Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The formula for the present value of perptuity cash flow s is very simple: PV=rPMT The formula for the present value of growing perptuity cash

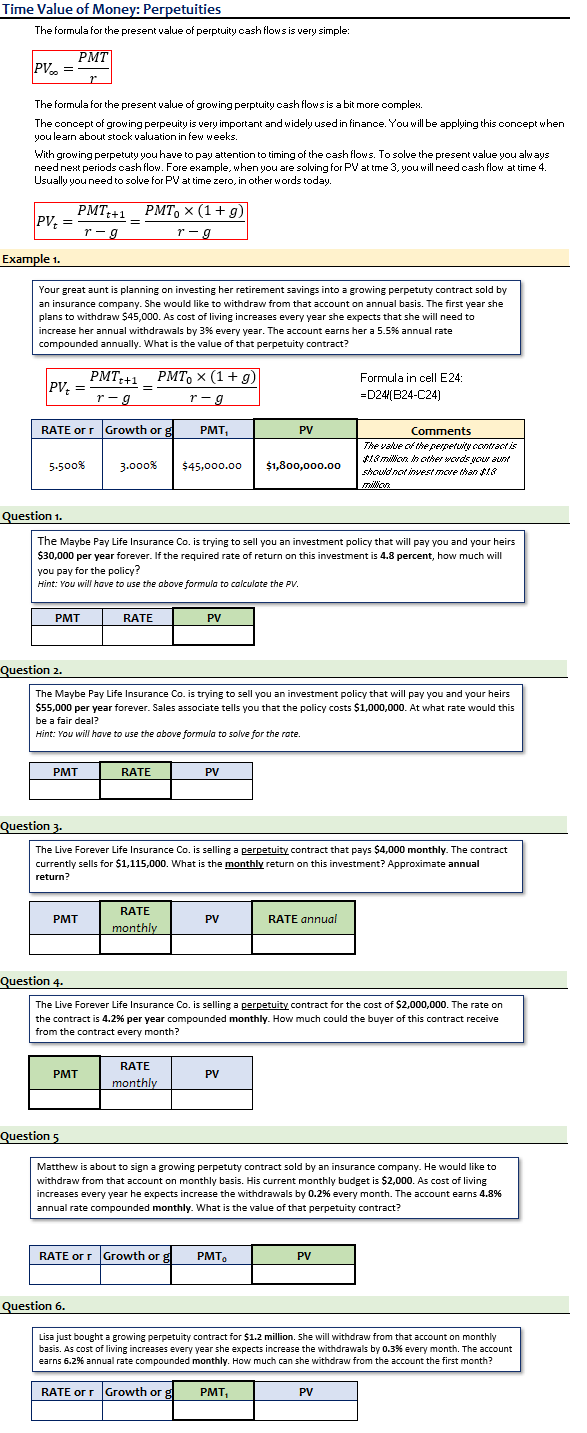

The formula for the present value of perptuity cash flow s is very simple: PV=rPMT The formula for the present value of growing perptuity cash flows is a bit more complex. The concept of growing perpeuity is very important and widely used in finance. You will be applying this concept when you learn about stock valuation in few weeks. With growing perpetuty you have to pay attention to timing of the cash flows. To solve the present value you alw ays need next periods cash flow. Fore example, when you are solving for PV at tme 3 , you will need cash flow at time 4 Usually you need to solve for PV at time zero, in other words today. PVt=rgPMTt+1=rgPMT0(1+g) Example 1. Your great aunt is planning on investing her retirement savings into a growing perpetuty contract sold by an insurance company. She would like to withdraw from that account on annual basis. The first year she plans to withdraw $45,000. As cost of living increases every year she expects that she will need to increase her annual withdrawals by 3% every year. The account earns her a 5.5% annual rate compounded annually. What is the value of that perpetuity contract? PVt=rgPMTt+1=rgPMT0(1+g) Formula in cell E24: =D24(B24C24) Question 1. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required rate of return on this investment is 4.8 percent, how much will you pay for the folicy? Hint: You will have to use the obove formula to colculote the PV. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required rate of return on this investment is 4.8 percent, how much will you pay for the policy? Hint: You will have to use the above formula to colculate the PV. Question 2. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $55,000 per year forever. Sales associate tells you that the policy costs $1,000,000. At what rate would this be a fair deal? Hint: You will have to use the obove formula to solve for the rote. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $55,000 per year forever. Sales associate tells you that the policy costs $1,000,000. At what rate would this be a fair deal? Hint: You will have to use the above formula to solve for the rote. Question 3. The Live Forever Life Insurance Co. is selling a perpetuity contract that pays $4,000 monthly. The contract currently sells for $1,115,000. What is the monthly return on this investment? Approximate annual return? Question 4. The Live Forever Life Insurance Co. is selling a perpetuity contract for the cost of $2,000,000. The rate on the contract is 4.2% per year compounded monthly. How much could the buyer of this contract receive from the contract every month? Question 5 Matthew is about to sign a growing perpetuty contract sold by an insurance company. He would like to withdraw from that account on monthly basis. His current monthly budget is $2,000. As cost of living increases every year he expects increase the withdrawals by 0.2% every month. The account earns 4.8% annual rate compounded monthly. What is the value of that perpetuity contract? Question 6. Lisa just bought a growing perpetuity contract for $1.2 million. She will withdraw from that account on monthly basis. As cost of living increases every year she expects increase the withdrawals by 0.3% every month. The account earns 6.2% annual rate compounded monthly. How much can she withdraw from the account the first month

The formula for the present value of perptuity cash flow s is very simple: PV=rPMT The formula for the present value of growing perptuity cash flows is a bit more complex. The concept of growing perpeuity is very important and widely used in finance. You will be applying this concept when you learn about stock valuation in few weeks. With growing perpetuty you have to pay attention to timing of the cash flows. To solve the present value you alw ays need next periods cash flow. Fore example, when you are solving for PV at tme 3 , you will need cash flow at time 4 Usually you need to solve for PV at time zero, in other words today. PVt=rgPMTt+1=rgPMT0(1+g) Example 1. Your great aunt is planning on investing her retirement savings into a growing perpetuty contract sold by an insurance company. She would like to withdraw from that account on annual basis. The first year she plans to withdraw $45,000. As cost of living increases every year she expects that she will need to increase her annual withdrawals by 3% every year. The account earns her a 5.5% annual rate compounded annually. What is the value of that perpetuity contract? PVt=rgPMTt+1=rgPMT0(1+g) Formula in cell E24: =D24(B24C24) Question 1. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required rate of return on this investment is 4.8 percent, how much will you pay for the folicy? Hint: You will have to use the obove formula to colculote the PV. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required rate of return on this investment is 4.8 percent, how much will you pay for the policy? Hint: You will have to use the above formula to colculate the PV. Question 2. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $55,000 per year forever. Sales associate tells you that the policy costs $1,000,000. At what rate would this be a fair deal? Hint: You will have to use the obove formula to solve for the rote. The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $55,000 per year forever. Sales associate tells you that the policy costs $1,000,000. At what rate would this be a fair deal? Hint: You will have to use the above formula to solve for the rote. Question 3. The Live Forever Life Insurance Co. is selling a perpetuity contract that pays $4,000 monthly. The contract currently sells for $1,115,000. What is the monthly return on this investment? Approximate annual return? Question 4. The Live Forever Life Insurance Co. is selling a perpetuity contract for the cost of $2,000,000. The rate on the contract is 4.2% per year compounded monthly. How much could the buyer of this contract receive from the contract every month? Question 5 Matthew is about to sign a growing perpetuty contract sold by an insurance company. He would like to withdraw from that account on monthly basis. His current monthly budget is $2,000. As cost of living increases every year he expects increase the withdrawals by 0.2% every month. The account earns 4.8% annual rate compounded monthly. What is the value of that perpetuity contract? Question 6. Lisa just bought a growing perpetuity contract for $1.2 million. She will withdraw from that account on monthly basis. As cost of living increases every year she expects increase the withdrawals by 0.3% every month. The account earns 6.2% annual rate compounded monthly. How much can she withdraw from the account the first month Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started