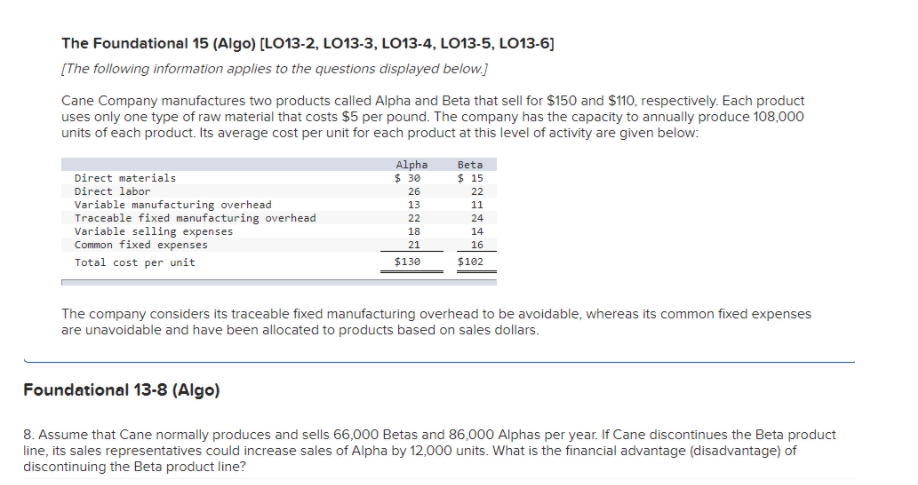

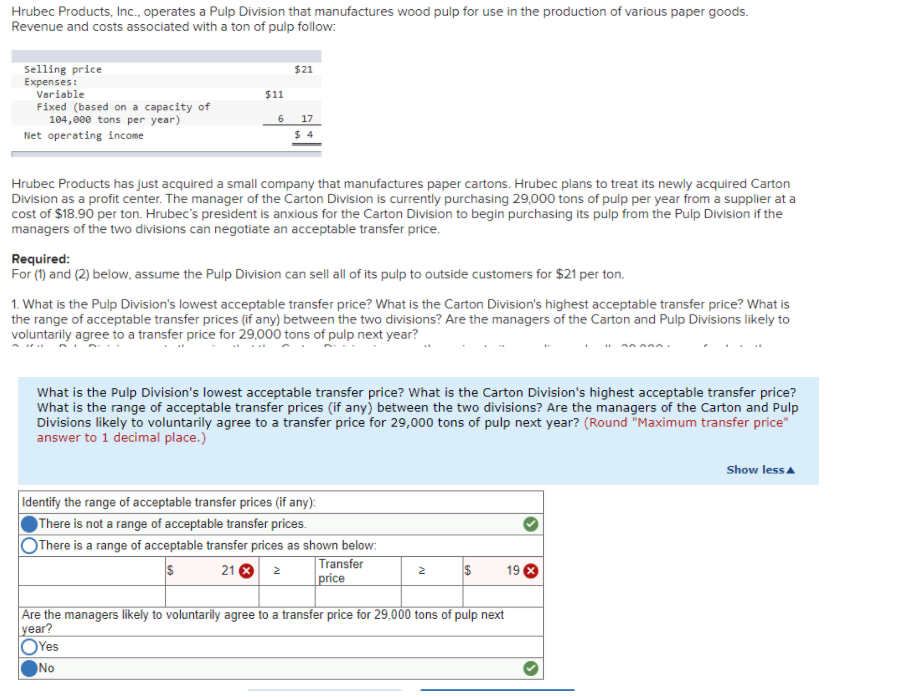

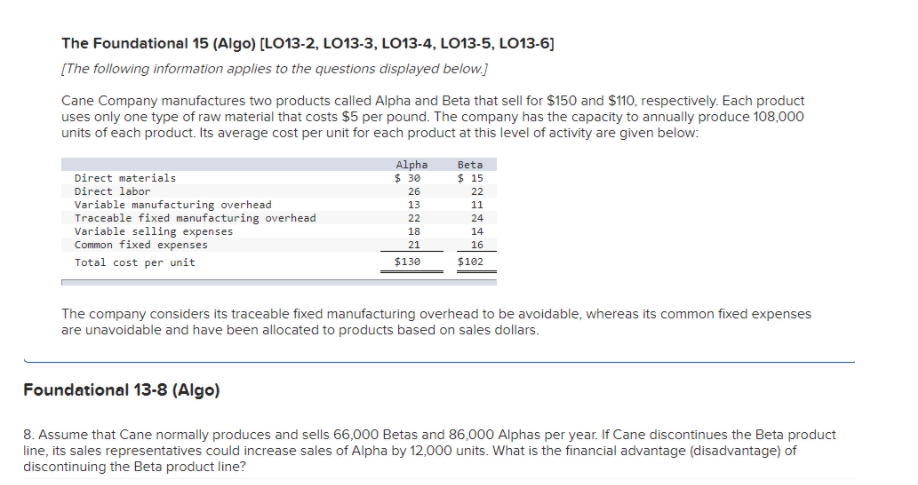

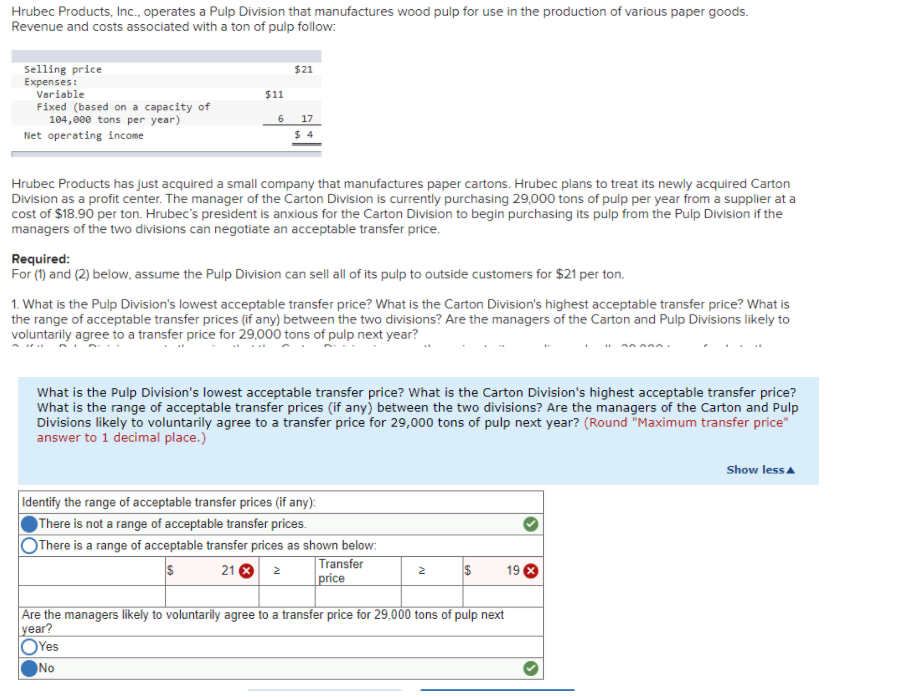

The Foundational 15 (Algo) (LO13-2, LO13-3, LO13-4, L013-5, LO13-6) [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively. Each product uses only one type of raw material that costs $5 per pound. The company has the capacity to annually produce 108,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 30 26 13 22 18 21 Beta $ 15 22 11 24 14 16 $102 $130 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Foundational 13-8 (Algo) 8. Assume that Cane normally produces and sells 66,000 Betas and 86,000 Alphas per year. If Cane discontinues the Beta product line, its sales representatives could increase sales of Alpha by 12,000 units. What is the financial advantage (disadvantage) of discontinuing the Beta product line? Hrubec Products, Inc., operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs associated with a ton of pulp follow: $21 $11 Selling price Expenses : Variable Fixed (based on a capacity of 104,000 tons per year) Net operating income 6 17 $ 4 Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acquired Carton Division as a profit center. The manager of the Carton Division is currently purchasing 29,000 tons of pulp per year from a supplier at a cost of $18.90 per ton. Hrubec's president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotiate an acceptable transfer price. Required: For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $21 per ton. 1. What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 29,000 tons of pulp next year? What is the Pulp Division's lowest acceptable transfer price? What is the Carton Division's highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 29,000 tons of pulp next year? (Round "Maximum transfer price" answer to 1 decimal place.) Show less Identify the range of acceptable transfer prices (if any): There is not a range of acceptable transfer prices. There is a range of acceptable transfer prices as shown below: $ 21 2 Transfer price $ 19 Are the managers likely to voluntarily agree to a transfer price for 29,000 tons of pulp next year? Yes No