Question

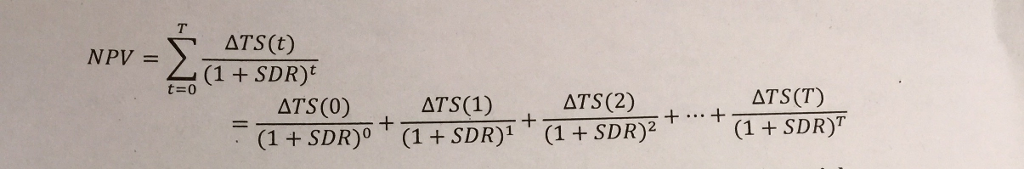

the formula to estimate the net present value(NPV) of a project is where t is time in years and T is the last year of

the formula to estimate the net present value(NPV) of a project is

where t is time in years and T is the last year of the project and the SDR is the social discount rate, which can for now be thought of as a socially efficient interest rate and  TS(t) represents the change in total social surplus in period t. If the NPV of a project exceeds 0, this means that the project is socially efficient in comparison to the counterfactual, meaning that the society should choose it based on this social welfare criterion. they may however want to consider other welfare criterion such as equity.

TS(t) represents the change in total social surplus in period t. If the NPV of a project exceeds 0, this means that the project is socially efficient in comparison to the counterfactual, meaning that the society should choose it based on this social welfare criterion. they may however want to consider other welfare criterion such as equity.

suppose that society incurs an abatement cost of $50 bill in the year 2000(year 0) relative to a counterfactual of no abatement. in 2050, this reduces climate change damages by $500 billion. in 2100, this abatement reduces climate change damages by $1000 billion. these costs and benefits are all in current values(have not been discounted). unrealistically, only three time periods are used to reduce calculation time.

a. put the current value of the social surplus change in a timeline. for example, your social surplus change for year 1 is $50 bill in current value. immediately underneath your entry, put the present value.

b. for each of the following three SDR, calculate the NPV. show your work, based upon the social efficiency criterion. for each SDR, indicate whether you would you recommend that society abates and why

SDR1=0.06(6%)

SDR2=0.02(2%)

SDR3=-0.01(2%)

c. what happens to the NPV as the SDR is decreased? briefly explain why

NPV t-0 ATS(t) ATS(0) (1 SDR) ATS(1) (1 SDR) ATS (2) ATS(T)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started