Answered step by step

Verified Expert Solution

Question

1 Approved Answer

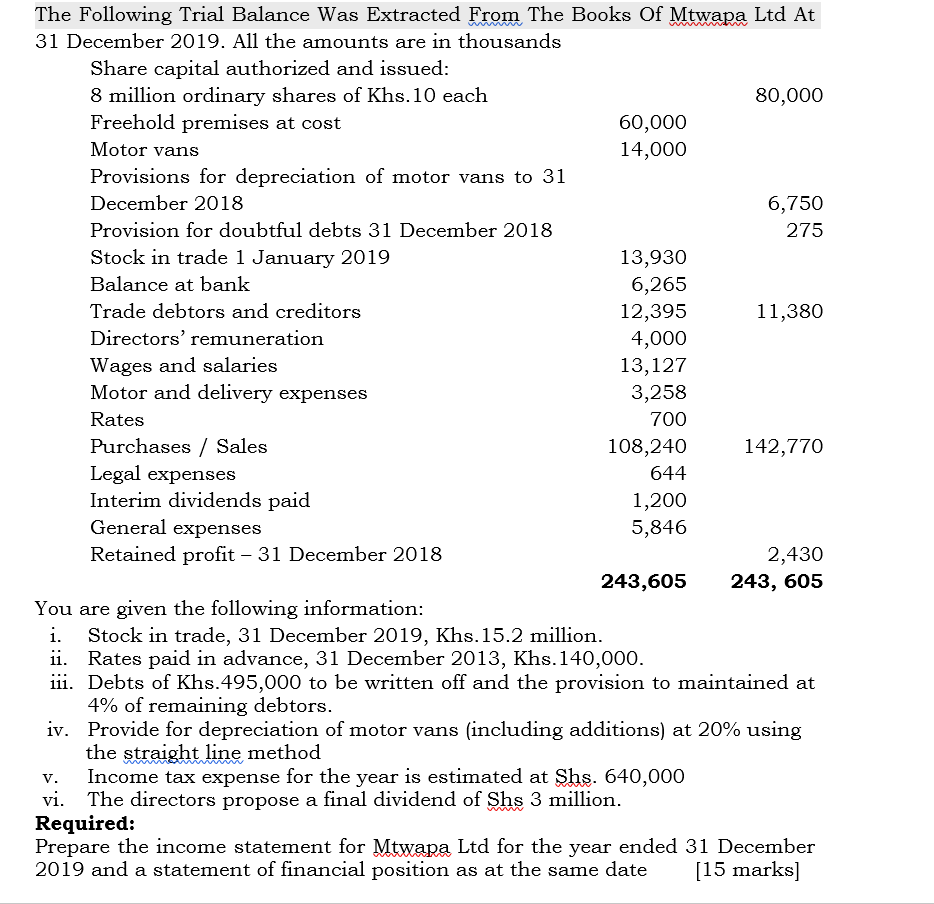

The Following Trial Balance Was Extracted From The Books Of Mtwapa Ltd At 31 December 2019. All the amounts are in thousands Share capital

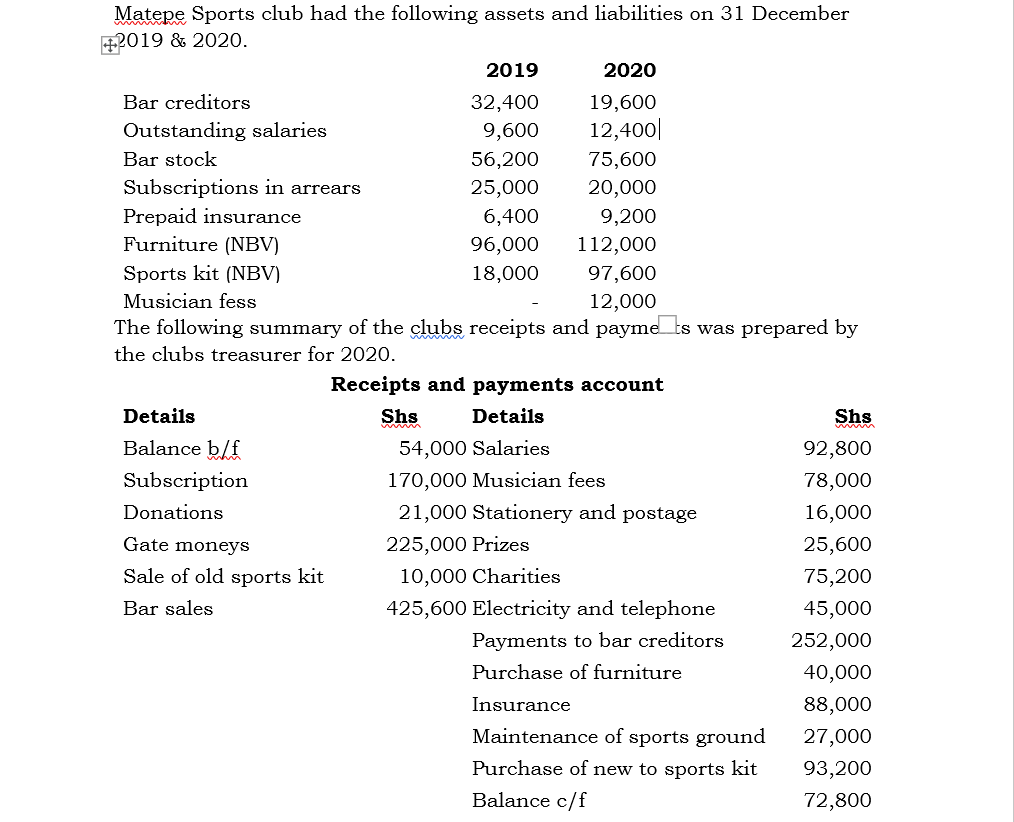

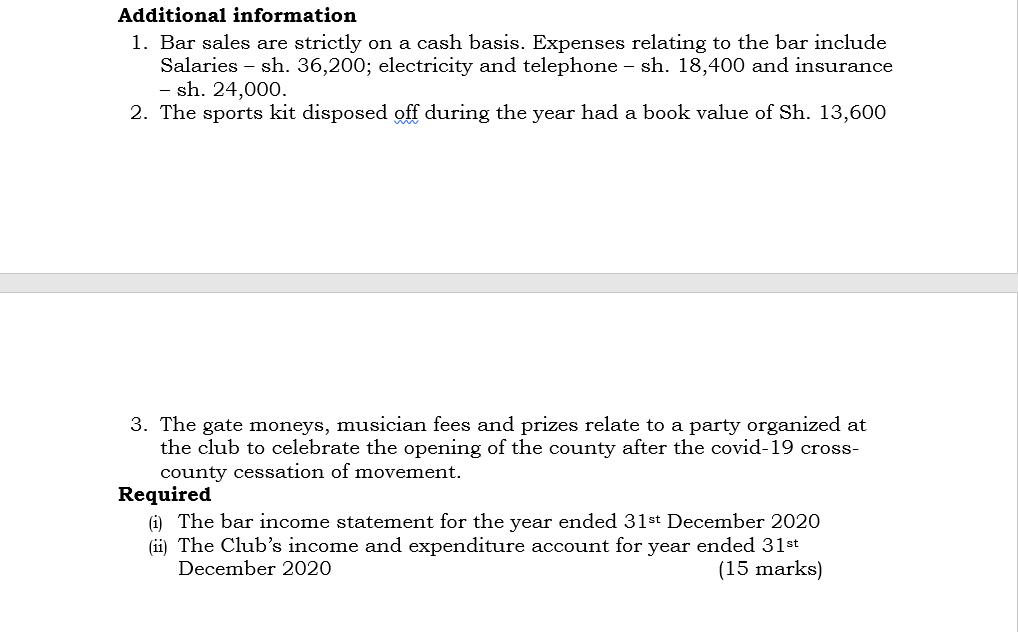

The Following Trial Balance Was Extracted From The Books Of Mtwapa Ltd At 31 December 2019. All the amounts are in thousands Share capital authorized and issued: 8 million ordinary shares of Khs. 10 each 80,000 Freehold premises at cost 60,000 Motor vans 14,000 Provisions for depreciation of motor vans to 31 December 2018 6,750 Provision for doubtful debts 31 December 2018 275 Stock in trade 1 January 2019 13,930 Balance at bank 6,265 Trade debtors and creditors Directors' remuneration Wages and salaries Motor and delivery expenses Rates Purchases Sales 12,395 11,380 4,000 13,127 3,258 700 108,240 142,770 General expenses Legal expenses Interim dividends paid Retained profit - 31 December 2018 644 1,200 5,846 2,430 243,605 243, 605 You are given the following information: i. Stock in trade, 31 December 2019, Khs. 15.2 million. ii. Rates paid in advance, 31 December 2013, Khs. 140,000. iii. Debts of Khs. 495,000 to be written off and the provision to maintained at 4% of remaining debtors. iv. Provide for depreciation of motor vans (including additions) at 20% using the straight line method V. Income tax expense for the year is estimated at Shs. 640,000 vi. The directors propose a final dividend of Shs 3 million. Required: Prepare the income statement for Mtwapa Ltd for the year ended 31 December 2019 and a statement of financial position as at the same date [15 marks] Matepe Sports club had the following assets and liabilities on 31 December +2019 & 2020. 2019 2020 Bar creditors 32,400 19,600 Outstanding salaries 9,600 12,400| Bar stock 56,200 75,600 Subscriptions in arrears 25,000 20,000 Prepaid insurance 6,400 9,200 Furniture (NBV) 96,000 112,000 Sports kit (NBV) 18,000 97,600 12,000 Musician fess The following summary of the clubs receipts and paymes was prepared by the clubs treasurer for 2020. Receipts and payments account Details Shs Details Shs Balance b/f 54,000 Salaries 92,800 Subscription 170,000 Musician fees 78,000 Donations Gate moneys 21,000 Stationery and postage 16,000 225,000 Prizes 25,600 Sale of old sports kit Bar sales 10,000 Charities 75,200 425,600 Electricity and telephone 45,000 Payments to bar creditors 252,000 Purchase of furniture 40,000 Insurance 88,000 Maintenance of sports ground 27,000 Purchase of new to sports kit 93,200 Balance c/f 72,800 Additional information 1. Bar sales are strictly on a cash basis. Expenses relating to the bar include Salaries sh. 36,200; electricity and telephone - sh. 18,400 and insurance - sh. 24,000. 2. The sports kit disposed off during the year had a book value of Sh. 13,600 3. The gate moneys, musician fees and prizes relate to a party organized at the club to celebrate the opening of the county after the covid-19 cross- county cessation of movement. Required (i) The bar income statement for the year ended 31st December 2020 (ii) The Club's income and expenditure account for year ended 31st December 2020 (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started