Answered step by step

Verified Expert Solution

Question

1 Approved Answer

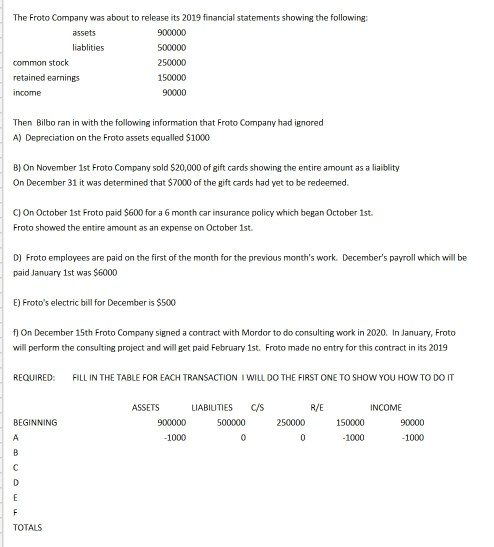

The Froto Company was about to release its 2019 financial statements showing the following: 900000 assets 500000 liablities common stock 250000 retained earnings 150000 income

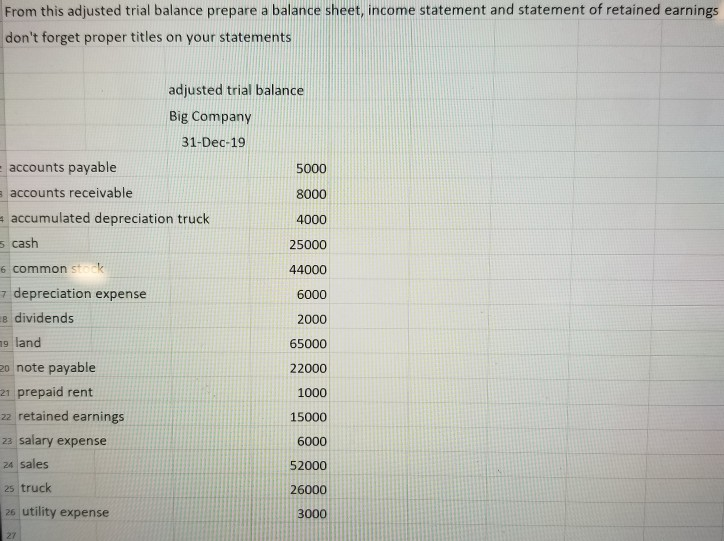

The Froto Company was about to release its 2019 financial statements showing the following: 900000 assets 500000 liablities common stock 250000 retained earnings 150000 income 90000 Then Bilbo ran in with the following information that Froto Company had ignored A) Depreciation on the Froto assets equalled $1000 B) On November 1st Froto Company sold $20,000 of gift cards showing the entire amount as a liaiblity On December 31 it was determined that $7000 of the gift cards had yet to be redeemed. C On October 1st Froto paid $600 for a 6 month car insurance policy which began October 1st. Froto showed the entire amount as an expense on October 1st D) Froto employees are paid on the first of the month for the previous month's work. December's payroll which will be paid January 1st was $6000 E) Froto's electric bill for December is $500 fOn December 15th Froto Company signed a contract with Mordor to do consulting work in 2020. In January, Froto- will perform the consulting project and will get paid February 1st. Froto made no entry for this contract in its 2019 REQUIRED FILL IN THE TABLE FOR EACH TRANSACTION I WILL DO THE FIRST ONE TO SHOW YOU HOW TO DO IT C/S R/E ASSETS LIABILITIES INCOME BEGINNING 900000 500000 250000 150000 90000 -1000 A -1000 00 B C D TOTALS From this adjusted trial balance prepare a balance sheet, income statement and statement of retained earnings don't forget proper titles on your statements adjusted trial balance Big Company 31-Dec-19 accounts payable 5000 s accounts receivable 8000 accumulated depreciation truck 4000 s cash 25000 6 common stock 44000 depreciation expense 6000 7 e dividends 2000 9 land 65000 20 note payable 22000 21 prepaid rent 1000 22 retained earnings 15000 salary expense 6000 23 24 sales 52000 25 truck 26000 utility expense 26 3000 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started