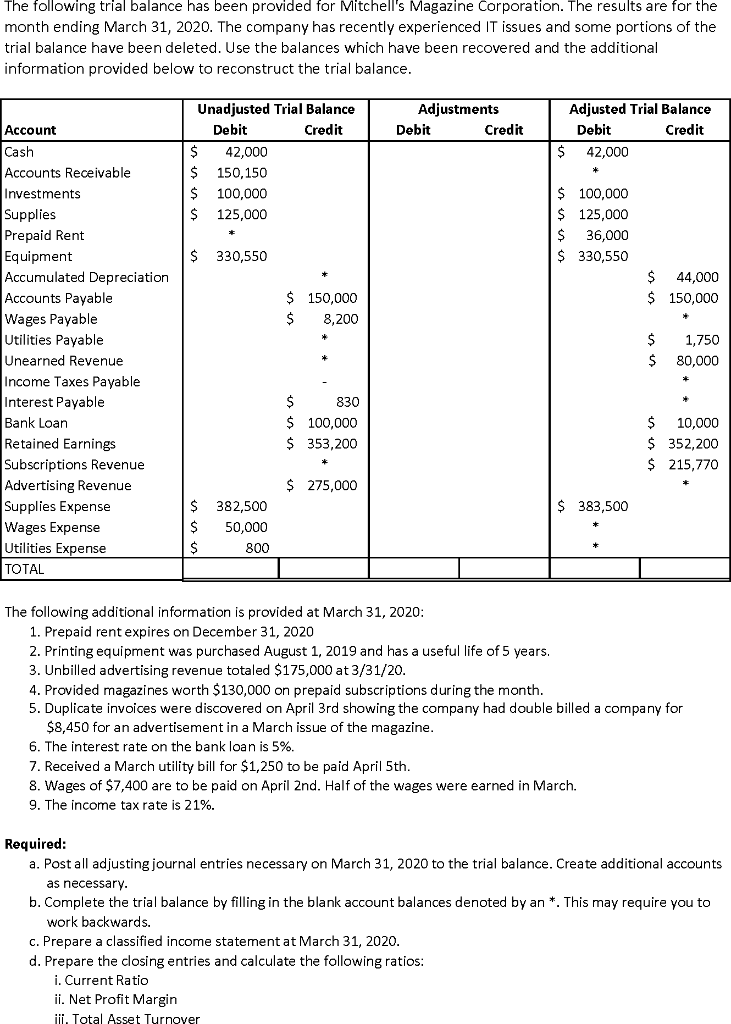

The following trial balance has been provided for Mitchell's Magazine Corporation. The results are for the month ending March 31, 2020. The company has recently experienced IT issues and some portions of the trial balance have been deleted. Use the balances which have been recovered and the additional information provided below to reconstruct the trial balance. Adjustments Debit Credit Adjusted Trial Balance Debit Credit $ 42,000 Unadjusted Trial Balance Debit Credit $ 42,000 $ 150,150 $ 100,000 $ 125,000 $ 100,000 $ 125,000 $ 36,000 $ 330,550 $ 330,550 $ $ 44,000 150,000 $ $ 150,000 8,200 Account Cash Accounts Receivable Investments Supplies Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Wages Payable Utilities Payable Unearned Revenue Income Taxes Payable Interest Payable Bank Loan Retained Earnings Subscriptions Revenue Advertising Revenue Supplies Expense Wages Expense Utilities Expense TOTAL $ $ 1,750 80,000 $ 830 $ 100,000 $ 353,200 $ 10,000 $ 352,200 $ 215,770 $ 275,000 $ 383,500 $ $ $ 382,500 50,000 800 The following additional information is provided at March 31, 2020: 1. Prepaid rent expires on December 31, 2020 2. Printing equipment was purchased August 1, 2019 and has a useful life of 5 years. 3. Unbilled advertising revenue totaled $175,000 at 3/31/20. 4. Provided magazines worth $130,000 on prepaid subscriptions during the month. 5. Duplicate invoices were discovered on April 3rd showing the company had double billed a company for $8,450 for an advertisement in a March issue of the magazine. 6. The interest rate on the bank loan is 5%. 7. Received a March utility bill for $1,250 to be paid April 5th. 8. Wages of $7,400 are to be paid on April 2nd. Half of the wages were earned in March. 9. The income tax rate is 21%. Required: a. Post all adjusting journal entries necessary on March 31, 2020 to the trial balance. Create additional accounts as necessary. b. Complete the trial balance by filling in the blank account balances denoted by an *. This may require you to work backwards. c. Prepare a classified income statement at March 31, 2020. d. Prepare the closing entries and calculate the following ratios: i. Current Ratio ii. Net Profit Margin iii. Total Asset Turnover The following trial balance has been provided for Mitchell's Magazine Corporation. The results are for the month ending March 31, 2020. The company has recently experienced IT issues and some portions of the trial balance have been deleted. Use the balances which have been recovered and the additional information provided below to reconstruct the trial balance. Adjustments Debit Credit Adjusted Trial Balance Debit Credit $ 42,000 Unadjusted Trial Balance Debit Credit $ 42,000 $ 150,150 $ 100,000 $ 125,000 $ 100,000 $ 125,000 $ 36,000 $ 330,550 $ 330,550 $ $ 44,000 150,000 $ $ 150,000 8,200 Account Cash Accounts Receivable Investments Supplies Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Wages Payable Utilities Payable Unearned Revenue Income Taxes Payable Interest Payable Bank Loan Retained Earnings Subscriptions Revenue Advertising Revenue Supplies Expense Wages Expense Utilities Expense TOTAL $ $ 1,750 80,000 $ 830 $ 100,000 $ 353,200 $ 10,000 $ 352,200 $ 215,770 $ 275,000 $ 383,500 $ $ $ 382,500 50,000 800 The following additional information is provided at March 31, 2020: 1. Prepaid rent expires on December 31, 2020 2. Printing equipment was purchased August 1, 2019 and has a useful life of 5 years. 3. Unbilled advertising revenue totaled $175,000 at 3/31/20. 4. Provided magazines worth $130,000 on prepaid subscriptions during the month. 5. Duplicate invoices were discovered on April 3rd showing the company had double billed a company for $8,450 for an advertisement in a March issue of the magazine. 6. The interest rate on the bank loan is 5%. 7. Received a March utility bill for $1,250 to be paid April 5th. 8. Wages of $7,400 are to be paid on April 2nd. Half of the wages were earned in March. 9. The income tax rate is 21%. Required: a. Post all adjusting journal entries necessary on March 31, 2020 to the trial balance. Create additional accounts as necessary. b. Complete the trial balance by filling in the blank account balances denoted by an *. This may require you to work backwards. c. Prepare a classified income statement at March 31, 2020. d. Prepare the closing entries and calculate the following ratios: i. Current Ratio ii. Net Profit Margin iii. Total Asset Turnover