Answered step by step

Verified Expert Solution

Question

1 Approved Answer

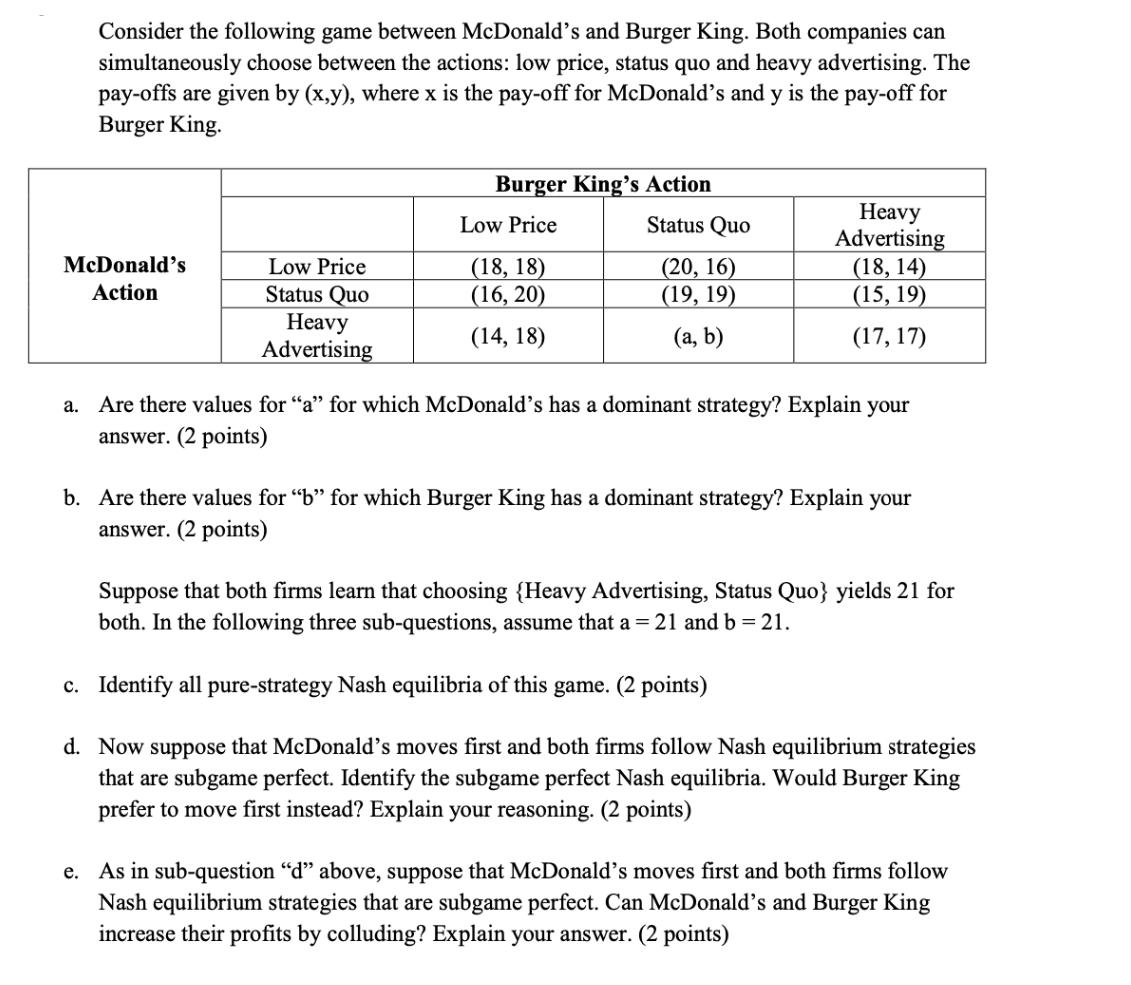

Consider the following game between McDonald's and Burger King. Both companies can simultaneously choose between the actions: low price, status quo and heavy advertising.

Consider the following game between McDonald's and Burger King. Both companies can simultaneously choose between the actions: low price, status quo and heavy advertising. The pay-offs are given by (x,y), where x is the pay-off for McDonald's and y is the pay-off for Burger King. McDonald's Action a. Low Price Status Quo Heavy Advertising Burger King's Action Low Price (18, 18) (16, 20) (14, 18) Status Quo (20, 16) (19, 19) (a, b) Heavy Advertising (18, 14) (15,19) (17, 17) Are there values for "a" for which McDonald's has a dominant strategy? Explain your answer. (2 points) b. Are there values for "b" for which Burger King has a dominant strategy? Explain your answer. (2 points) Suppose that both firms learn that choosing {Heavy Advertising, Status Quo} yields 21 for both. In the following three sub-questions, assume that a = 21 and b = 21. c. Identify all pure-strategy Nash equilibria of this game. (2 points) d. Now suppose that McDonald's moves first and both firms follow Nash equilibrium strategies that are subgame perfect. Identify the subgame perfect Nash equilibria. Would Burger King prefer to move first instead? Explain your reasoning. (2 points) e. As in sub-question "d" above, suppose that McDonald's moves first and both firms follow Nash equilibrium strategies that are subgame perfect. Can McDonald's and Burger King increase their profits by colluding? Explain your answer. (2 points)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATION OF WEIGHTED PROFIT Year Ended Profit Weights Weighted Profit 31st March 2014 105000 1 105000 31st March 2015 80000 2 160000 31st March 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started