Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vaughn Sports sells volleyball kits that it purchases from a sports equipment distributor. The following static budget based on sales of 2,400 kits was

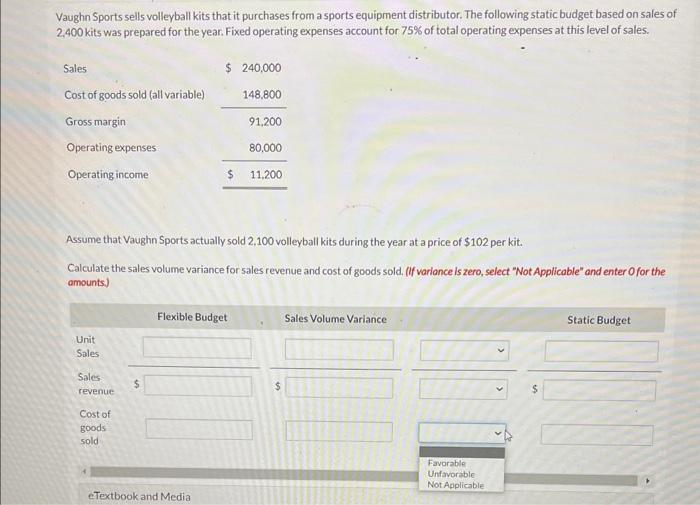

Vaughn Sports sells volleyball kits that it purchases from a sports equipment distributor. The following static budget based on sales of 2,400 kits was prepared for the year. Fixed operating expenses account for 75% of total operating expenses at this level of sales. Sales Cost of goods sold (all variable) Gross margin Operating expenses Operating income Unit Sales Sales revenue Assume that Vaughn Sports actually sold 2,100 volleyball kits during the year at a price of $102 per kit. Calculate the sales volume variance for sales revenue and cost of goods sold. (If variance is zero, select "Not Applicable" and enter O for the amounts) Cost of goods sold $ $ 240,000 148,800 $ eTextbook and Medial Flexible Budget 91,200 80,000 11,200 $ Sales Volume Variance Favorable Unfavorable Not Applicable $ Static Budget

Step by Step Solution

★★★★★

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Flexible Budget Sales volume variance Static b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started