Answered step by step

Verified Expert Solution

Question

1 Approved Answer

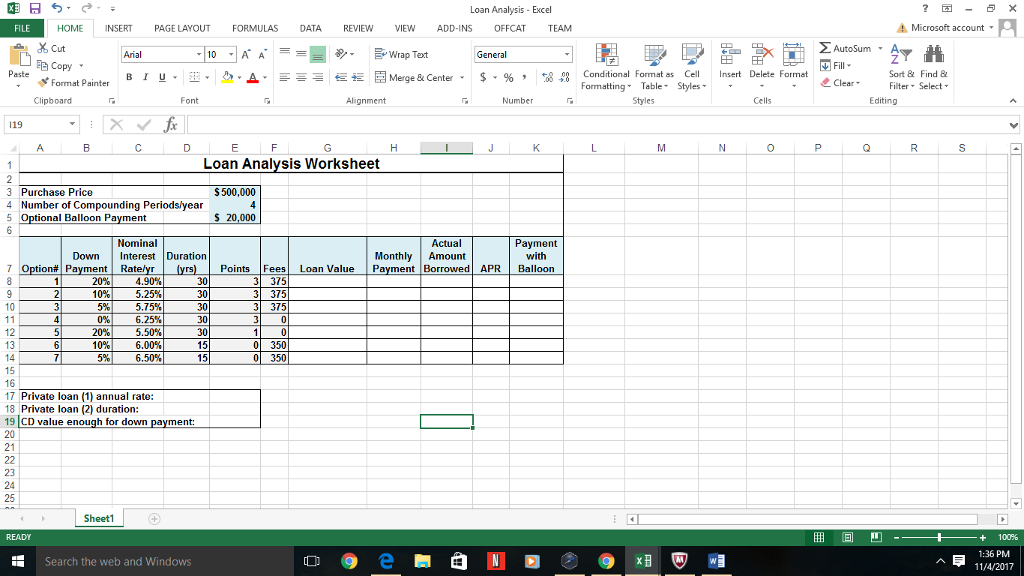

The formulas for each Loan Analysis Excel FILE HOME INSERT PAGE LAYOUTFORMULAS DATA REVIEW VIEW ADD-INS OFFCAT TEAM Microsoft account . S Cut Wrap Text

The formulas for each

Loan Analysis Excel FILE HOME INSERT PAGE LAYOUTFORMULAS DATA REVIEW VIEW ADD-INS OFFCAT TEAM Microsoft account . S Cut Wrap Text General Fill Clear Copy Paste Conditional Format as Cell Insert Delete Format ormatting TableStyles- Sort &Find& B 1 u . EE r Merge & Center. $. % , e" Format Painter Filter Select Font Alignment Cells Editing 119 Loan Analysis Worksheet 3 Purchase Price 4Number of Compounding Periodslyear $500,000 nal Balloon Pa S 20,000 Payment Nominal Down Interest Duration Actual MonthlyAmount Points Fees Loan Value P Payment Rate 20% 10% Borrowed APR Balloon 4.90% 5.25% 5.75% 6.25% 5.50% 6.00% 6.50% 3375 3375 3375 30 10 12 13 20% 10% 5% 01 350 01 350 15 16 17 Private loan (1) annual rate 18 Private loan (2) duration: 19 CD value enough for down 20 21 ent: 23 25 Sheet1 - + 100% 1:36 PM Search the web and Windows 11/4/2017 Loan Analysis Excel FILE HOME INSERT PAGE LAYOUTFORMULAS DATA REVIEW VIEW ADD-INS OFFCAT TEAM Microsoft account . S Cut Wrap Text General Fill Clear Copy Paste Conditional Format as Cell Insert Delete Format ormatting TableStyles- Sort &Find& B 1 u . EE r Merge & Center. $. % , e" Format Painter Filter Select Font Alignment Cells Editing 119 Loan Analysis Worksheet 3 Purchase Price 4Number of Compounding Periodslyear $500,000 nal Balloon Pa S 20,000 Payment Nominal Down Interest Duration Actual MonthlyAmount Points Fees Loan Value P Payment Rate 20% 10% Borrowed APR Balloon 4.90% 5.25% 5.75% 6.25% 5.50% 6.00% 6.50% 3375 3375 3375 30 10 12 13 20% 10% 5% 01 350 01 350 15 16 17 Private loan (1) annual rate 18 Private loan (2) duration: 19 CD value enough for down 20 21 ent: 23 25 Sheet1 - + 100% 1:36 PM Search the web and Windows 11/4/2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started