Answered step by step

Verified Expert Solution

Question

1 Approved Answer

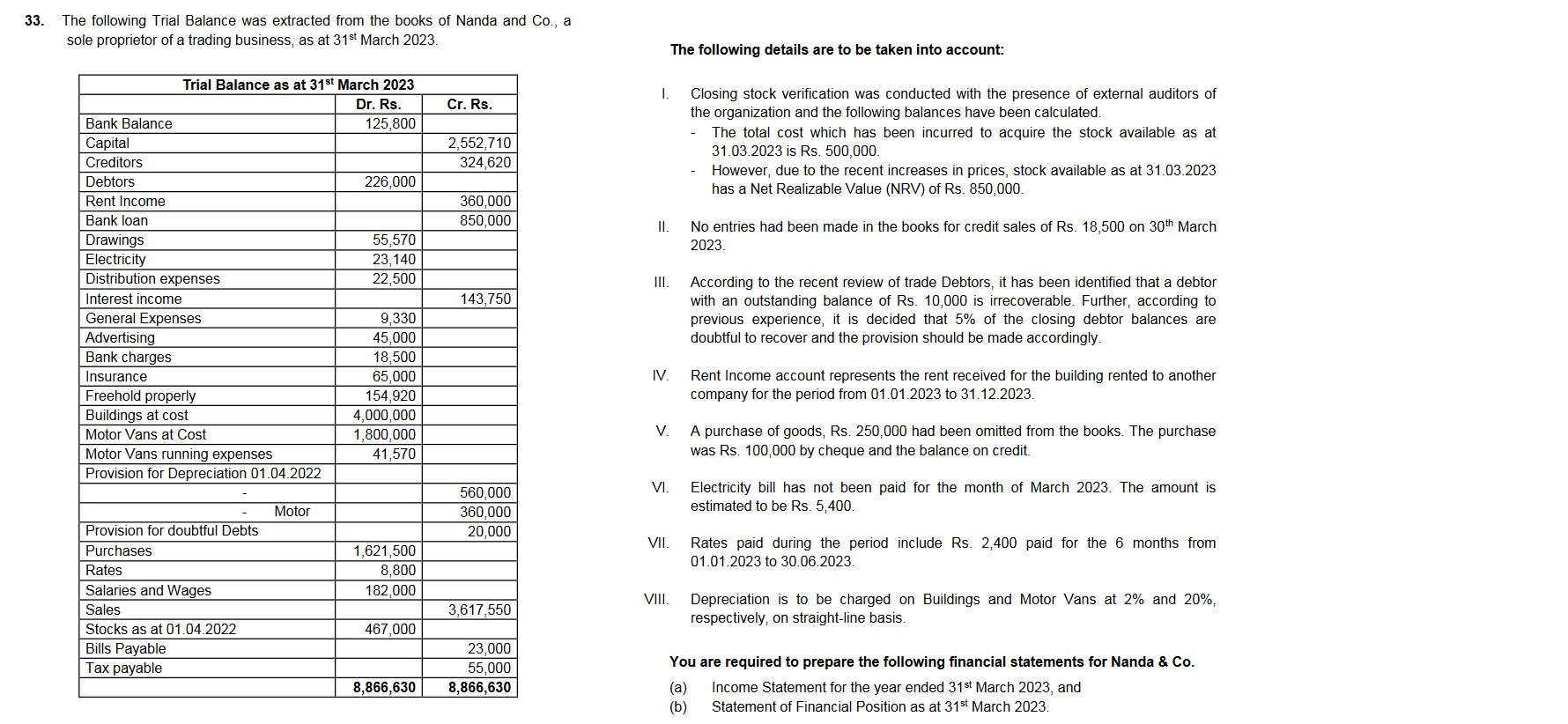

The following Trial Balance was extracted from the books of Nanda and Co . , a sole proprietor of a trading business, as at 3

The following Trial Balance was extracted from the books of Nanda and Co a sole proprietor of a trading business, as at March

tableTrial Balance as at st March Dr RsCr RsBank Balance,CapitalCreditorsDebtorsRent Income,,Bank loan,DrawingsElectricityDistribution expenses,,Interest income,General Expenses,AdvertisingBank charges,InsuranceFreehold properly,Buildings at costMotor Vans at Cost,,Motor Vans running expenses,,Provision for Depreciation Provision for doubtful Debts,PurchasesRatesSalaries and Wages,,SalesStocks as at Bills Payable,,Tax payable,,

The following details are to be taken into account:

I. Closing stock verification was conducted with the presence of external auditors of the organization and the following balances have been calculated.

The total cost which has been incurred to acquire the stock available as at is Rs

However, due to the recent increases in prices, stock available as at has a Net Realizable Value NRV of Rs

II No entries had been made in the books for credit sales of Rs on March

III. According to the recent review of trade Debtors, it has been identified that a debtor with an outstanding balance of Rs is irrecoverable. Further, according to previous experience, it is decided that of the closing debtor balances are doubtful to recover and the provision should be made accordingly.

IV Rent Income account represents the rent received for the building rented to another company for the period from to

V A purchase of goods, Rs had been omitted from the books. The purchase was Rs by cheque and the balance on credit.

VI Electricity bill has not been paid for the month of March The amount is estimated to be Rs

VII. Rates paid during the period include Rs paid for the months from to

VIII. Depreciation is to be charged on Buildings and Motor Vans at and respectively, on straightline basis.

You are required to prepare the following financial statements for Nanda & Co

a Income Statement for the year ended March and

b Statement of Financial Position as at March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started