Question

The following trial balance relates to Jelly Berhad at 30 September 2022: Note RM'000 RM'000 Land and Buildings at valuation 1 October 2021 (i) 150,000

The following trial balance relates to Jelly Berhad at 30 September 2022:

|

| Note |

| RM'000 |

| RM'000 |

| Land and Buildings at valuation 1 October 2021 | (i) |

| 150,000 |

|

|

| Plant and equipment at cost | (i) |

| 229,800 |

|

|

| Plant and equipment accumulated depreciation at 1 October 2021 |

|

|

|

| 73,800 |

| Capitalised development expenditure at 1 October 2021 | (ii) |

| 60,000 |

|

|

| Development expenditure accumulated amortisation at 1 October 2021 |

|

|

|

| 18,000 |

| Closing inventory at 30 September 2022 |

|

| 60,000 |

|

|

| Trade receivables |

|

| 129,300 |

|

|

| Bank |

|

|

|

| 3,900 |

| Trade payables and provisions | (iii) |

|

|

| 71,400 |

| Revenue | (i) |

|

|

| 900,000 |

| Cost of sales |

|

| 612,000 |

|

|

| Distribution costs |

|

| 43,500 |

|

|

| Administrative expenses | (iii) |

| 66,600 |

|

|

| Preference dividend paid |

|

| 2,400 |

|

|

| Interest on bank borrowings |

|

| 600 |

|

|

| Equity dividend paid |

|

| 18,000 |

|

|

| Research and development costs | (ii) |

| 25,800 |

|

|

| Equity shares (200 million shares) |

|

|

|

| 150,000 |

| 8% redeemable preference shares of RM1 each | (iv) |

|

|

| 60,000 |

| Retained earnings at 1 October 2021 |

|

|

|

| 90,900 |

| Revaluation reserve Land and building |

|

|

|

| 30,000 |

|

|

|

| 1,398,000 |

| 1,398,000 |

|

|

|

|

|

|

|

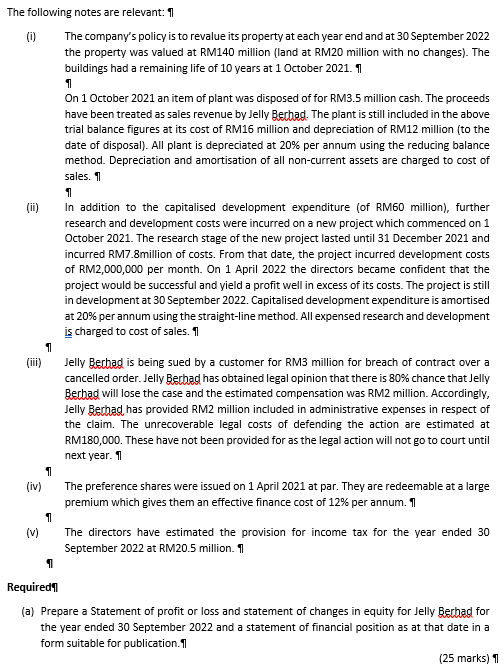

The following notes are relevant: (i) The company's policy is to revalue its property at each year end and at 30 September 2022 the property was valued at RM140 million (land at RM20 million with no changes). The buildings had a remaining life of 10 years at 1 October 2021. On 1 October 2021 an item of plant was disposed of for RM3.5 million cash. The proceeds have been treated as sales revenue by Jelly Bechad. The plant is still included in the above trial balance figures at its cost of RM16 million and depreciation of RM12 million (to the date of disposal). All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets are charged to cost of sales. (ii) In addition to the capitalised development expenditure (of RM60 million), further research and development costs were incurred on a new project which commenced on 1 October 2021. The research stage of the new project lasted until 31 December 2021 and incurred RM7.8million of costs. From that date, the project incurred development costs of RM2,000,000 per month. On 1 April 2022 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 2022 . Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development is charged to cost of sales. (iii) Jelly Berhad is being sued by a customer for RM3 million for breach of contract over a cancelled order. Jelly Berhag has obtained legal opinion that there is 80% chance that Jelly Berhad will lose the case and the estimated compensation was RM2 million. Accordingly, Jelly Berhad has provided RM2 million included in administrative expenses in respect of the claim. The unrecoverable legal costs of defending the action are estimated at RM180,000. These have not been provided for as the legal action will not go to court until next year. (iv) The preference shares were issued on 1 April 2021 at par. They are redeemable at a large premium which gives them an effective finance cost of 12% per annum. (v) The directors have estimated the provision for income tax for the year ended 30 September 2022 at RM20.5 million. Required (a) Prepare a Statement of profit or loss and statement of changes in equity for Jelly Berhag for the year ended 30 September 2022 and a statement of financial position as at that date in a form suitable for publication. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started