Question

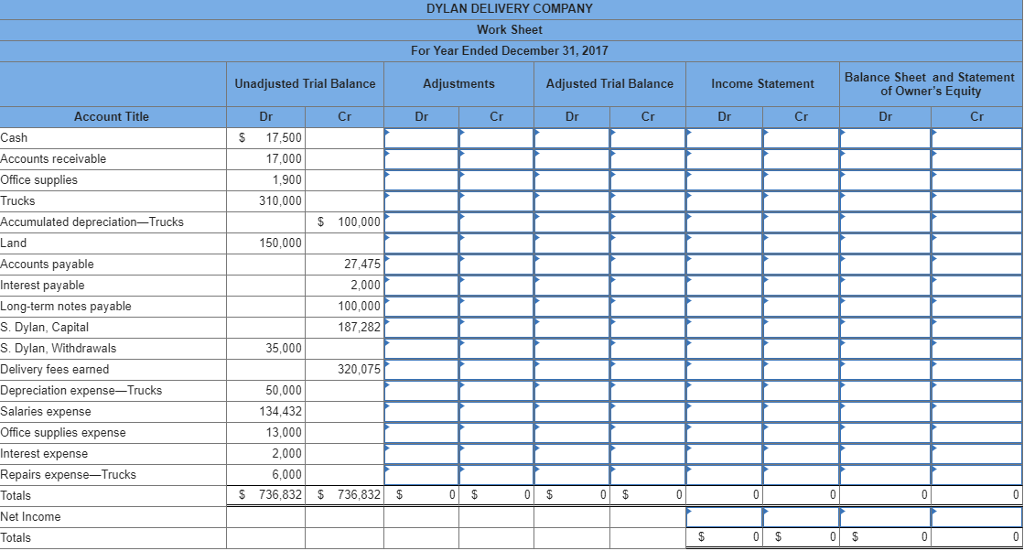

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31, 2017. Unrecorded depreciation on the trucks at

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31, 2017.

Unrecorded depreciation on the trucks at the end of the year is $9,602.

The total amount of accrued interest expense at year-end is $8,000.

The cost of unused office supplies still available at year-end is $900.

1. Use the above information about the companys adjustments to complete a 10-column work sheet. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31, 2017. 2b. Determine the capital amount to be reported on the December 31, 2017 balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started