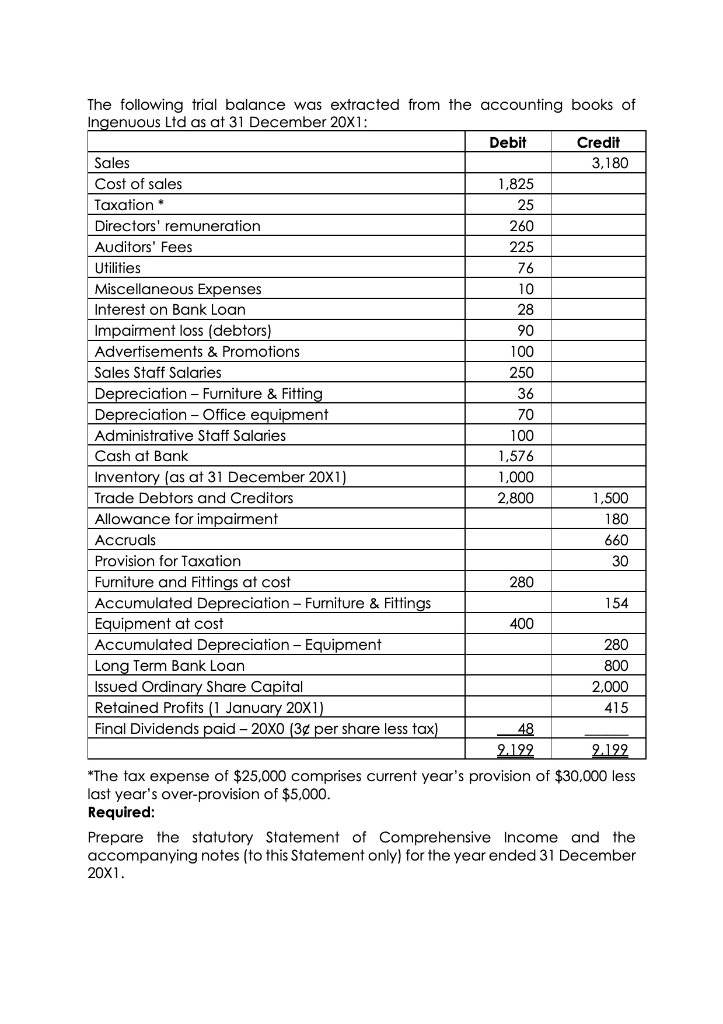

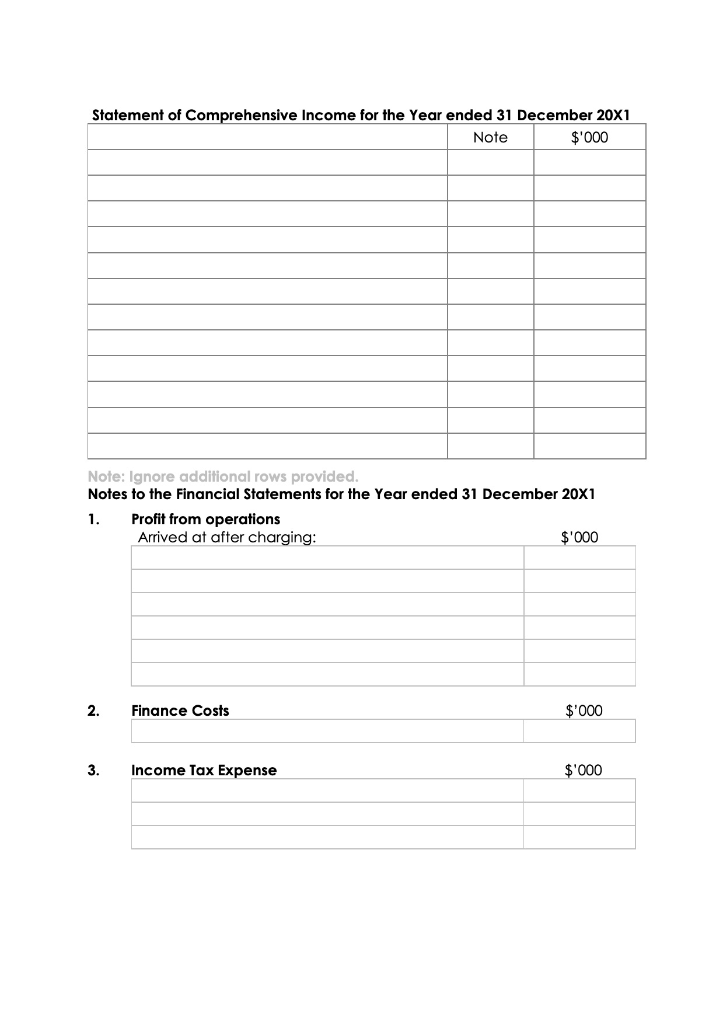

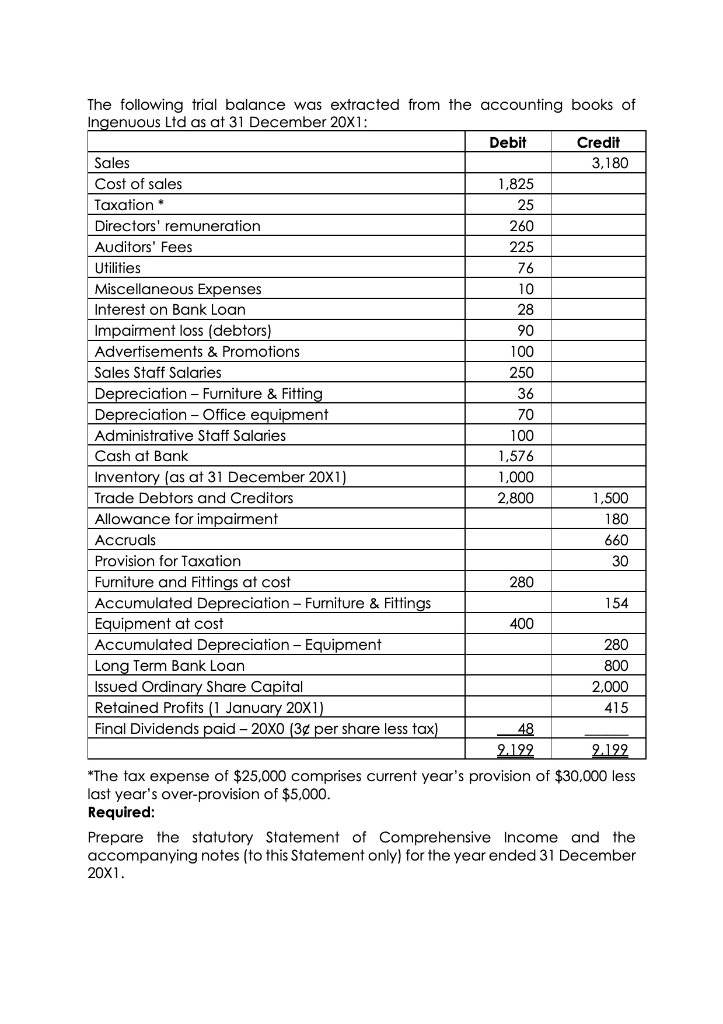

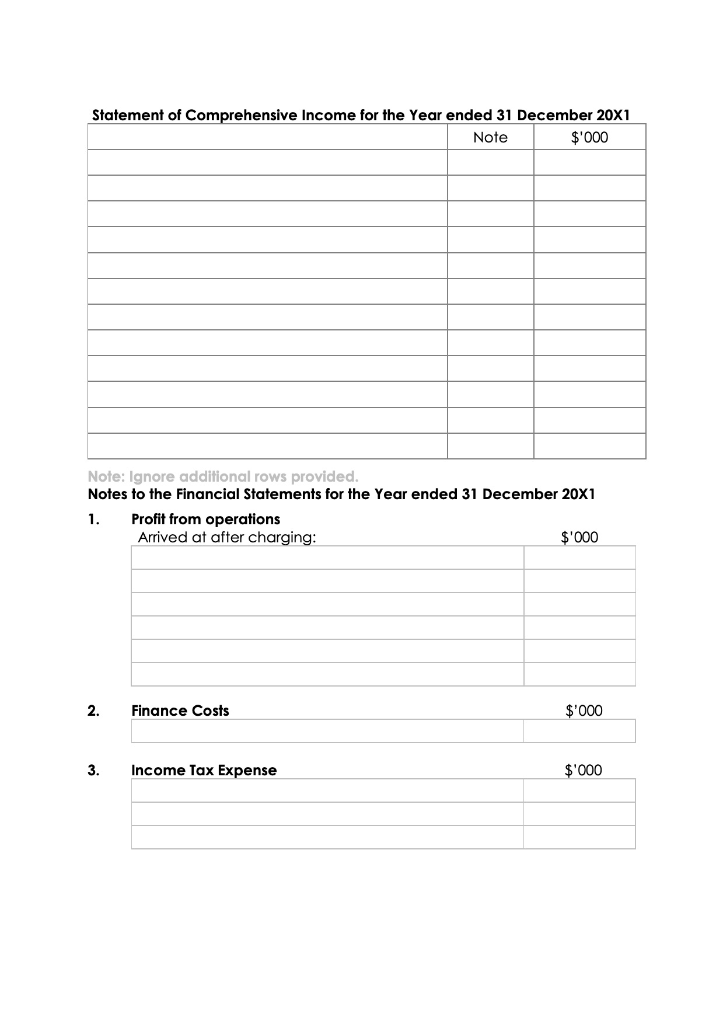

The following trial balance was extracted from the accounting books of Ingenuous Ltd as at 31 December 20X1: Debit Credit Sales 3,180 Cost of sales 1,825 Taxation 25 Directors' remuneration 260 Auditors' Fees 225 Utilities 76 Miscellaneous Expenses 10 Interest on Bank Loan 28 Impairment loss (debtors) 90 Advertisements & Promotions 100 Sales Staff Salaries 250 Depreciation - Furniture & Fitting 36 Depreciation - Office equipment 70 Administrative Staff Salaries 100 Cash at Bank 1,576 Inventory (as at 31 December 20X1) 1,000 Trade Debtors and Creditors 2,800 1,500 Allowance for impairment 180 Accruals 660 Provision for Taxation 30 Furniture and Fittings at cost 280 Accumulated Depreciation - Furniture & Fittings 154 Equipment at cost 400 Accumulated Depreciation - Equipment Long Term Bank Loan 800 Issued Ordinary Share Capital 2,000 Retained Profits (1 January 20X1) 415 Final Dividends paid - 20X0 (3 per share less tax) 48 2.199 2.199 *The tax expense of $25,000 comprises current year's provision of $30,000 less last year's over-provision of $5,000. Required: Prepare the statutory Statement of Comprehensive Income and the accompanying notes (to this statement only) for the year ended 31 December 20X1. 280 Statement of Comprehensive Income for the Year ended 31 December 20X1 Note $'000 Note: Ignore additional rows provided. Notes to the Financial Statements for the Year ended 31 December 20X1 1. Profit from operations Arrived at after charging: $'000 2. Finance Costs $'000 3. Income Tax Expense $'000 The following trial balance was extracted from the accounting books of Ingenuous Ltd as at 31 December 20X1: Debit Credit Sales 3,180 Cost of sales 1,825 Taxation 25 Directors' remuneration 260 Auditors' Fees 225 Utilities 76 Miscellaneous Expenses 10 Interest on Bank Loan 28 Impairment loss (debtors) 90 Advertisements & Promotions 100 Sales Staff Salaries 250 Depreciation - Furniture & Fitting 36 Depreciation - Office equipment 70 Administrative Staff Salaries 100 Cash at Bank 1,576 Inventory (as at 31 December 20X1) 1,000 Trade Debtors and Creditors 2,800 1,500 Allowance for impairment 180 Accruals 660 Provision for Taxation 30 Furniture and Fittings at cost 280 Accumulated Depreciation - Furniture & Fittings 154 Equipment at cost 400 Accumulated Depreciation - Equipment Long Term Bank Loan 800 Issued Ordinary Share Capital 2,000 Retained Profits (1 January 20X1) 415 Final Dividends paid - 20X0 (3 per share less tax) 48 2.199 2.199 *The tax expense of $25,000 comprises current year's provision of $30,000 less last year's over-provision of $5,000. Required: Prepare the statutory Statement of Comprehensive Income and the accompanying notes (to this statement only) for the year ended 31 December 20X1. 280 Statement of Comprehensive Income for the Year ended 31 December 20X1 Note $'000 Note: Ignore additional rows provided. Notes to the Financial Statements for the Year ended 31 December 20X1 1. Profit from operations Arrived at after charging: $'000 2. Finance Costs $'000 3. Income Tax Expense $'000