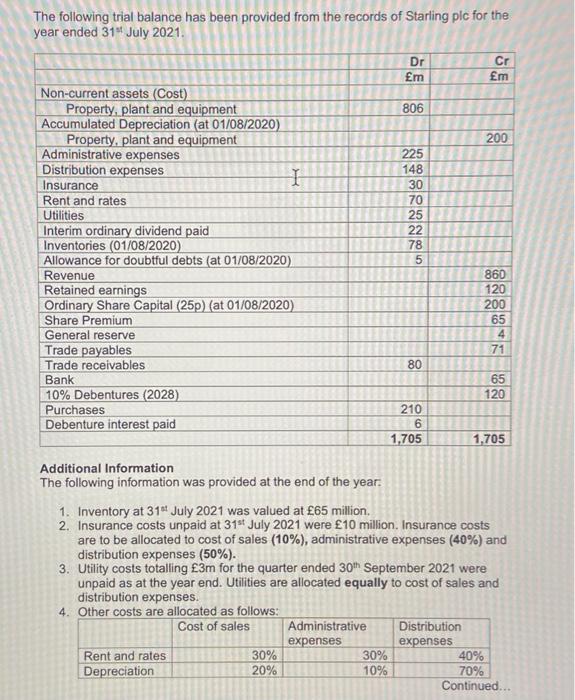

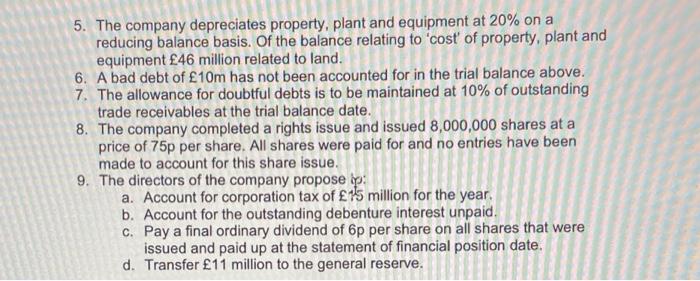

The following trial balance has been provided from the records of Starling plc for the year ended 31 July 2021. Dr m Cr m 806 200 Non-current assets (Cost) Property, plant and equipment Accumulated Depreciation (at 01/08/2020) Property, plant and equipment Administrative expenses Distribution expenses I Insurance Rent and rates Utilities Interim ordinary dividend paid Inventories (01/08/2020) Allowance for doubtful debts (at 01/08/2020) Revenue Retained earnings Ordinary Share Capital (25p) (at 01/08/2020) Share Premium General reserve Trade payables Trade receivables Bank 10% Debentures (2028) Purchases Debenture interest paid 225 148 30 70 25 22 78 5 860 120 200 65 4 71 80 65 120 210 6 1,705 1,705 Additional Information The following information was provided at the end of the year. 1. Inventory at 31 July 2021 was valued at 65 million. 2. Insurance costs unpaid at 31st July 2021 were 10 million. Insurance costs are to be allocated to cost of sales (10%), administrative expenses (40%) and distribution expenses (50%). 3. Utility costs totalling 3m for the quarter ended 30th September 2021 were unpaid as at the year end. Utilities are allocated equally to cost of sales and distribution expenses. 4. Other costs are allocated as follows: Cost of sales Administrative Distribution expenses expenses Rent and rates 30% 30% 40% Depreciation 20% 10% 70% Continued... 5. The company depreciates property, plant and equipment at 20% on a reducing balance basis. Of the balance relating to cost of property, plant and equipment 46 million related to land. 6. A bad debt of 10m has not been accounted for in the trial balance above. 7. The allowance for doubtful debts is to be maintained at 10% of outstanding trade receivables at the trial balance date. 8. The company completed a rights issue and issued 8,000,000 shares at a price of 75p per share. All shares were paid for and no entries have been made to account for this share issue. 9. The directors of the company propose op: a. Account for corporation tax of 15 million for the year. b. Account for the outstanding debenture interest unpaid. c. Pay a final ordinary dividend of 6p per share on all shares that were issued and paid up at the statement of financial position date. d. Transfer 11 million to the general reserve. Your finance course director has asked questions about the preparation of accounts and wants information on the points below. e) Identify 3 subsidiary books. (3 marks) f) Describe the purpose of, and information included in, each of the the subsidiary books identified in part 'e' above. (6 marks) TOTAL: 60 marks