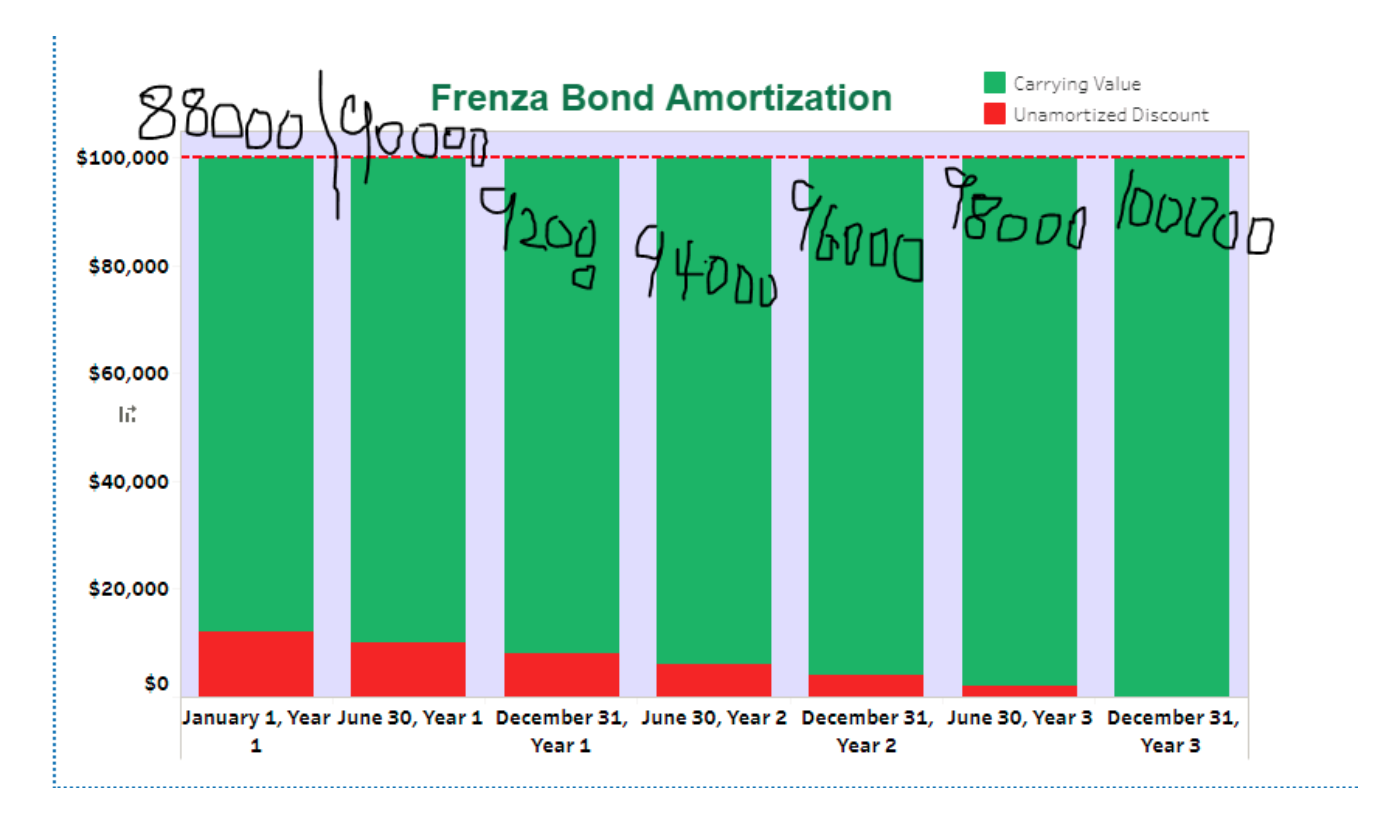

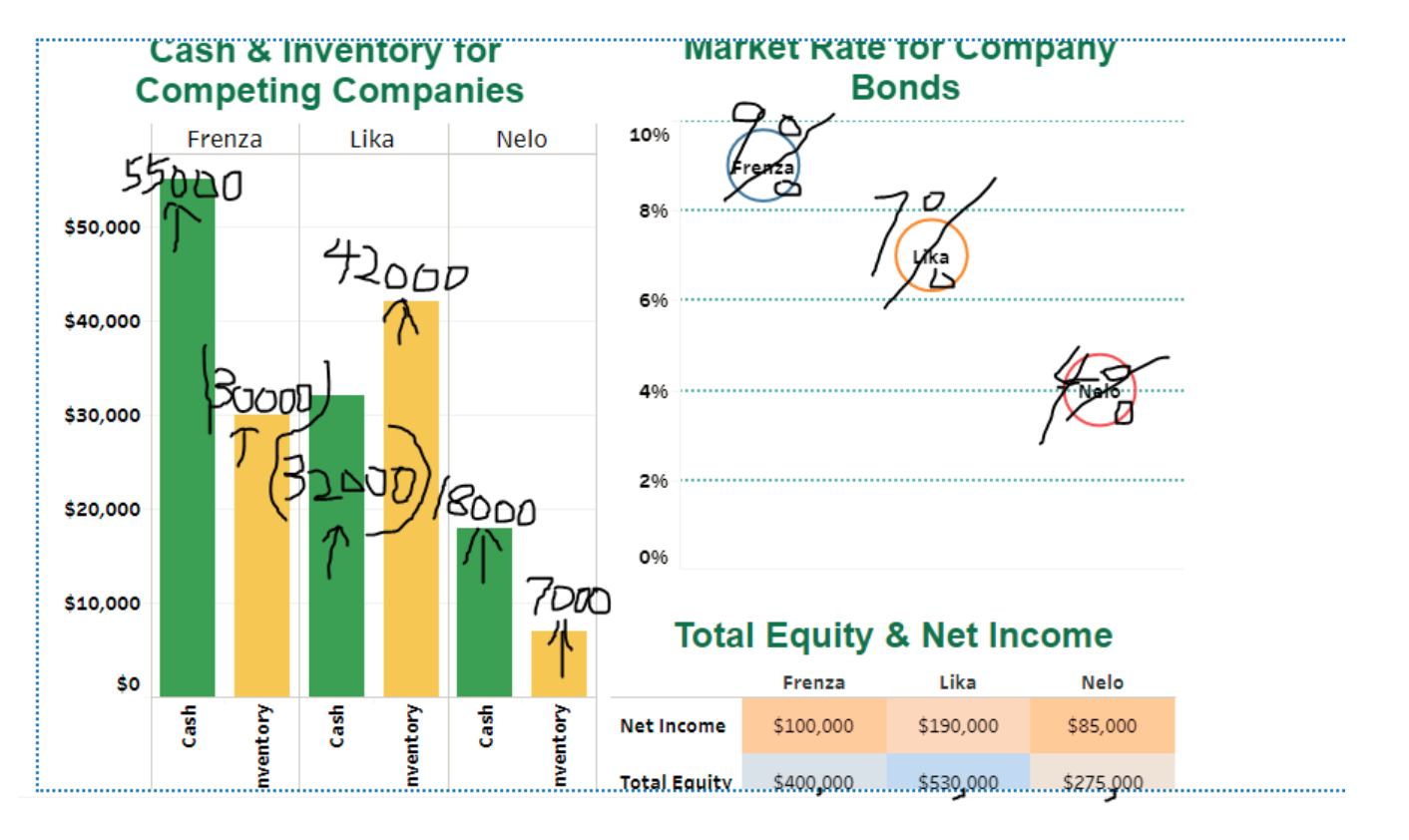

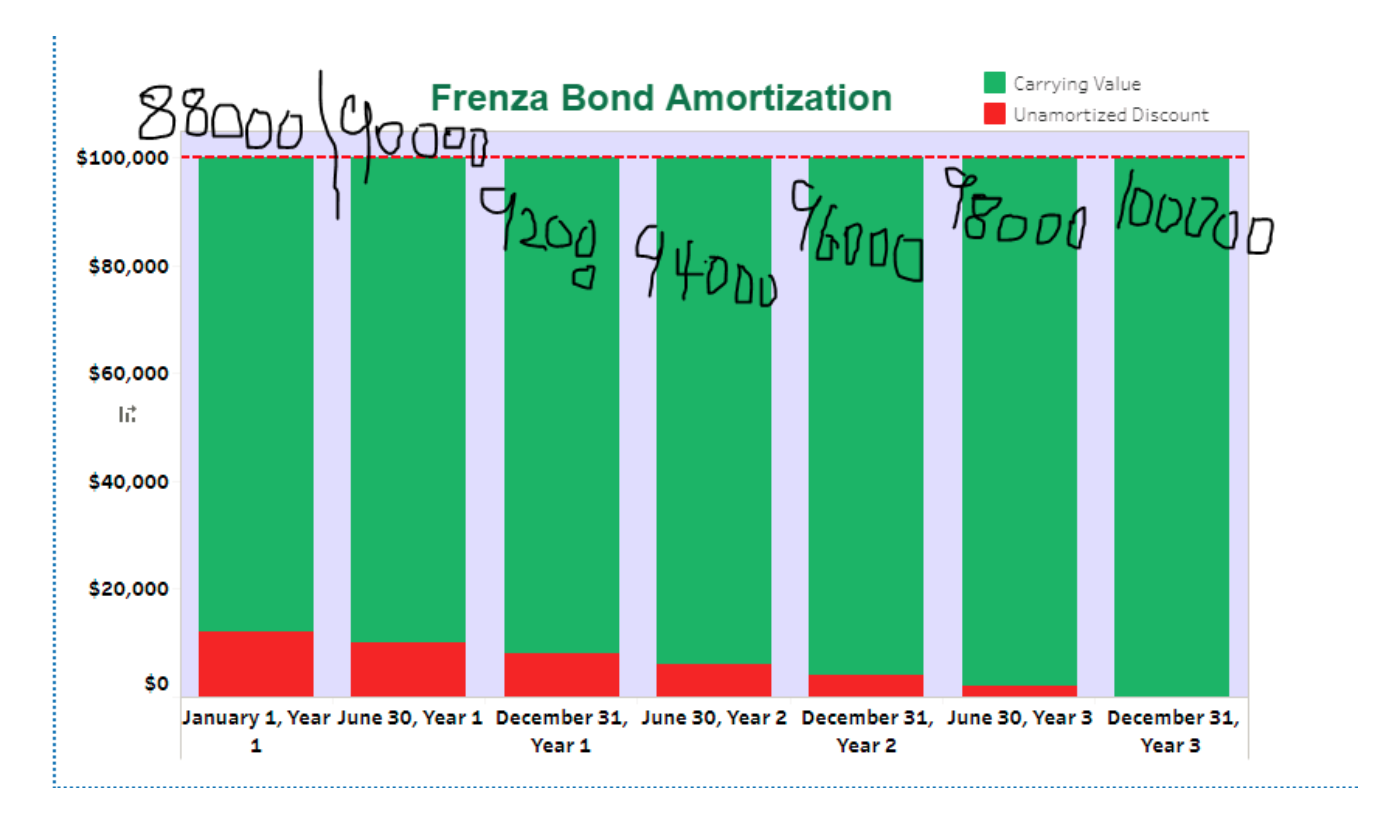

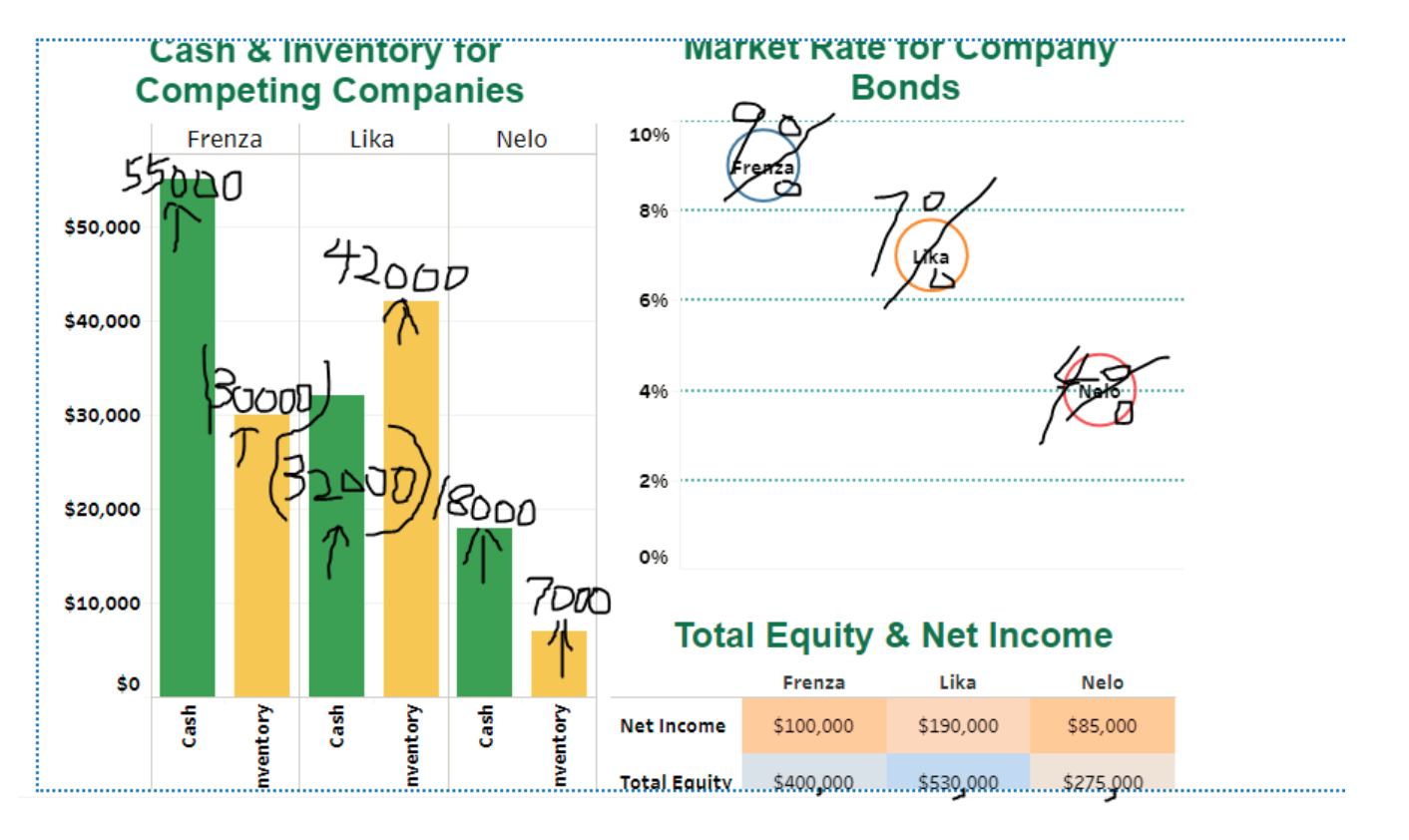

The founder of Frenza asks us to assist her in accounting and analysis of the corporations bonds, which have an annual contract rate of 8%. She wants to know the business and accounting implications of further debt issuances as she looks for ways to finance the growth of Frenza. The following Tableau Dashboard is provided to help us address her questions and provide recommendations for her business decisions.

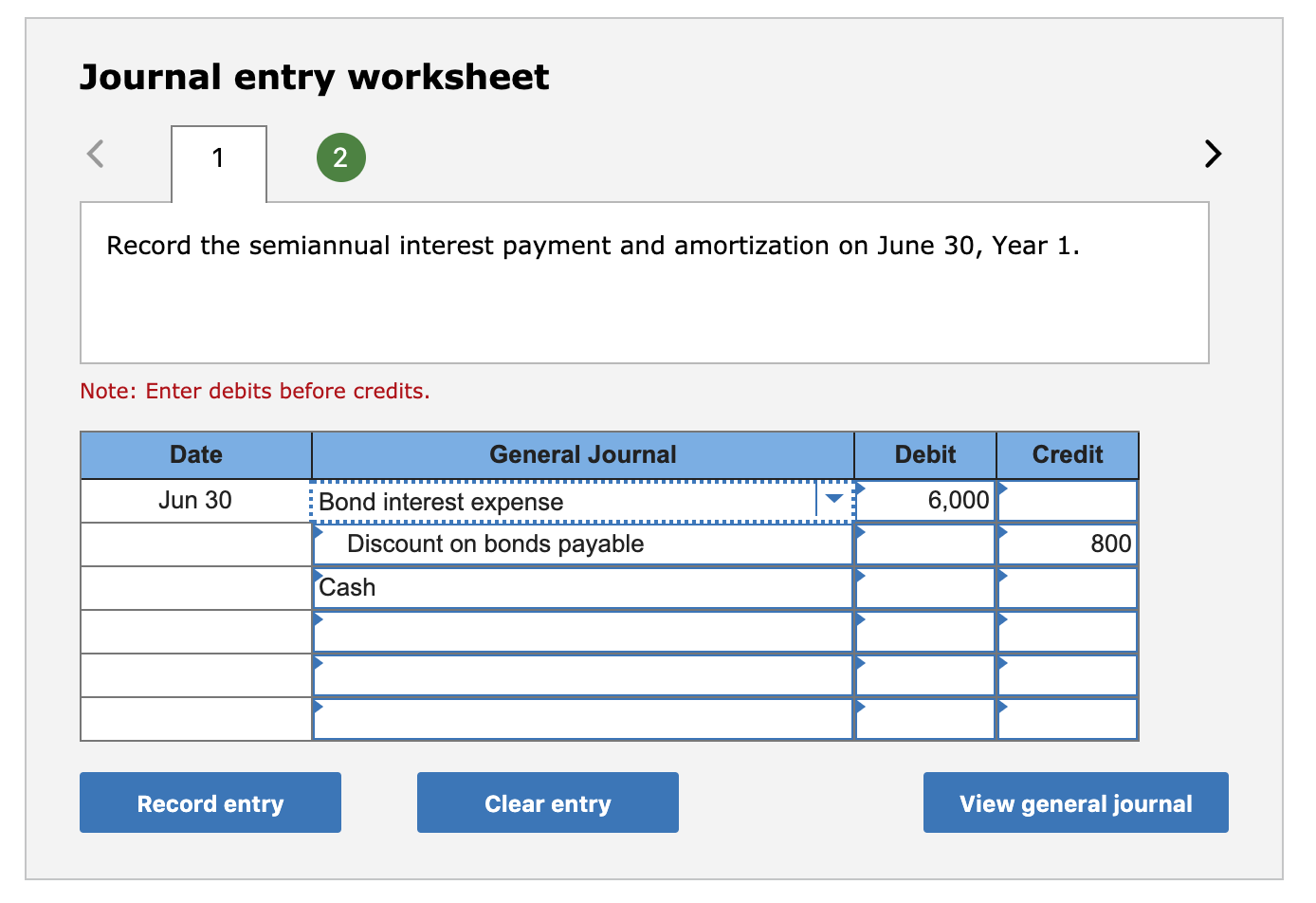

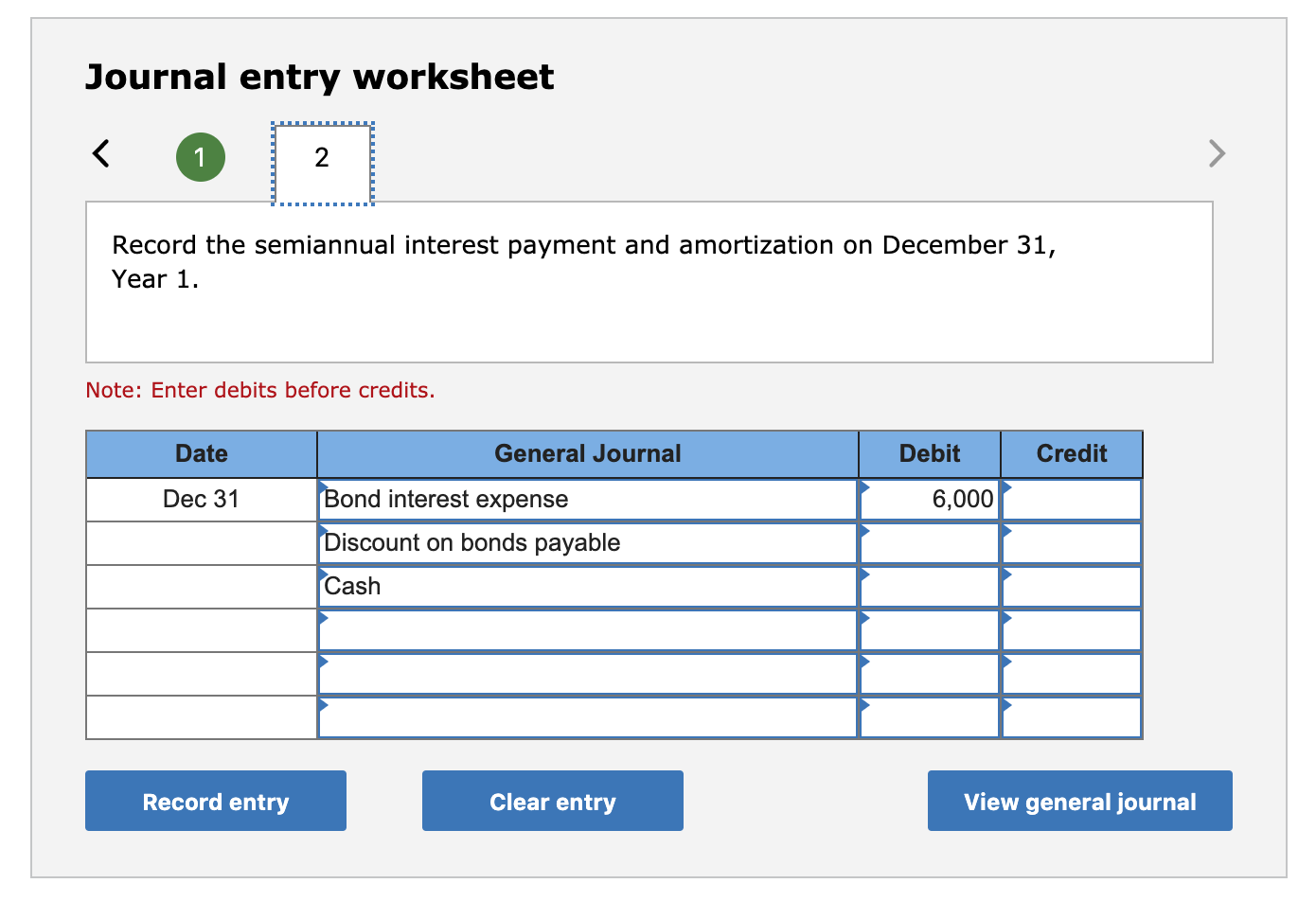

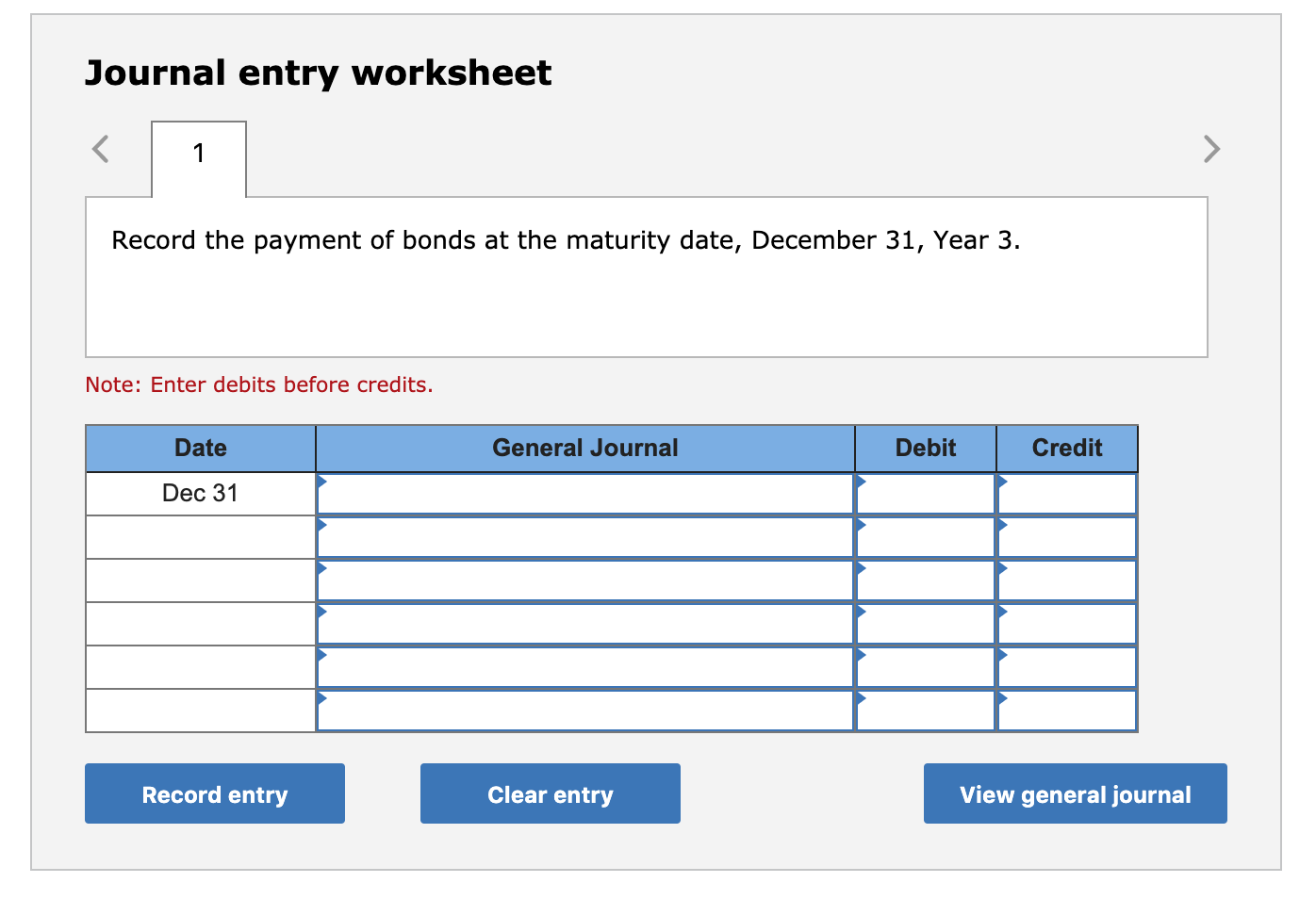

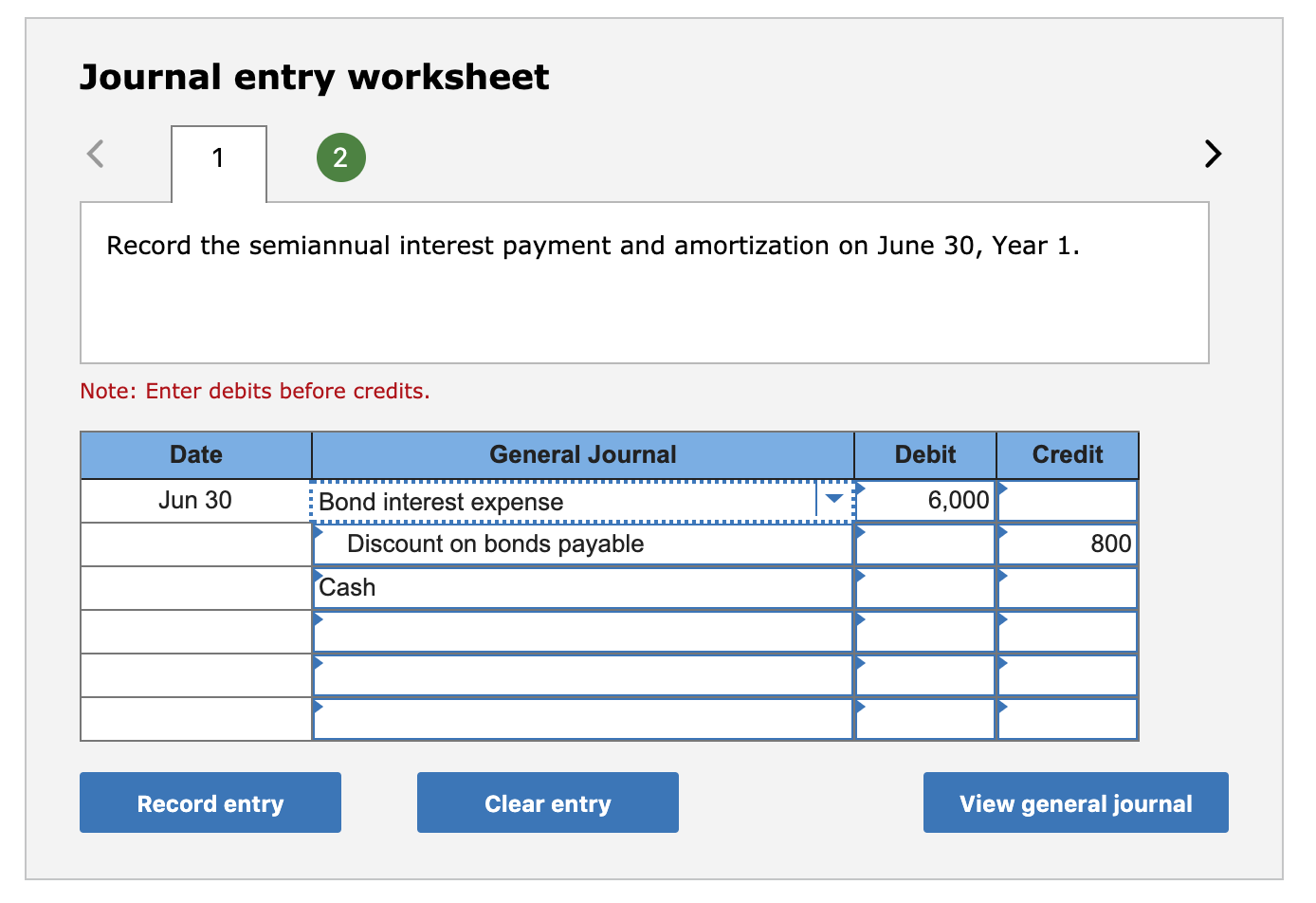

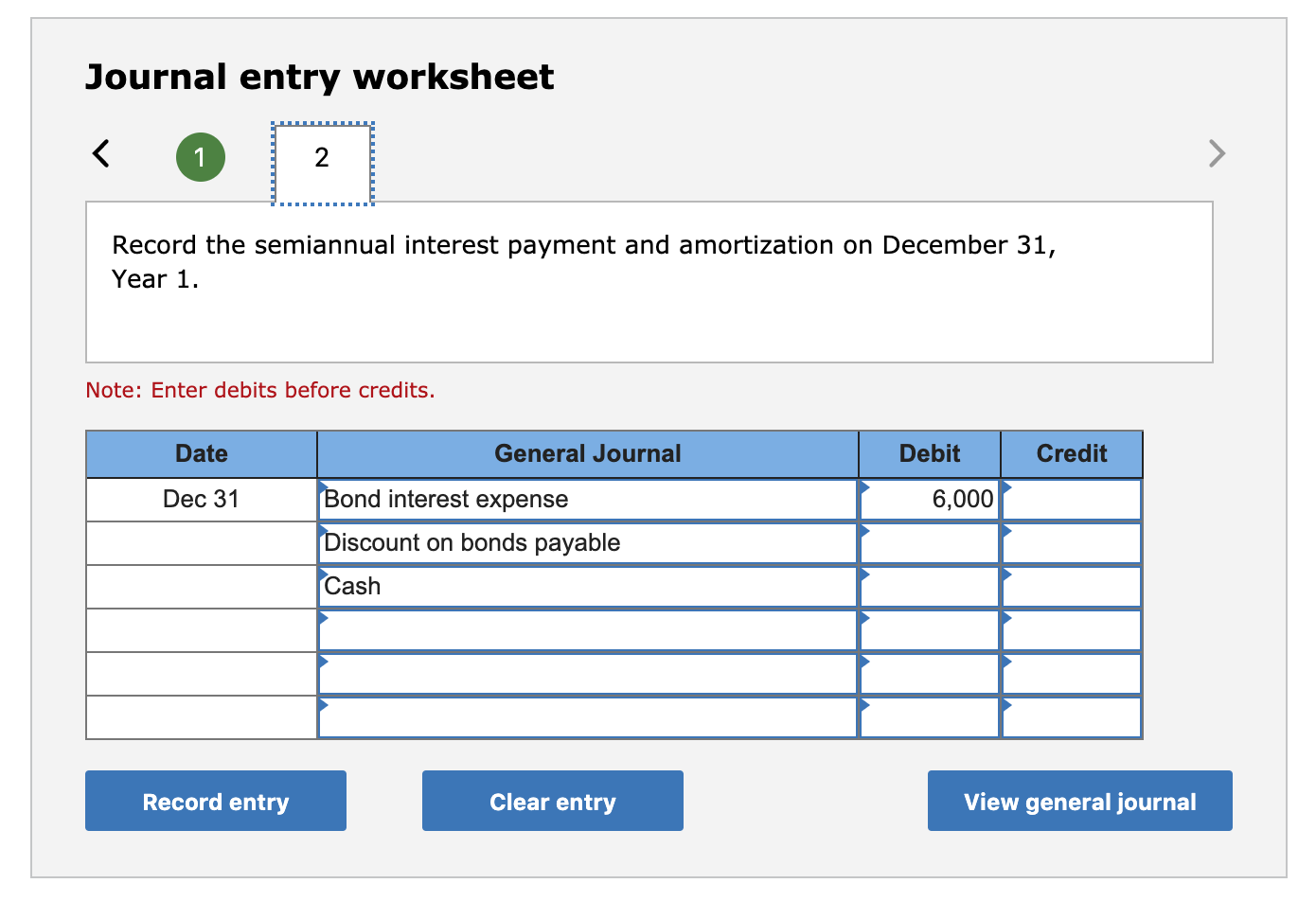

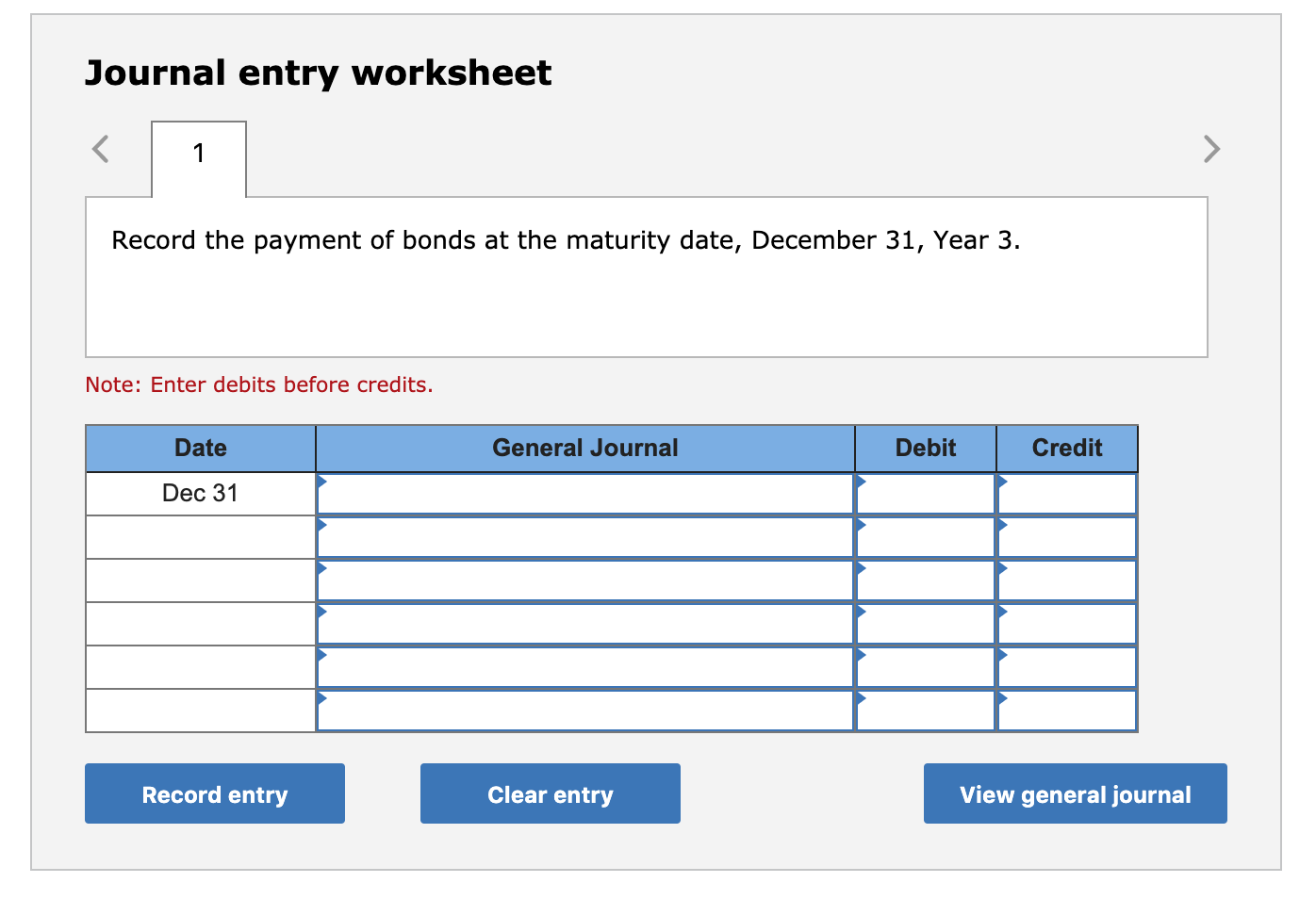

FILL IN JOURNAL ENTRIES BELOW.

Frenza Bond Amortization Carrying Value Unamortized Discount 0000 40000 $100,000 go to hold oor boven $80,000 $60,000 $40,000 $20,000 January 1, Year June 30, Year 1 December 31, June 30, Year 2 December 31, June 30, Year 3 December 31, Year 1 Year 2 Year 3 ***mempena Market Rate for company Bonds ****Cash & Inventory for Competing Companies Frenza Lika Nelo 55000 $50,000 42000 $40,000 Buool Neo $30,000 132000) 18000 $20,000 7000 $10,000 $0 Total Equity & Net Income Frenza Lika Nelo Net Income $100,000 $190,000 $85,000 Cash Cash Cash nventory inventory nventory Total.Eguity......$400,00..........$530,000.......$27.5.0.0... Journal entry worksheet Record the semiannual interest payment and amortization on June 30, Year 1. Note: Enter debits before credits. Credit Date Jun 30 Debit 6,000 General Journal Bond interest expense Discount on bonds payable Cash 800 Record entry Clear entry View general journal Journal entry worksheet Record the semiannual interest payment and amortization on December 31, Year 1. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Bond interest expense 0,000 Discount on bonds payable Cash Record entry Clear entry View general journal Journal entry worksheet Record the payment of bonds at the maturity date, December 31, Year 3. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Frenza Bond Amortization Carrying Value Unamortized Discount 0000 40000 $100,000 go to hold oor boven $80,000 $60,000 $40,000 $20,000 January 1, Year June 30, Year 1 December 31, June 30, Year 2 December 31, June 30, Year 3 December 31, Year 1 Year 2 Year 3 ***mempena Market Rate for company Bonds ****Cash & Inventory for Competing Companies Frenza Lika Nelo 55000 $50,000 42000 $40,000 Buool Neo $30,000 132000) 18000 $20,000 7000 $10,000 $0 Total Equity & Net Income Frenza Lika Nelo Net Income $100,000 $190,000 $85,000 Cash Cash Cash nventory inventory nventory Total.Eguity......$400,00..........$530,000.......$27.5.0.0... Journal entry worksheet Record the semiannual interest payment and amortization on June 30, Year 1. Note: Enter debits before credits. Credit Date Jun 30 Debit 6,000 General Journal Bond interest expense Discount on bonds payable Cash 800 Record entry Clear entry View general journal Journal entry worksheet Record the semiannual interest payment and amortization on December 31, Year 1. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Bond interest expense 0,000 Discount on bonds payable Cash Record entry Clear entry View general journal Journal entry worksheet Record the payment of bonds at the maturity date, December 31, Year 3. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal