Question

The following Trial Balance is extracted from the books of Smile Enterprise, a sole trader as at 31 December 2019. The following additional information is

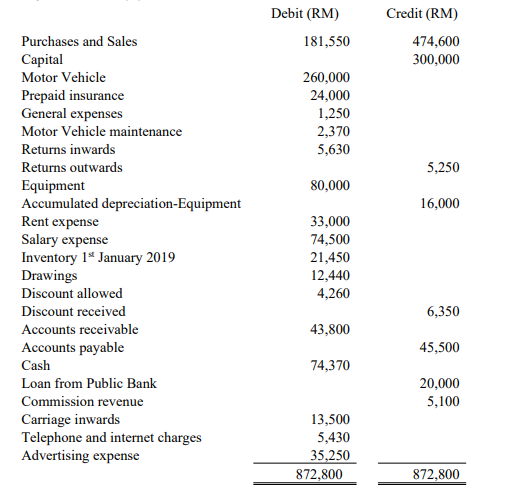

The following Trial Balance is extracted from the books of Smile Enterprise, a sole trader as at 31 December 2019.

The following additional information is available as at 31 December 2019:

i. Inventory as at 31 December 2019 was valued at RM19,040.

ii. The owner took RM2,500 to pay his sons hospital bill.

iii. The owner has decided to write off an additional of bad debts amounting to RM2,170.

iv. Equipment is depreciated at 20% per annum using reducing balance method while motor vehicle is depreciated at 20% per annum on cost using straight line method.

v. The prepaid insurance is for a 12-month policy purchased by cash on 1April 2019. The policy is effective from 1 April 2019.

vi. Interest on loan from Public Bank at 6% per annum has not been paid.

vii. Telephone and internet charges outstanding amounted to RM1,500.

Required:

a. Prepare the statement of profit or loss for the year ended 31 December 2019.

b. Prepare the statement of financial position as at 31 December 2019.

Debit (RM) 181,550 Credit (RM) 474,600 300,000 260,000 24,000 1,250 2,370 5,630 5,250 80,000 16,000 Purchases and Sales Capital Motor Vehicle Prepaid insurance General expenses Motor Vehicle maintenance Returns inwards Returns outwards Equipment Accumulated depreciation-Equipment Rent expense Salary expense Inventory 19 January 2019 Drawings Discount allowed Discount received Accounts receivable Accounts payable Cash Loan from Public Bank Commission revenue Carriage inwards Telephone and internet charges Advertising expense 33,000 74,500 21,450 12,440 4,260 6,350 43,800 45,500 74,370 20,000 5,100 13,500 5,430 35,250 872,800 872,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started