Question

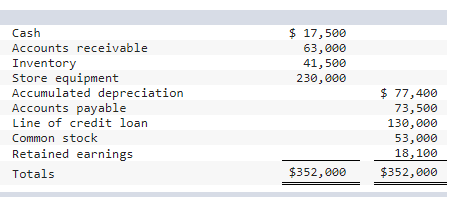

The following trial balance was drawn from the records of Benson Company as of October 1, year 2. Required a-1. Based on the following information,

The following trial balance was drawn from the records of Benson Company as of October 1, year 2.

Required

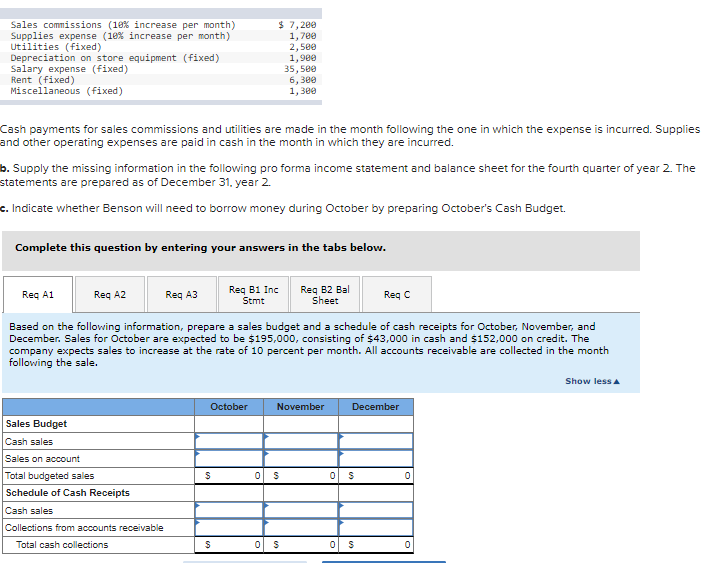

a-1. Based on the following information, prepare a sales budget and a schedule of cash receipts for October, November, and December. Sales for October are expected to be $195,000, consisting of $43,000 in cash and $152,000 on credit. The company expects sales to increase at the rate of 10 percent per month. All accounts receivable are collected in the month following the sale.

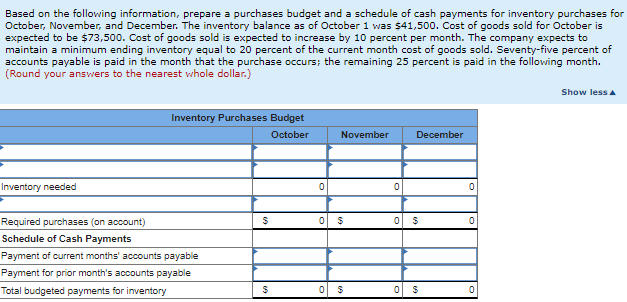

a-2. Based on the following information, prepare a purchases budget and a schedule of cash payments for inventory purchases for October, November, and December. The inventory balance as of October 1 was $41,500. Cost of goods sold for October is expected to be $73,500. Cost of goods sold is expected to increase by 10 percent per month. The company expects to maintain a minimum ending inventory equal to 20 percent of the current month cost of goods sold. Seventy-five percent of accounts payable is paid in the month that the purchase occurs; the remaining 25 percent is paid in the following month.

a-3. Based on the following selling and administrative expenses budgeted for October, prepare a selling and administrative expenses budget for October, November, and December.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started