Answered step by step

Verified Expert Solution

Question

1 Approved Answer

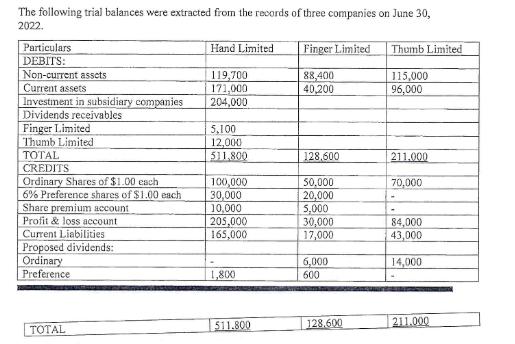

The following trial balances were extracted from the records of three companies on June 30, 2022. Particulars DEBITS: Non-current assets Current assets Investment in

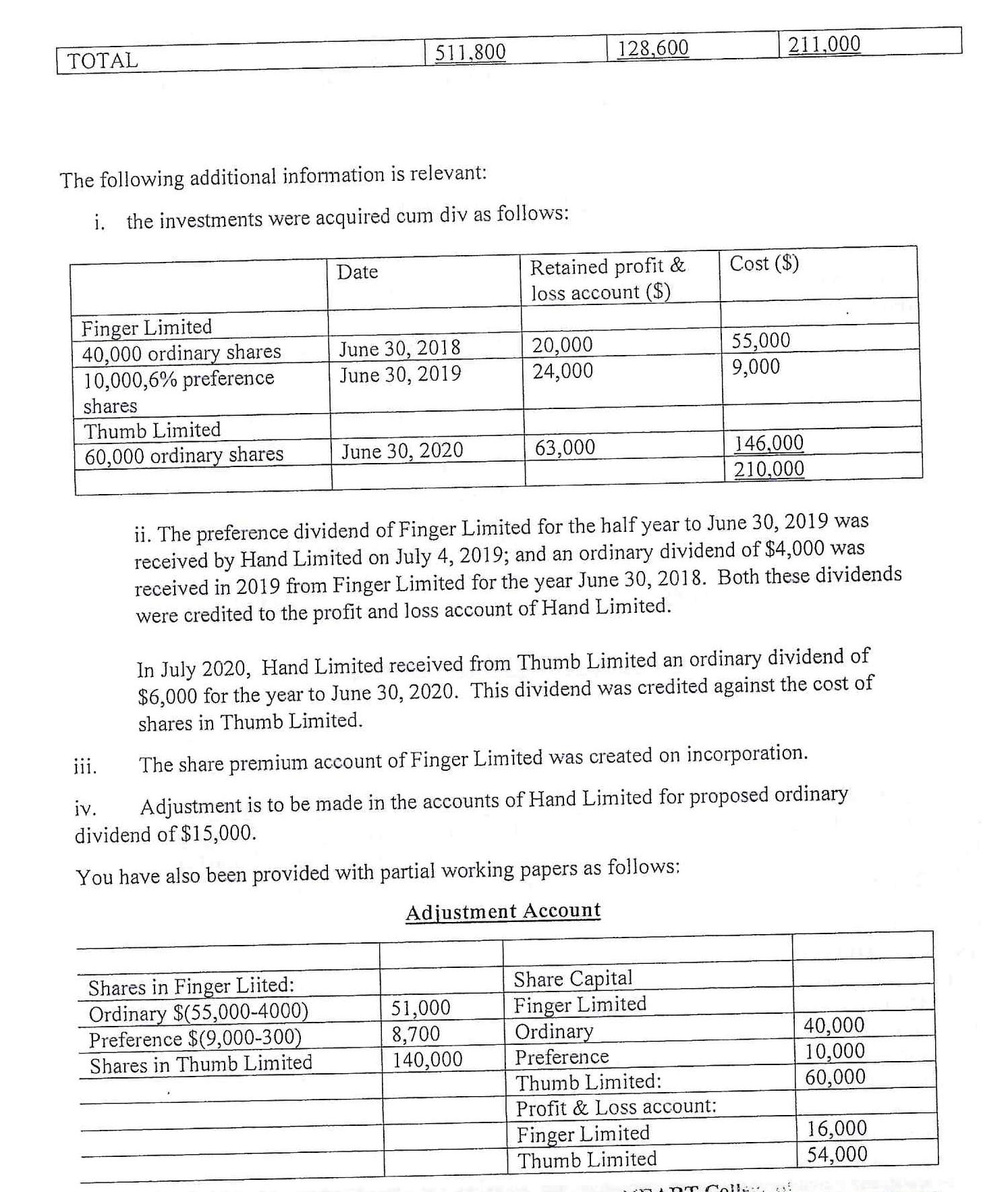

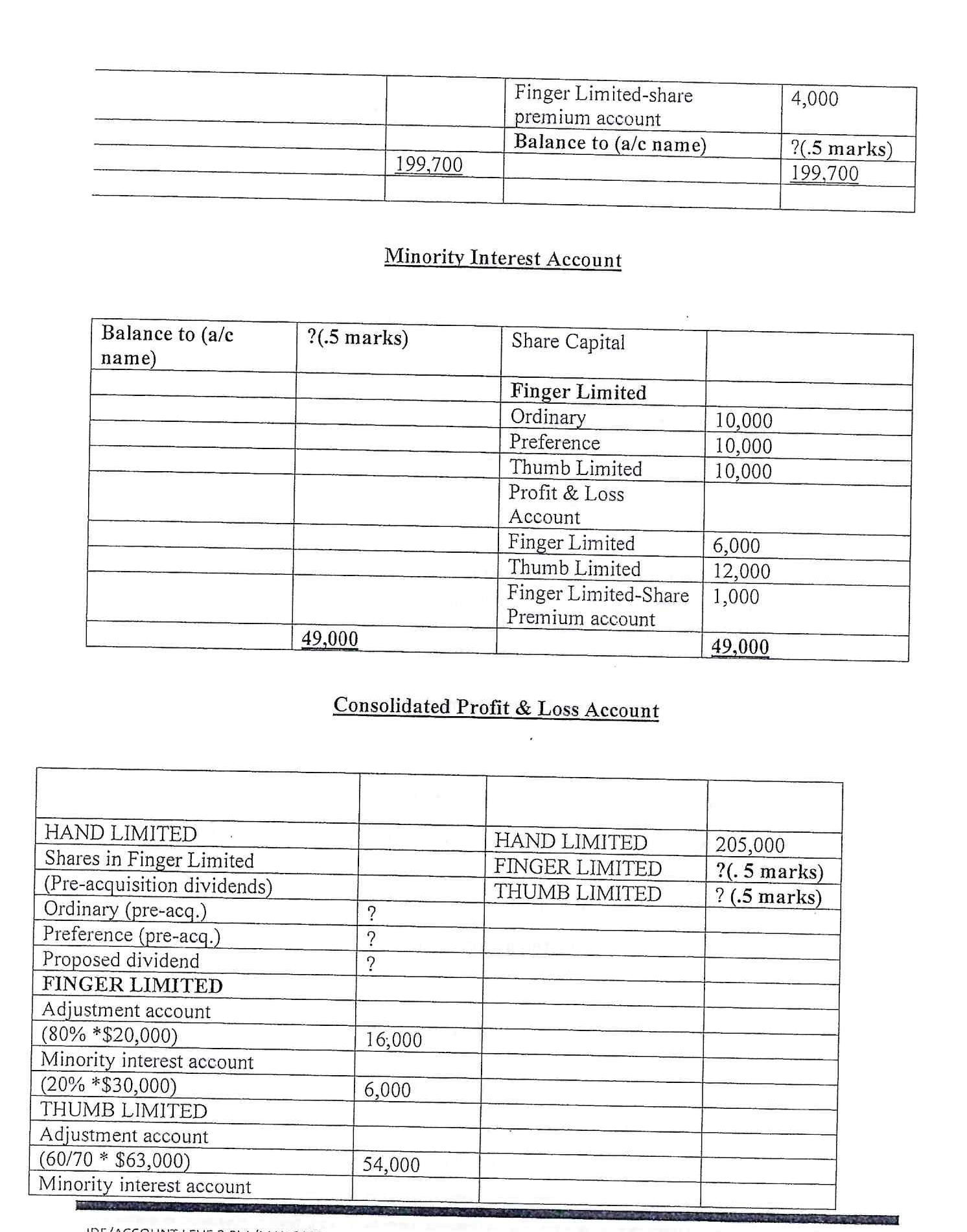

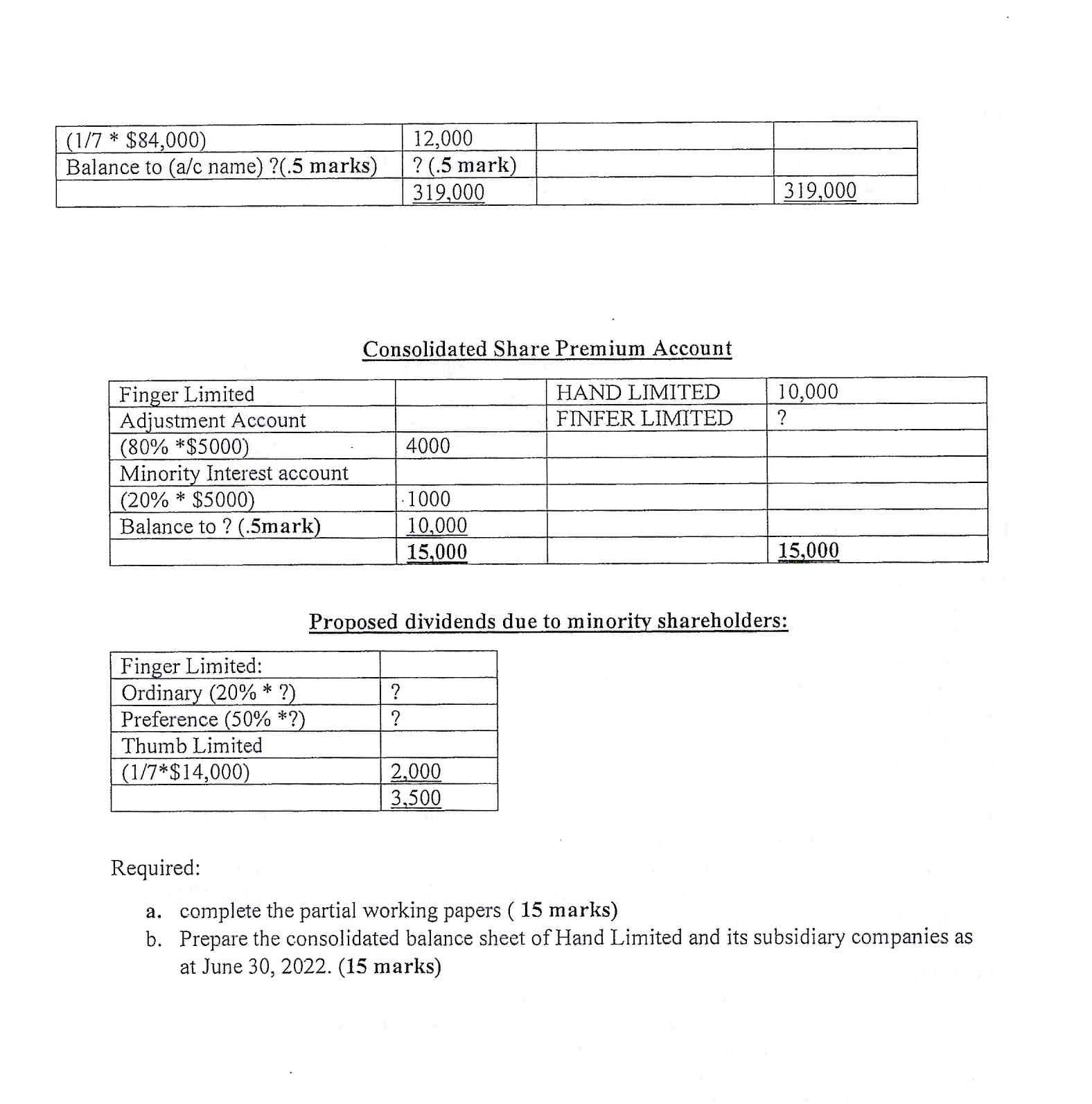

The following trial balances were extracted from the records of three companies on June 30, 2022. Particulars DEBITS: Non-current assets Current assets Investment in subsidiary companies Dividends receivables Finger Limited Thumb Limited TOTAL CREDITS Ordinary Shares of $1.00 each 6% Preference shares of $1.00 each Share premium account Profit & loss account Current Liabilities Proposed dividends: Ordinary Preference TOTAL Hand Limited 119,700 171,000 204,000 5,100 12,000 511,800 100,000 30,000 10,000 205,000 165,000 1,800 511.800 Finger Limited 88,400 40,200 128,600 50,000 20,000 5,000 30,000 17,000 6,000 600 128.600 Thumb Limited 115,000 96,000 211.000 70,000 84,000 43,000 14,000 reda 211.000 TOTAL The following additional information is relevant: i. the investments were acquired cum div as follows: Finger Limited 40,000 ordinary shares 10,000,6% preference shares Thumb Limited 60,000 ordinary shares 511,800 Date June 30, 2018 June 30, 2019 Shares in Finger Liited: Ordinary $(55,000-4000) Preference $(9,000-300) Shares in Thumb Limited June 30, 2020 Retained profit & loss account 20,000 24,000 63,000 51,000 8,700 140,000 128,600 ii. The preference dividend of Finger Limited for the half year to June 30, 2019 was received by Hand Limited on July 4, 2019; and an ordinary dividend of $4,000 was received in 2019 from Finger Limited for the year June 30, 2018. Both these dividends were credited to the profit and loss account of Hand Limited. 211,000 In July 2020, Hand Limited received from Thumb Limited an ordinary dividend of $6,000 for the year to June 30, 2020. This dividend was credited against the cost of shares in Thumb Limited. Share Capital Finger Limited Ordinary Preference Cost ($) iii. The share premium account of Finger Limited was created on incorporation. iv. Adjustment is to be made in the accounts of Hand Limited for proposed ordinary dividend of $15,000. You have also been provided with partial working papers as follows: Adjustment Account 55,000 9,000 Thumb Limited: Profit & Loss account: Finger Limited Thumb Limited 146,000 210,000 DT Collef 40,000 10,000 60,000 16,000 54,000 Balance to (a/c name) HAND LIMITED Shares in Finger Limited (Pre-acquisition dividends) Ordinary (pre-acq.) Preference (pre-acq.) Proposed dividend FINGER LIMITED Adjustment account (80% *$20,000) Minority interest account (20% *$30,000) THUMB LIMITED Adjustment account (60/70 $63,000) Minority interest account IDEWACCOUN 49,000 ?(.5 marks) 199,700 ? ? ? Minority Interest Account 16,000 Finger Limited-share premium account Balance to (a/c name) 6,000 Consolidated Profit & Loss Account 54,000 Share Capital Finger Limited Ordinary Preference Thumb Limited Profit & Loss Account Finger Limited Th Limited Finger Limited-Share Premium account HAND LIMITED FINGER LIMITED THUMB LIMITED 10,000 10,000 10,000 6,000 12,000 1,000 49,000 4,000 ?(.5 marks) 199,700 205,000 ?(. 5 marks) ? (.5 marks) (1/7 * $84,000) Balance to (a/c name) ?(.5 marks) Finger Limited Adjustment Account (80% *$5000) Minority Interest account (20% * $5000) Balance to? (.5mark) Finger Limited: Ordinary (20% * ?) Preference (50% *?) Thumb Limited (1/7*$14,000) 12,000 ? (.5 mark) 319,000 Consolidated Share Premium Account HAND LIMITED FINFER LIMITED ? ? 4000 1000 10,000 15,000 319,000 2,000 3,500 10,000 ? Proposed dividends due to minority shareholders: 15,000 Required: a. complete the partial working papers ( 15 marks) b. Prepare the consolidated balance sheet of Hand Limited and its subsidiary companies as at June 30, 2022. (15 marks)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Completion of Partial Working Papers Lets complete the partial working papers step by step Adjustment Account Particulars Debit Credit Shares in Fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started