Answered step by step

Verified Expert Solution

Question

1 Approved Answer

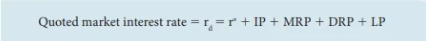

The formula that needs to be used in this is: I have a couple of them set up, but I keep not getting the answer

The formula that needs to be used in this is:  I have a couple of them set up, but I keep not getting the answer thats given in the back of the book (the ending answer is supposed to 6.0%).

I have a couple of them set up, but I keep not getting the answer thats given in the back of the book (the ending answer is supposed to 6.0%).

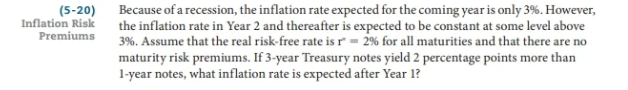

Quoted market interest rate =rd=r+IP+MRP+DRP+LP (520) Because of a recession, the inflation rate expected for the coming year is only 3%. However, Inflation Risk the inflation rate in Year 2 and thereafter is expected to be constant at some level above Premiums 3%. Assume that the real risk-free rate is rr=2% for all maturities and that there are no maturity risk premiums. If 3 -year Treasury notes yield 2 percentage points more than 1-year notes, what inflation rate is expected after Year 1

Quoted market interest rate =rd=r+IP+MRP+DRP+LP (520) Because of a recession, the inflation rate expected for the coming year is only 3%. However, Inflation Risk the inflation rate in Year 2 and thereafter is expected to be constant at some level above Premiums 3%. Assume that the real risk-free rate is rr=2% for all maturities and that there are no maturity risk premiums. If 3 -year Treasury notes yield 2 percentage points more than 1-year notes, what inflation rate is expected after Year 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started