Answered step by step

Verified Expert Solution

Question

1 Approved Answer

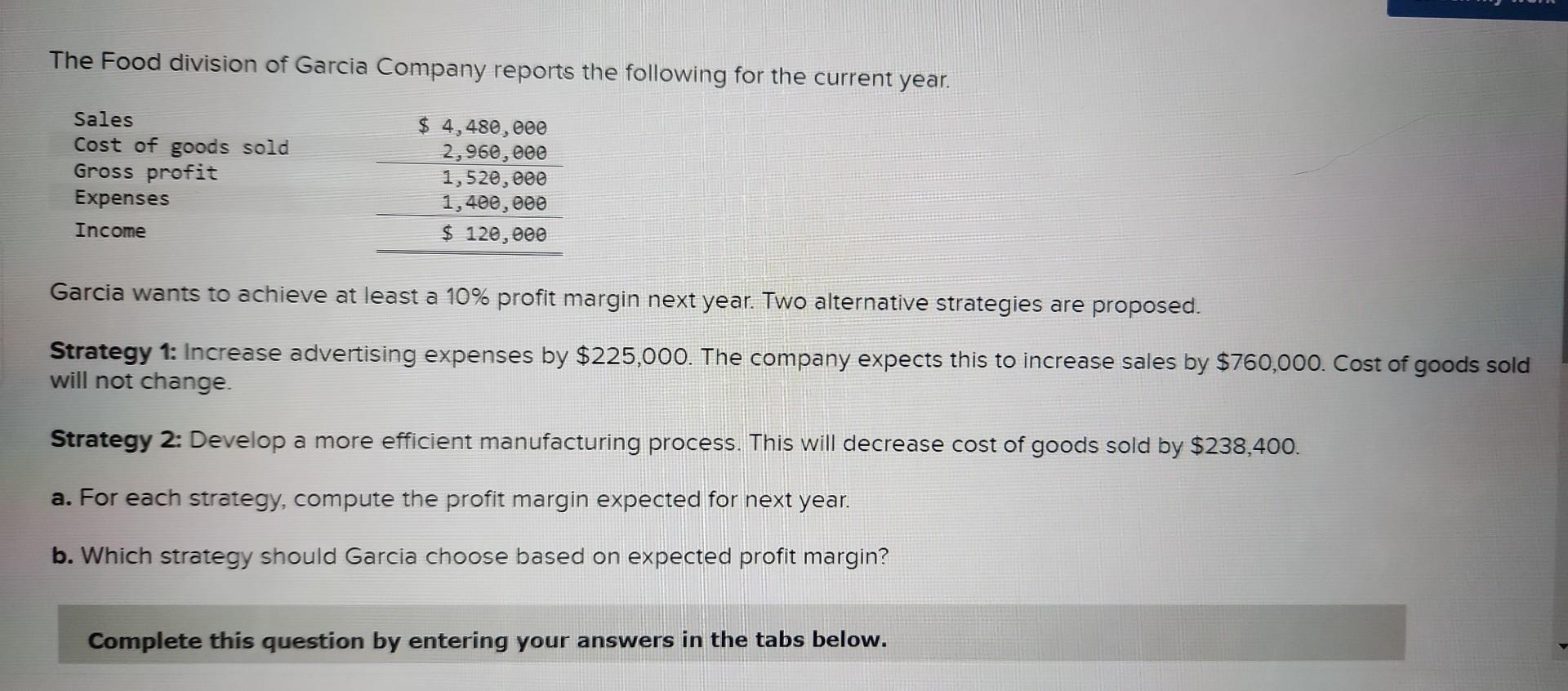

The Food division of Garcia Company reports the following for the current year. Garcia wants to achieve at least a 10% profit margin next year.

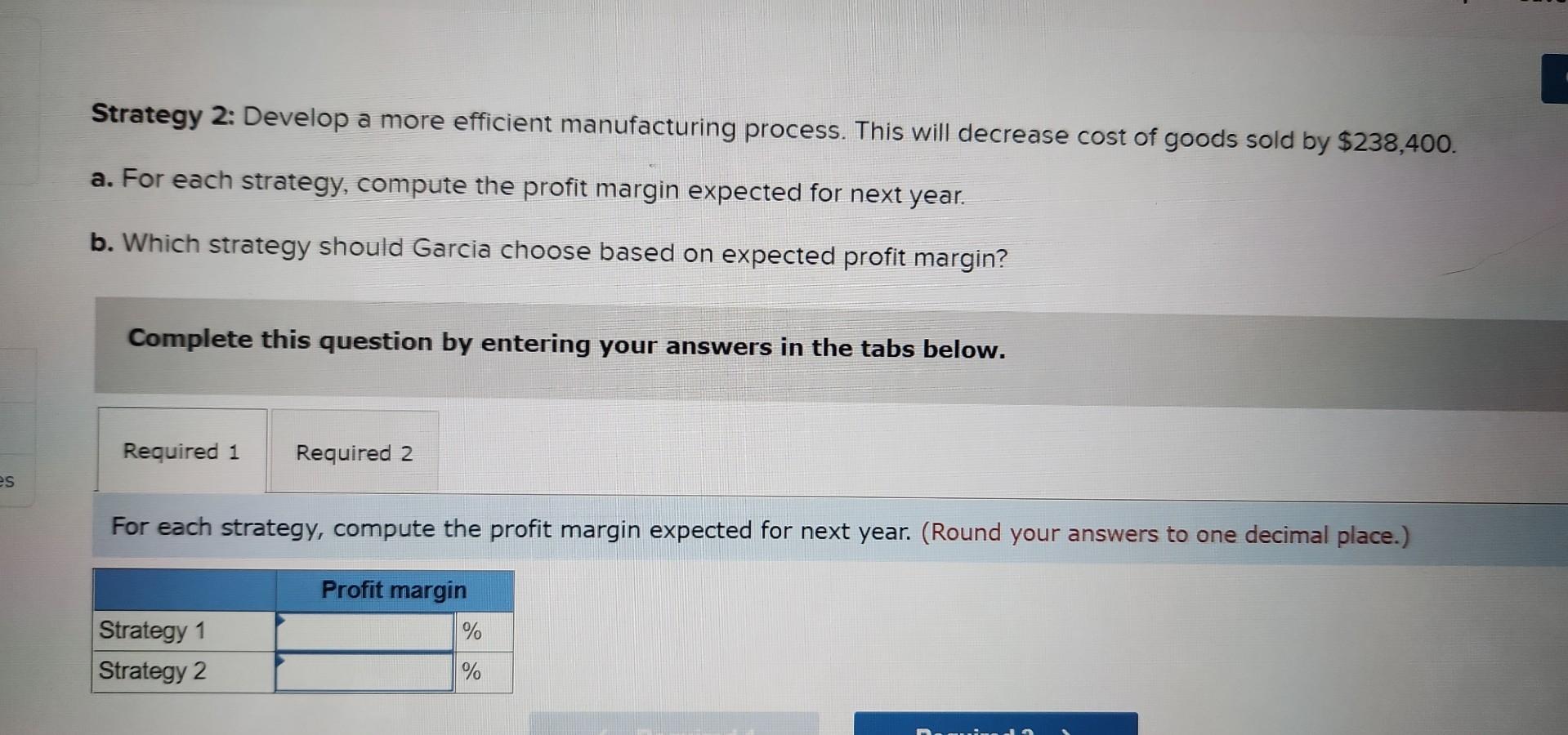

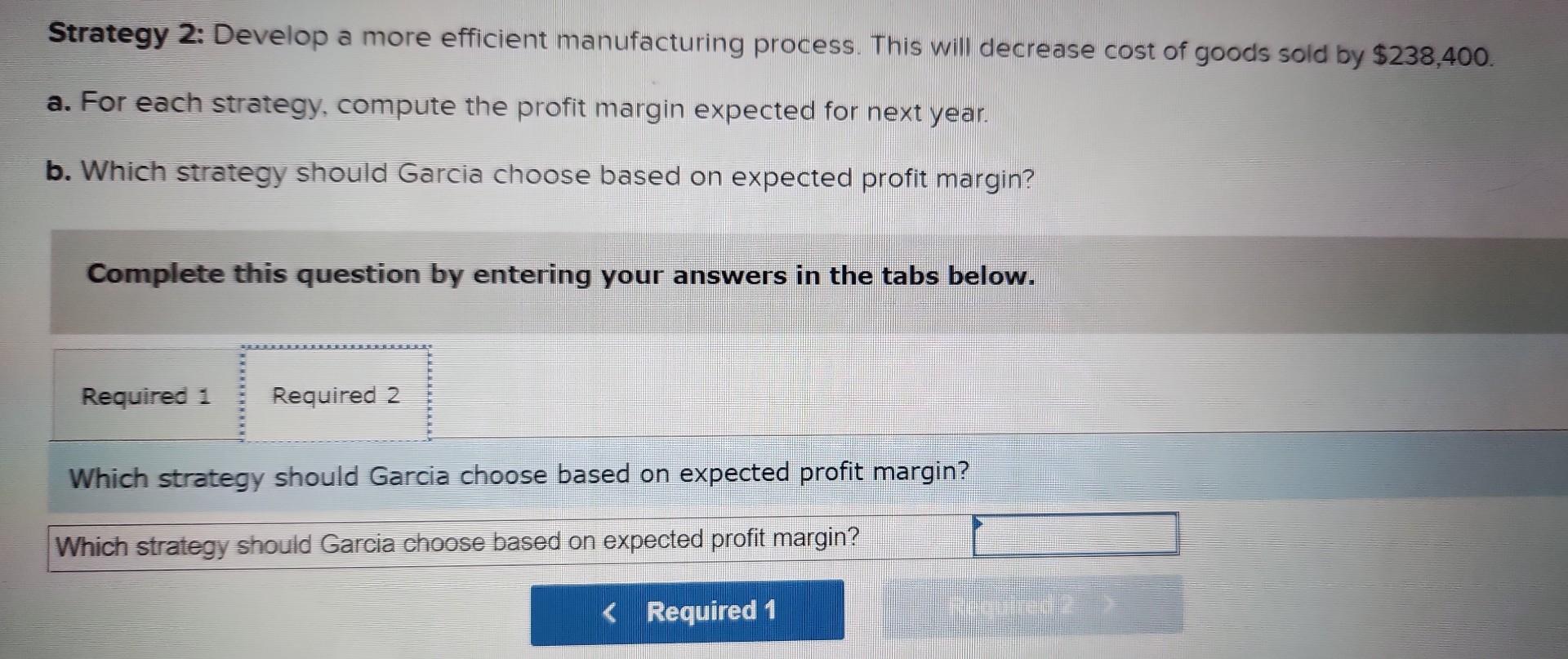

The Food division of Garcia Company reports the following for the current year. Garcia wants to achieve at least a 10\% profit margin next year. Two alternative strategies are proposed. Strategy 1: Increase advertising expenses by $225,000. The company expects this to increase sales by $760,000. Cost of goods sol will not change. Strategy 2: Develop a more efficient manufacturing process. This will decrease cost of goods sold by $238,400. a. For each strategy, compute the profit margin expected for next year. b. Which strategy should Garcia choose based on expected profit margin? Complete this question by entering your answers in the tabs below. Strategy 2: Develop a more efficient manufacturing process. This will decrease cost of goods sold by $238,400. a. For each strategy, compute the profit margin expected for next year. b. Which strategy should Garcia choose based on expected profit margin? Complete this question by entering your answers in the tabs below. For each strategy, compute the profit margin expected for next year. (Round your answers to one decimal place.) Strategy 2: Develop a more efficient manufacturing process. This will decrease cost of goods sold by $238,400. a. For each strategy, compute the profit margin expected for next year. b. Which strategy should Garcia choose based on expected profit margin? Complete this question by entering your answers in the tabs below. Which strategy should Garcia choose based on expected profit margin? Which strategy should Garcia choose based on expected profit margin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started