Answered step by step

Verified Expert Solution

Question

1 Approved Answer

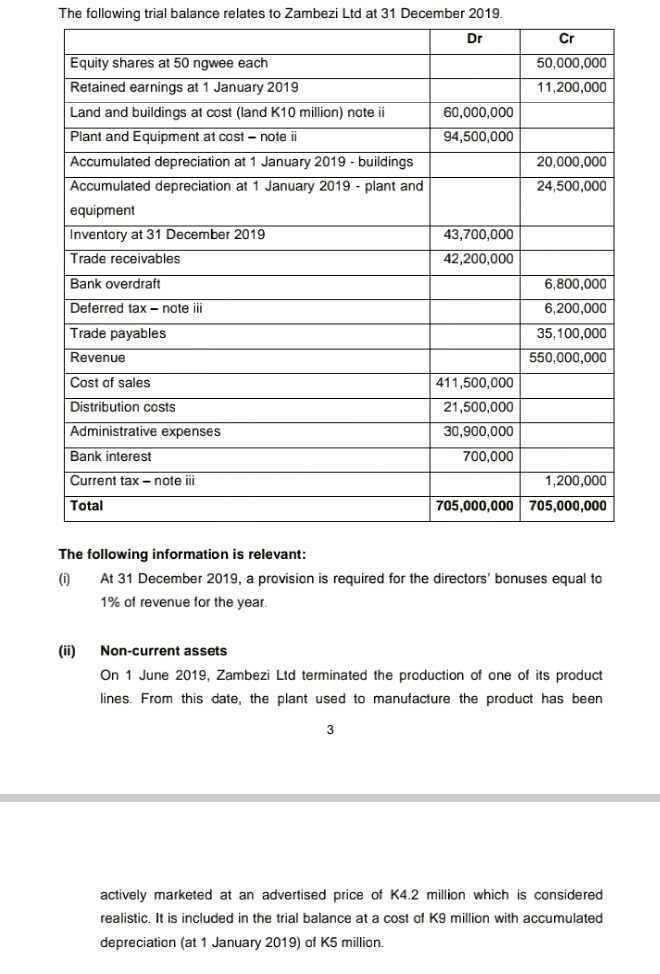

The following trial balance relates to Zambezi Ltd at 31 December 2019. Dr Cr 50,000,000 11,200,000 60,000,000 94,500,000 20,000,000 24,500,000 Equity shares at 50 ngwee

The following trial balance relates to Zambezi Ltd at 31 December 2019. Dr Cr 50,000,000 11,200,000 60,000,000 94,500,000 20,000,000 24,500,000 Equity shares at 50 ngwee each Retained earnings at 1 January 2019 Land and buildings at cost (land K10 million) noteii Plant and Equipment at cost - note ii Accumulated depreciation at 1 January 2019 - buildings Accumulated depreciation at 1 January 2019 - plant and equipment Inventory at 31 December 2019 Trade receivables Bank overdraft Deferred tax - note ili Trade payables Revenue Cost of sales Distribution costs Administrative expenses Bank interest Current tax-note ili Total 43,700,000 42,200,000 6,800,000 6,200,000 35,100,000 550,000,000 411,500,000 21,500,000 30,900,000 700,000 1,200,000 705,000,000 705,000,000 The following information is relevant: 0 At 31 December 2019, a provision is required for the directors' bonuses equal to 1% of revenue for the year. (ii) Non-current assets On 1 June 2019, Zambezi Ltd terminated the production of one of its product lines. From this date, the plant used to manufacture the product has been actively marketed at an advertised price of K4.2 million which is considered realistic. It is included in the trial balance at a cost of K9 million with accumulated depreciation (at 1 January 2019) of K5 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started