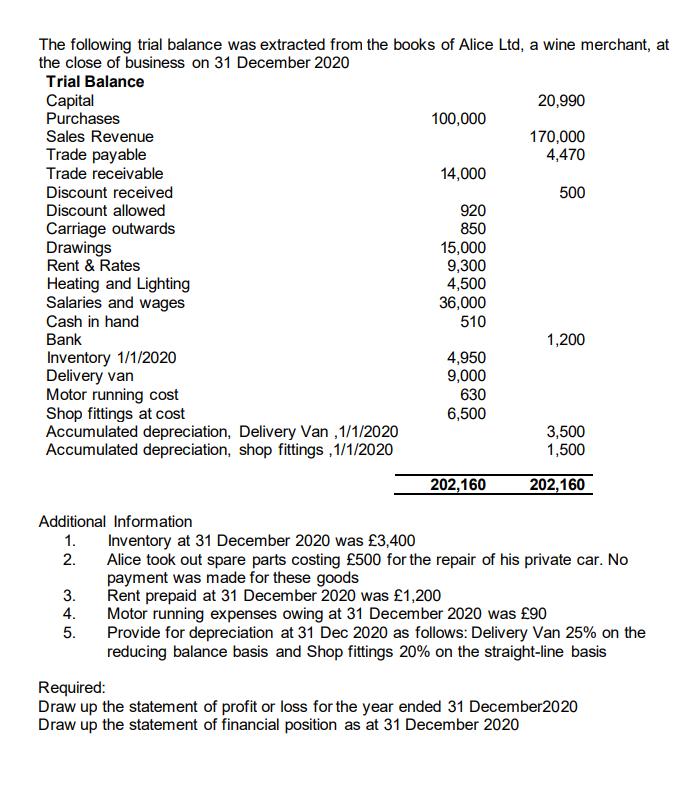

The following trial balance was extracted from the books of Alice Ltd, a wine merchant, at the close of business on 31 December 2020

The following trial balance was extracted from the books of Alice Ltd, a wine merchant, at the close of business on 31 December 2020 Trial Balance Capital Purchases Sales Revenue Trade payable Trade receivable Discount received Discount allowed Carriage outwards Drawings Rent & Rates Heating and Lighting Salaries and wages Cash in hand Bank Inventory 1/1/2020 Delivery van Motor running cost Shop fittings at cost Accumulated depreciation, Delivery Van ,1/1/2020 Accumulated depreciation, shop fittings ,1/1/2020 Additional Information 1. 2. 3. 4. 5. 100,000 14,000 920 850 15,000 9,300 4,500 36,000 510 4,950 9,000 630 6,500 202,160 20,990 170,000 4,470 500 1,200 3,500 1,500 202,160 Inventory at 31 December 2020 was 3,400 Alice took out spare parts costing 500 for the repair of his private car. No payment was made for these goods Rent prepaid at 31 December 2020 was 1,200 Motor running expenses owing at 31 December 2020 was 90 Provide for depreciation at 31 Dec 2020 as follows: Delivery Van 25% on the reducing balance basis and Shop fittings 20% on the straight-line basis Required: Draw up the statement of profit or loss for the year ended 31 December2020 Draw up the statement of financial position as at 31 December 2020

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started