Answered step by step

Verified Expert Solution

Question

1 Approved Answer

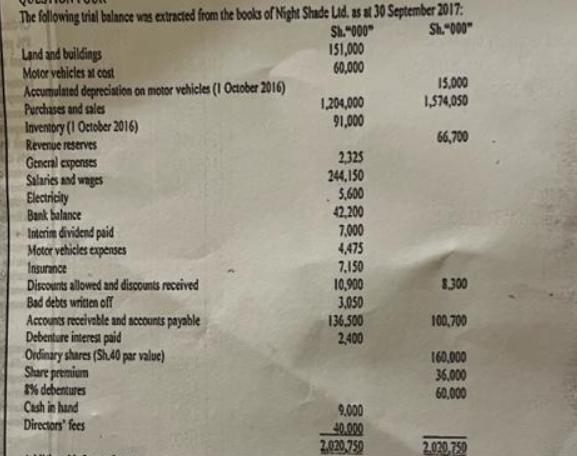

The following trial balance was extracted from the books of Night Shade Ltd. as at 30 September 2017: Sh.000 Sh.000 Land and buildings 151,000

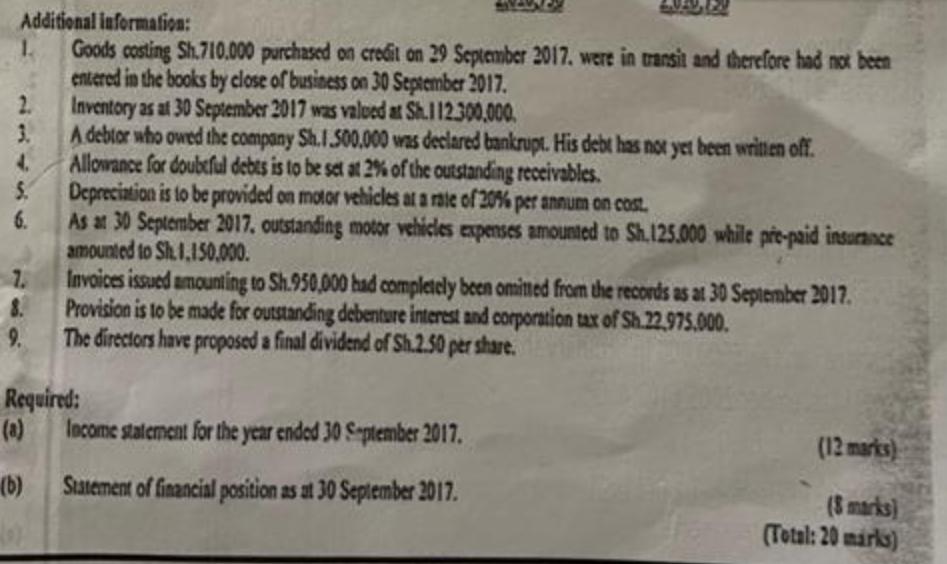

The following trial balance was extracted from the books of Night Shade Ltd. as at 30 September 2017: Sh."000 Sh."000 Land and buildings 151,000 Motor vehicles at cost 60,000 Accumulated depreciation on motor vehicles (1 October 2016) 15,000 Purchases and sales 1,204,000 1,574,050 Inventory (1 October 2016) 91,000 66,700 Revenue reserves General expenses 2,325 Salaries and wages 244,150 Electricity Bank balance 5,600 42,200 Interim dividend paid 7,000 Motor vehicles expenses 4,475 Insurance 7.150 Discounts allowed and discounts received 10,900 8.300 Bad debts written off 3,050 Accounts receivable and accounts payable 136.500 100,700 Debenture interest paid 2,400 Ordinary shares (Sh.40 par value) 160,000 Share premium 36,000 8% debentures Cash in hand Directors' fees 60,000 9.000 40.000 2,020,750 2.020.750 Additional information: 2. 3. 4. S. 6. 7. 9. Goods costing Sh.710.000 purchased on credit on 29 September 2017. were in transit and therefore had not been entered in the books by close of business on 30 September 2017. Inventory as at 30 September 2017 was valued at Sh.112.300,000. A debtor who owed the company Sh.1.500.000 was declared bankrupt. His debt has not yet been written off. Allowance for doubtful debts is to be set at 2% of the outstanding receivables. Depreciation is to be provided on motor vehicles at a rate of 20% per annum on cost. As at 30 September 2017. outstanding motor vehicles expenses amounted to Sh.125.000 while pre-paid insurance amounted to Sh.1,150,000. Invoices issued amounting to Sh.950,000 had completely been omitted from the records as at 30 September 2017. Provision is to be made for outstanding debenture interest and corporation tax of Sh.22,975,000. The directors have proposed a final dividend of Sh.2.50 per share. Required: (a) Income statement for the year ended 30 September 2017. (12 marks) (b) Statement of financial position as at 30 September 2017. (8 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Income Statement for the Year Ended 30 September 2017 Revenue 1574050 Cost of Sales 19140...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started