Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The future value of an annuity is a fundamental concept in finance. However there are some details and distinctions that can make a big difference

The future value of an annuity is a fundamental concept in finance. However there are some details and distinctions that can make a big difference in the future value of annuity

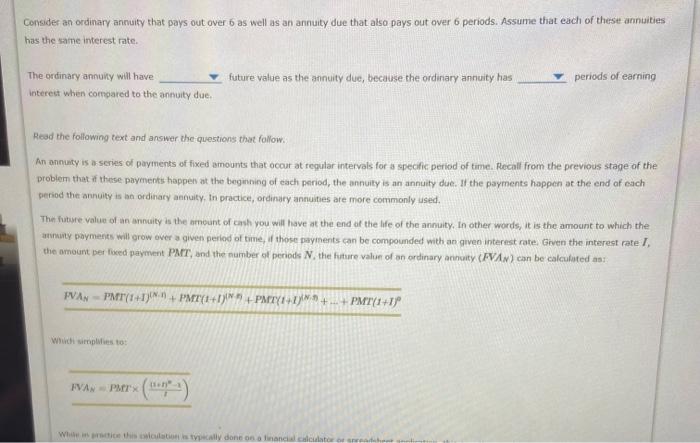

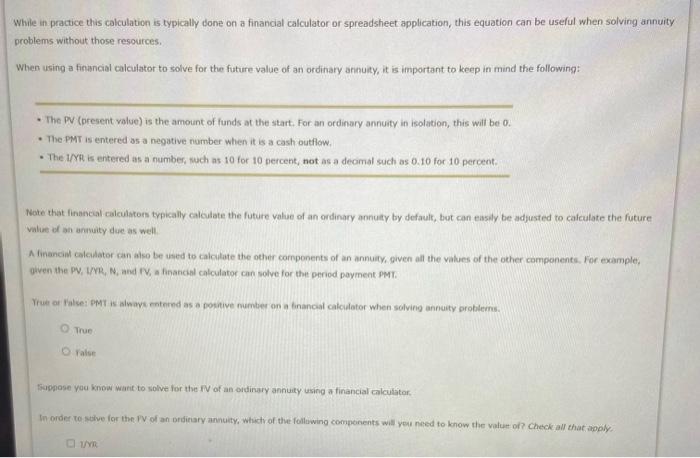

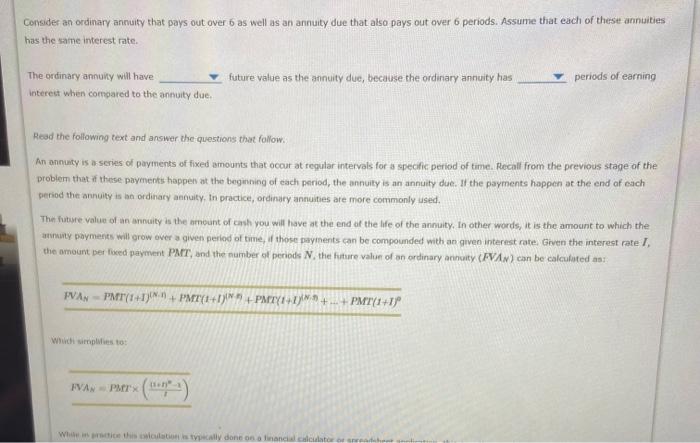

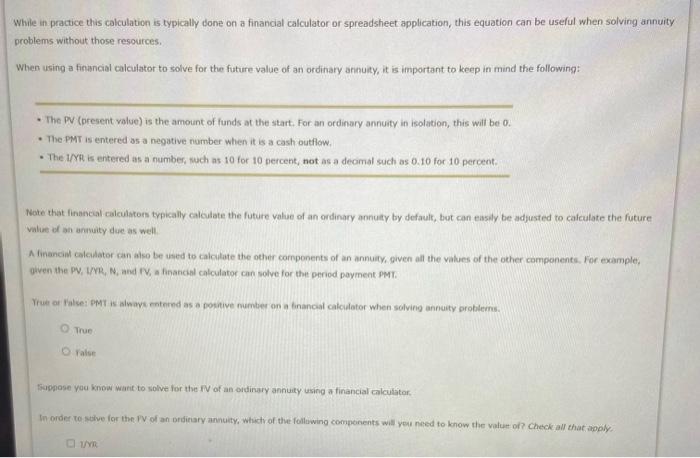

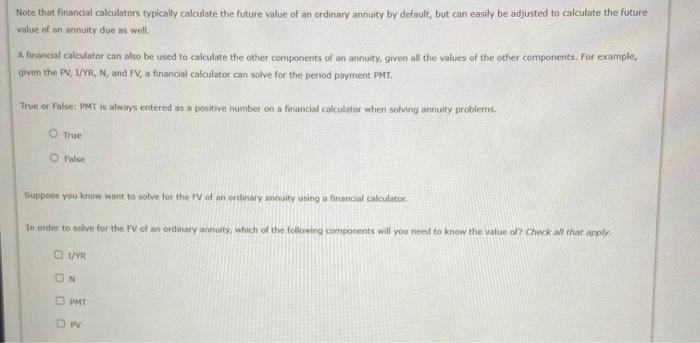

Consider an ordinary annuity that pays out over o as well as an annuity due that also pays out over 6 periods. Assume that each of these annuities has the same interest rate. future value as the annuity due, because the ordinary annuity has periods of earning The ordinary annuity will have Interest when compared to the annuity due Read the following text and answer the questions that follow An annuity is a series of payments of fixed amounts that occur at regular intervals for a specific period of time. Recall from the previous stage of the problem that if these payments happen at the beginning of each period, the annuity is an annuity due. If the payments happen at the end of each period the annuity is an ordinary annuity. In practice, ordinary annuities are more commonly used The future value of an annuity is the amount of cash you will have at the end of the life of the annuity. In other words, it is the amount to which the animorty payments will grow over a given period of time, if those payments can be compounded with an given interest rate. Given the interest rate I the amount per Tised payment PMT, and the number of periods N the future value of an ordinary annaty (FVA) can be calculated PVA PMFY1+1}'M + PMT (141) +PMYR). + PMTY1+1 Wuch simplifiesto FVAN PIX What this tally done on a financiero while in practice this calculation is typically done on a financial calculator or spreadsheet application, this equation can be useful when solving annuity problems without those resources, When using a financial calculator to solve for the future value of an ordinary annuity, it is important to keep in mind the following: The PV (present value) is the amount of funds at the start. For an ordinary annuity in isolation, this will be 0. The PMT is entered as a negative number when it is a cash outflow, The 1/8 is entered as a number, such as 10 for 10 percent, not as a decimal such as 0.10 for 10 percent Note that financial calculators typically calculate the future value of an ordinary annuity by default, but can easily be adjusted to calculate the future value of an annuity due as well A financil calculator can also be used to calculate the other components of an annuity, given all the values of the other components. For example, given the PV, DYR, N. and IV, financial calculator can solve for the period payment PMY. Yrue or role: PMT * wwwe entered as a positive number on a financial calculator when solving annuity problems, True Oralse Suppose you know want to solve for the IV of an ordinary annuity using a financial calculator In order to solve for the PV of an ordinary annuity, which of the following components will you need to know the value of? Check all that apply WYR Note that financial calculators typically calculate the future value of an ordinary annuity by default, but can easily be adjusted to calculate the future value of an annuity due as well A financial calculator can also be used to calculate the other components of an annuity, given all the values of the other components. For example, given the PV, I/VR, N, and PV, a financial calculator can solve for the period payment PML True or Pole: PMT is always entered as a positive number on a financial calculator when solving annuity problems, True False Suppose you know want to solve for the IV of an ordinary annuity using a financial calculator In order to solve for the IV of an ordinary annuity, which of the following components will you need to know the value of check the apply. 1/YR DN OP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started