Answered step by step

Verified Expert Solution

Question

1 Approved Answer

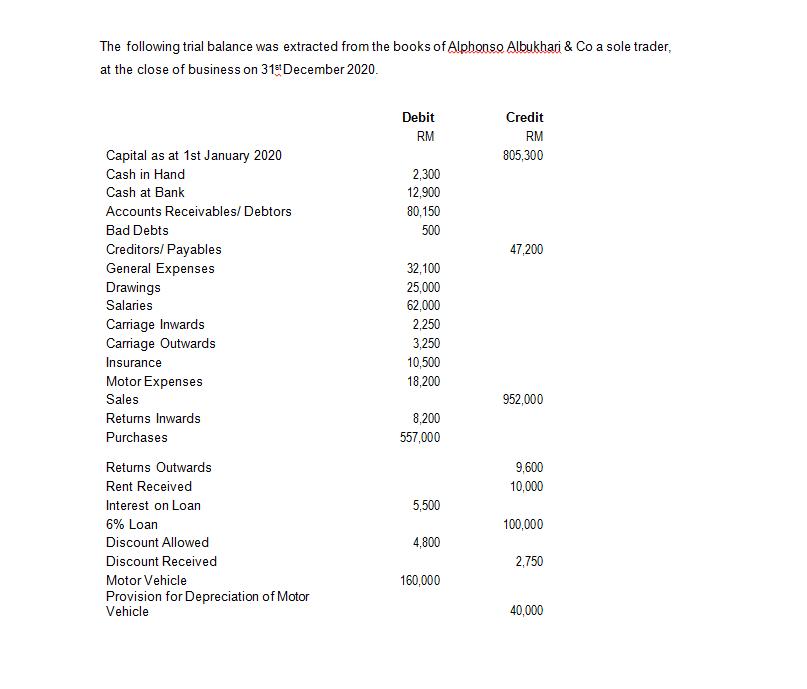

The following trial balance was extracted from the books of Alphonso Albukhari & Co a sole trader, at the close of business on 31st

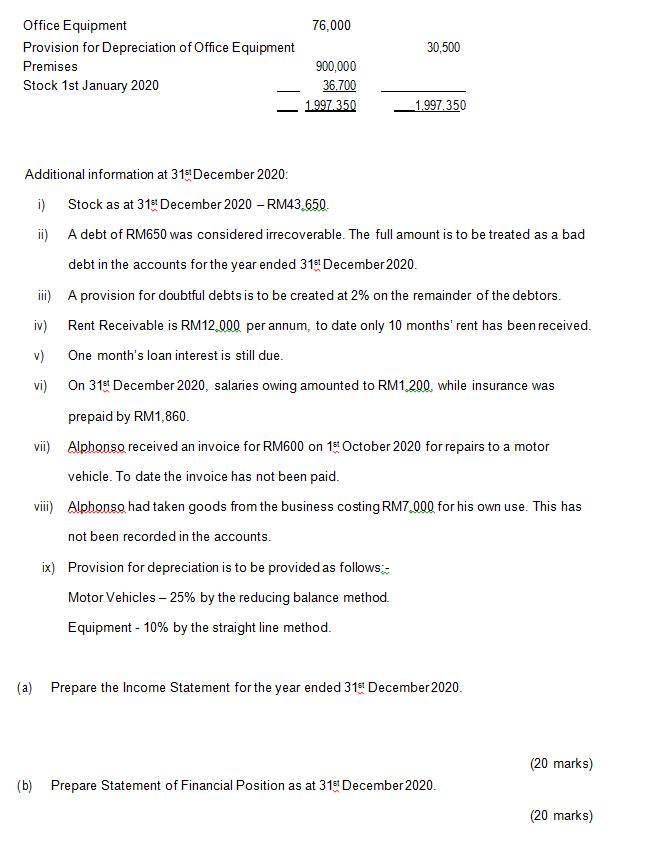

The following trial balance was extracted from the books of Alphonso Albukhari & Co a sole trader, at the close of business on 31st December 2020. Capital as at 1st January 2020 Cash in Hand Cash at Bank Accounts Receivables/ Debtors Bad Debts Creditors/Payables General Expenses Drawings Salaries Carriage Inwards Carriage Outwards Insurance Motor Expenses Sales Returns Inwards Purchases Returns Outwards Rent Received Interest on Loan 6% Loan Discount Allowed Discount Received Motor Vehicle Provision for Depreciation of Motor Vehicle Debit RM 2,300 12,900 80,150 500 32,100 25,000 62,000 2,250 3,250 10,500 18,200 8,200 557,000 5,500 4,800 160,000 Credit RM 805,300 47,200 952,000 9,600 10,000 100,000 2,750 40,000 Office Equipment Provision for Depreciation of Office Equipment Premises Stock 1st January 2020 Additional information at 31st December 2020: 76,000 900,000 36.700 1.997.350 30,500 ix) Provision for depreciation is to be provided as follows: Motor Vehicles - 25% by the reducing balance method. Equipment - 10% by the straight line method. 1.997,350 i) Stock as at 31st December 2020-RM43.650. ii) A debt of RM650 was considered irrecoverable. The full amount is to be treated as a bad debt in the accounts for the year ended 31 December 2020. iii) A provision for doubtful debts is to be created at 2% on the remainder of the debtors. iv) Rent Receivable is RM12,000 per annum, to date only 10 months' rent has been received. One month's loan interest is still due. v) vi) On 31st December 2020, salaries owing amounted to RM1,200, while insurance was prepaid by RM1,860. vii) Alphonso received an invoice for RM600 on 1st October 2020 for repairs to a motor vehicle. To date the invoice has not been paid. viii) Alphonso had taken goods from the business costing RM7,000 for his own use. This has not been recorded in the accounts. (a) Prepare the Income Statement for the year ended 31st December 2020. (b) Prepare Statement of Financial Position as at 315 December 2020. (20 marks) (20 marks)

Step by Step Solution

★★★★★

3.49 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Insurance expense for the year Insurance expense as per trial balance Prepaid insurance 10500 1860 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started