Question

The following Trial Balance was extracted from the books of Nyame Tease Enterprise at 31st March 2020. GHS GHS Capital 3,527,200 Investment 2,600,000 Purchases and

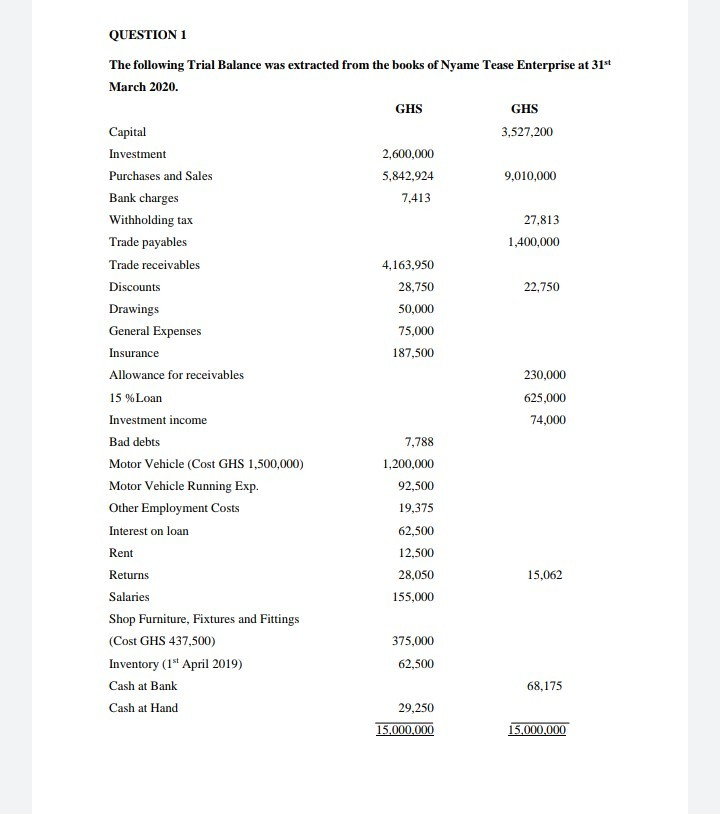

The following Trial Balance was extracted from the books of Nyame Tease Enterprise at 31st March 2020. GHS GHS Capital 3,527,200 Investment 2,600,000 Purchases and Sales 5,842,924 9,010,000 Bank charges 7,413 Withholding tax 27,813 Trade payables 1,400,000 Trade receivables 4,163,950 Discounts 28,750 22,750 Drawings 50,000 General Expenses 75,000 Insurance 187,500 Allowance for receivables 230,000 15 %Loan 625,000 Investment income 74,000 Bad debts 7,788 Motor Vehicle (Cost GHS 1,500,000) 1,200,000 Motor Vehicle Running Exp. 92,500 Other Employment Costs 19,375 Interest on loan 62,500 Rent 12,500 Returns 28,050 15,062 Salaries 155,000 Shop Furniture, Fixtures and Fittings (Cost GHS 437,500) 375,000 Inventory (1 st April 2019) 62,500 Cash at Bank 68,175 Cash at Hand 29,250 15,000,000 15,000,000

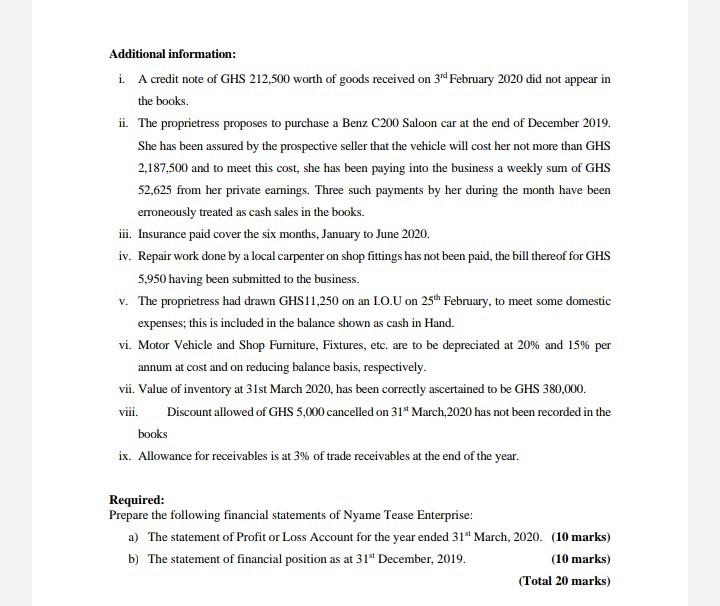

QUESTION 1 The following Trial Balance was extracted from the books of Nyame Tease Enterprise at 31 March 2020. GHS GHS Capital 3,527,200 Investment 2,600,000 Purchases and Sales 5,842,924 9,010,000 Bank charges 7,413 Withholding tax 27,813 Trade payables 1,400,000 Trade receivables 4,163,950 Discounts 28,750 22,750 Drawings 50,000 General Expenses 75,000 Insurance 187,500 Allowance for receivables 230,000 15 % Loan 625,000 Investment income 74,000 Bad debts 7,788 Motor Vehicle (Cost GHS 1,500,000) 1,200,000 Motor Vehicle Running Exp. 92,500 Other Employment Costs 19,375 Interest on loan 62,500 Rent 12,500 Returns 28,050 15,062 Salaries 155,000 Shop Furniture, Fixtures and Fittings (Cost GHS 437,500) 375,000 Inventory (1st April 2019) 62,500 Cash at Bank 68,175 Cash at Hand 29,250 15,000,000 15,000,000 Additional information: i. A credit note of GHS 212,500 worth of goods received on 314 February 2020 did not appear in the books. ii. The proprietress proposes to purchase a Benz C200 Saloon car at the end of December 2019. She has been assured by the prospective seller that the vehicle will cost her not more than GHS 2,187,500 and to meet this cost, she has been paying into the business a weekly sum of GHS 52,625 from her private earnings. Three such payments by her during the month have been erroneously treated as cash sales in the books. iii. Insurance paid cover the six months, January to June 2020. iv. Repair work done by a local carpenter on shop fittings has not been paid, the bill thereof for GHS 5,950 having been submitted to the business. v. The proprietress had drawn GHS11,250 on an 1.0.U on 25 February, to meet some domestic expenses, this is included in the balance shown as cash in Hand. vi. Motor Vehicle and Shop Furniture, Fixtures, etc. are to be depreciated at 20% and 15% per annum at cost and on reducing balance basis, respectively. vii. Value of inventory at 31st March 2020, has been correctly ascertained to be GHS 380,000. Discount allowed of GHS 5,000 cancelled on 314 March, 2020 has not been recorded in the viii. books ix. Allowance for receivables is at 3% of trade receivables at the end of the year. Required: Prepare the following financial statements of Nyame Tease Enterprise: a) The statement of Profit or Loss Account for the year ended 31" March, 2020. (10 marks) b) The statement of financial position as at 31st December, 2019. (10 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started