Question

The following trial balance was taken from the books of Fisk Corporation on December 31, 2017. Account Debit Credit Cash $8,300 Accounts Receivable 38,200 Notes

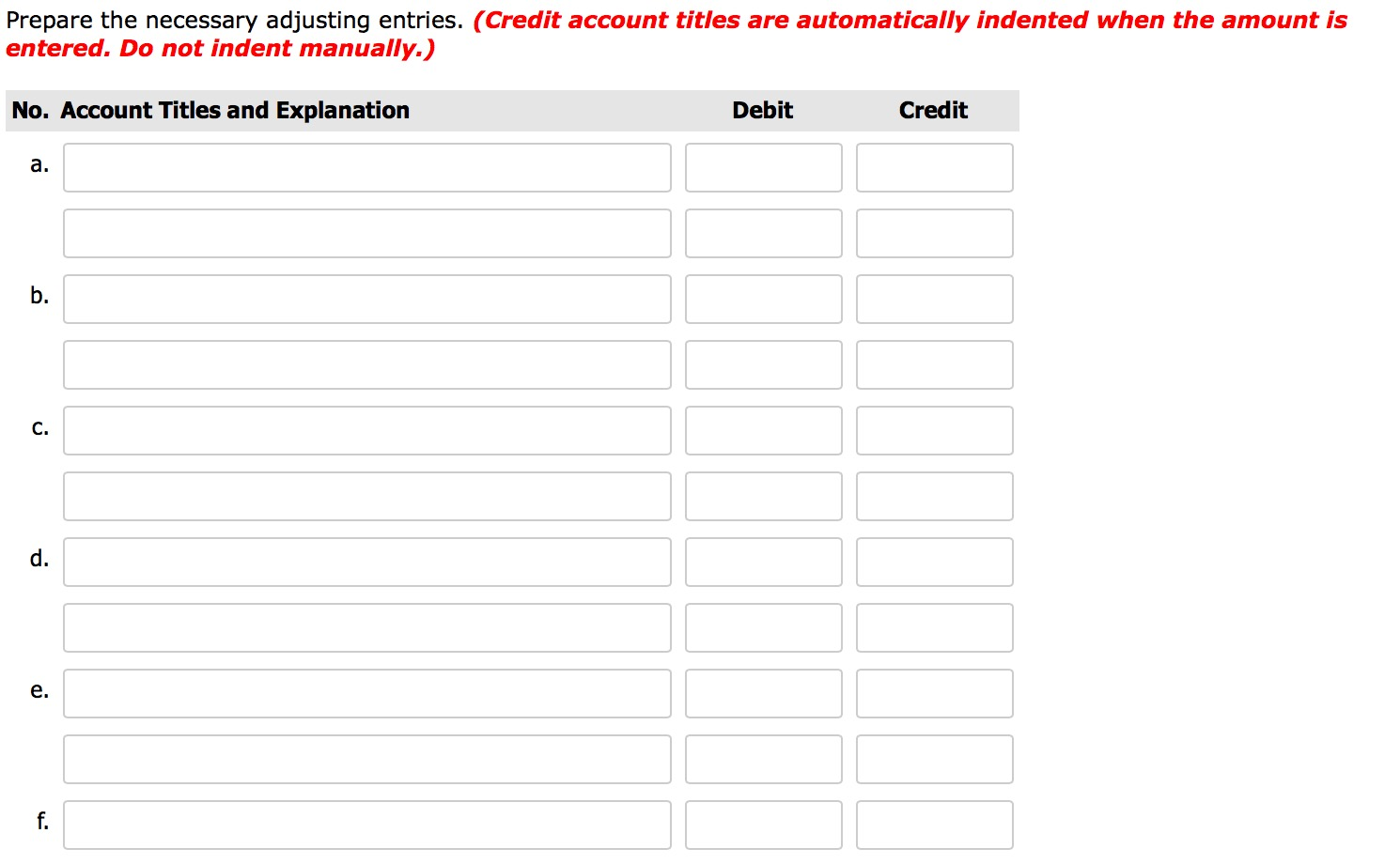

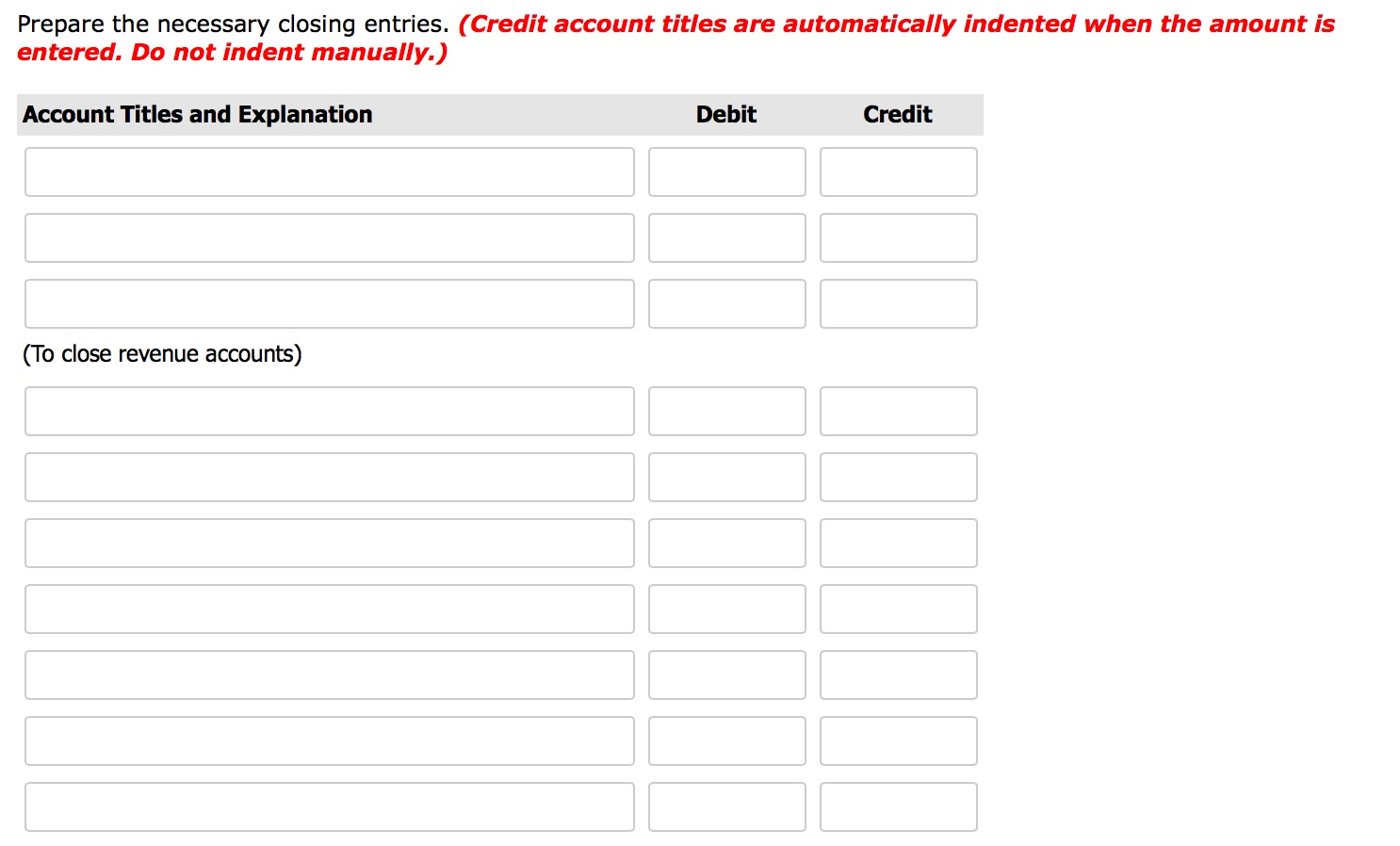

The following trial balance was taken from the books of Fisk Corporation on December 31, 2017. Account Debit Credit Cash $8,300 Accounts Receivable 38,200 Notes Receivable 12,700 Allowance for Doubtful Accounts $1,900 Inventory 44,400 Prepaid Insurance 4,000 Equipment 117,000 Accumulated Depreciation--Equip. 15,000 Accounts Payable 10,000 Common Stock 40,000 Retained Earnings 69,020 Sales Revenue 280,300 Cost of Goods Sold 126,600 Salaries and Wages Expense 52,490 Rent Expense 12,530 Totals $416,220 $416,220 At year end, the following items have not yet been recorded. a. Insurance expired during the year, $2,000. b. Estimated bad debts, 2% of gross sales. c. Depreciation on equipment, 10% per year on original cost. d. Interest at 4% is receivable on the note for one full year. e. Rent paid in advance at December 31, $5,350 (originally charged to expense). f. Accrued salaries and wages at December 31, $6,300.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started