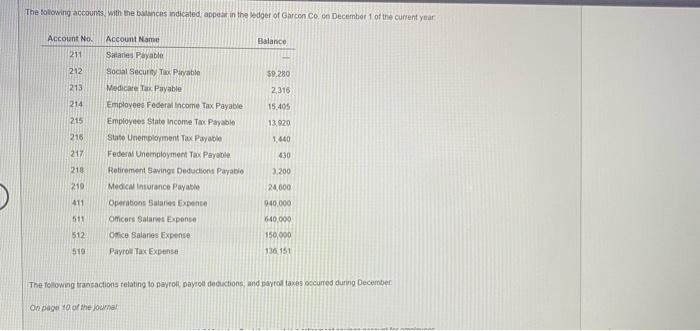

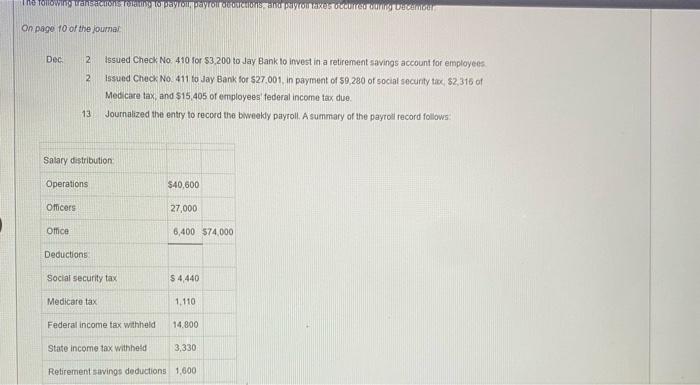

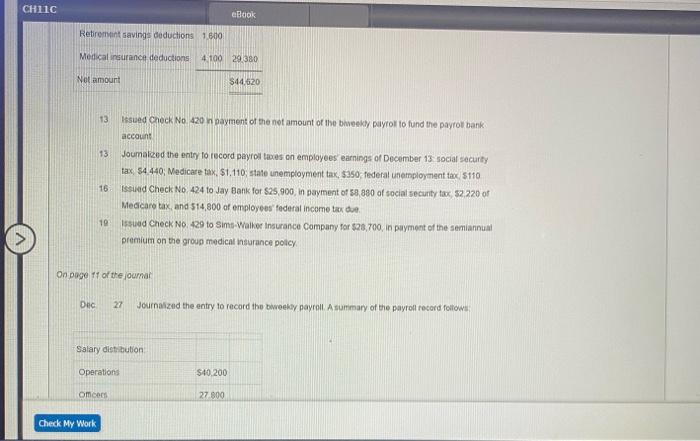

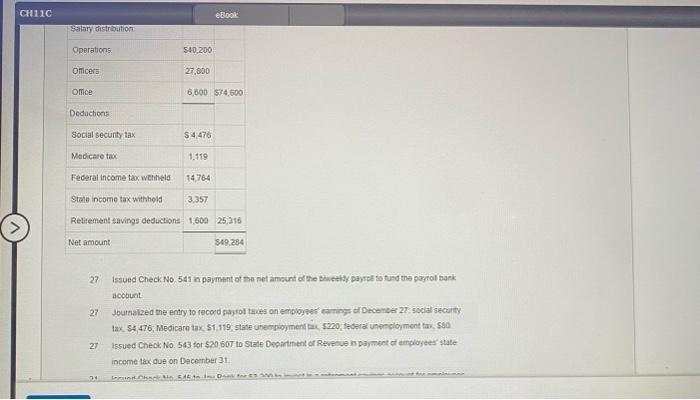

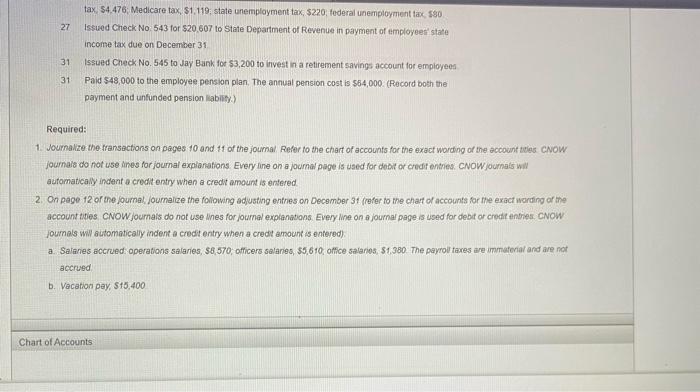

The folowing accounss sith be butancas nidicated appear in the kdoer of Garcon Co, on December 1 of the current ynar The folowing trancactions relating to pavrol, payrod decoctions, and pavtod faxes occurned during December. On page 10 of the jocvinal On page 10 of the joumai Dec 2. Assued Cheok No: 410 for $3,200 to Jay Bank to invest in a retirement savings account for employees. 2 Issued Check No. 411 to Jay Bank for $27.001, in payment of 59,280 of social security tioc, $2,316 of Med care tax, and $15,405 of employees federal income tax due. 13. Journalized the entry to record the beveekly payroll. A summary of the payroli record follows: 13. Itsued Creck No 420n payment of the not amount of the bheekly puyrof to fund the payrol bark. aceatint 13 Joumaloed the entry to record payrod taxes on employees earnings of December 13 sociar securty tax, 54.440; Medicare tax, \$1.110; state unemployment tax, 5350 , federal unemployment tax, 5110 16. Issuad Check No, 424 to Jay Bank for $25,900, in payment of 58,880 af social security tax, 32,220 of Mecicare tax, and 514,800 af employes' federal income tax doe. 19 Issuad Check No, 429 to Sims-Valked Insurance Compuny for $28,700, in plyyment of the semiannual premium on the groug modical haurance potcy. On poge 11 of the journat Dhc 27 Journalized the entry to record the bwoeky payroll. A summary of the payront resord foilows: 27. Issued Check No. 541 in payment of the net amsount of the bweetiy payret sa tund the poyroi bark account. 27 Journalzed the entry to recoed gayrol taves on enployesf eaningr dr Decenter 27 : social secanty tax S4 476, Medicare tax, 51,119 , state unenployment tas $2200, teverai unencloyment tax, $40 21. Issued Check, No. 543 tor $70,607 to Stale Dopartinent or Revenue n payment ef employees state income tax due on Deceenber 31 tax, \$4.476; Medicare tax, \$1,119; state unemployment tax, \$220: federal unemployment tax 590 27 Issued Check No: 543 for $20.607 to State Department of Revenue in payment of tmployeer' state income tax due on December 31 31 Issued Check No. 545 to Jay Bank for $3,200 to invest in a retirement savings account for employees 31 Paid $48,000 to the employee pension plan, The annual pension cost is $64,000. (Record both the payment and unfunded pension liabiify.) Required: 1. Joumalize the fransactions on pages 10 and 11 of the joumal. Refer to the chart of accounts for the exact wording of the account aries cvow jounale do not use ines for journal explanations. Every line on a journal page is used for dool or credi entres. CNOW joumats will automatically indent a credit entry when a credt amount is entered. 2. On pege 12 of the joumal, Journalize the following adusting entnes on Decsmber 31, fefer to the chat of accounts for the exact wording of the dccount tites CNOW Journais do not use ines for journal explanations. Every ine on a joumar page is used for debi or credit entres. CNOW Journals will automatically indent a credt entry when a credt amount is entered). a. Salanes accrued operations salanies, $6,570, officers salanes, $5,610, olice salanos, $1,380. The payroil taxes we immaterial and are not accrued. b. Vacation pey, $15,400 The folowing accounss sith be butancas nidicated appear in the kdoer of Garcon Co, on December 1 of the current ynar The folowing trancactions relating to pavrol, payrod decoctions, and pavtod faxes occurned during December. On page 10 of the jocvinal On page 10 of the joumai Dec 2. Assued Cheok No: 410 for $3,200 to Jay Bank to invest in a retirement savings account for employees. 2 Issued Check No. 411 to Jay Bank for $27.001, in payment of 59,280 of social security tioc, $2,316 of Med care tax, and $15,405 of employees federal income tax due. 13. Journalized the entry to record the beveekly payroll. A summary of the payroli record follows: 13. Itsued Creck No 420n payment of the not amount of the bheekly puyrof to fund the payrol bark. aceatint 13 Joumaloed the entry to record payrod taxes on employees earnings of December 13 sociar securty tax, 54.440; Medicare tax, \$1.110; state unemployment tax, 5350 , federal unemployment tax, 5110 16. Issuad Check No, 424 to Jay Bank for $25,900, in payment of 58,880 af social security tax, 32,220 of Mecicare tax, and 514,800 af employes' federal income tax doe. 19 Issuad Check No, 429 to Sims-Valked Insurance Compuny for $28,700, in plyyment of the semiannual premium on the groug modical haurance potcy. On poge 11 of the journat Dhc 27 Journalized the entry to record the bwoeky payroll. A summary of the payront resord foilows: 27. Issued Check No. 541 in payment of the net amsount of the bweetiy payret sa tund the poyroi bark account. 27 Journalzed the entry to recoed gayrol taves on enployesf eaningr dr Decenter 27 : social secanty tax S4 476, Medicare tax, 51,119 , state unenployment tas $2200, teverai unencloyment tax, $40 21. Issued Check, No. 543 tor $70,607 to Stale Dopartinent or Revenue n payment ef employees state income tax due on Deceenber 31 tax, \$4.476; Medicare tax, \$1,119; state unemployment tax, \$220: federal unemployment tax 590 27 Issued Check No: 543 for $20.607 to State Department of Revenue in payment of tmployeer' state income tax due on December 31 31 Issued Check No. 545 to Jay Bank for $3,200 to invest in a retirement savings account for employees 31 Paid $48,000 to the employee pension plan, The annual pension cost is $64,000. (Record both the payment and unfunded pension liabiify.) Required: 1. Joumalize the fransactions on pages 10 and 11 of the joumal. Refer to the chart of accounts for the exact wording of the account aries cvow jounale do not use ines for journal explanations. Every line on a journal page is used for dool or credi entres. CNOW joumats will automatically indent a credit entry when a credt amount is entered. 2. On pege 12 of the joumal, Journalize the following adusting entnes on Decsmber 31, fefer to the chat of accounts for the exact wording of the dccount tites CNOW Journais do not use ines for journal explanations. Every ine on a joumar page is used for debi or credit entres. CNOW Journals will automatically indent a credt entry when a credt amount is entered). a. Salanes accrued operations salanies, $6,570, officers salanes, $5,610, olice salanos, $1,380. The payroil taxes we immaterial and are not accrued. b. Vacation pey, $15,400