Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The gap between is just the page split, all the relevant information has been uploaded. Let me know what is unclear! 3. (Bounds on relurns)

The gap between is just the page split, all the relevant information has been uploaded. Let me know what is unclear!

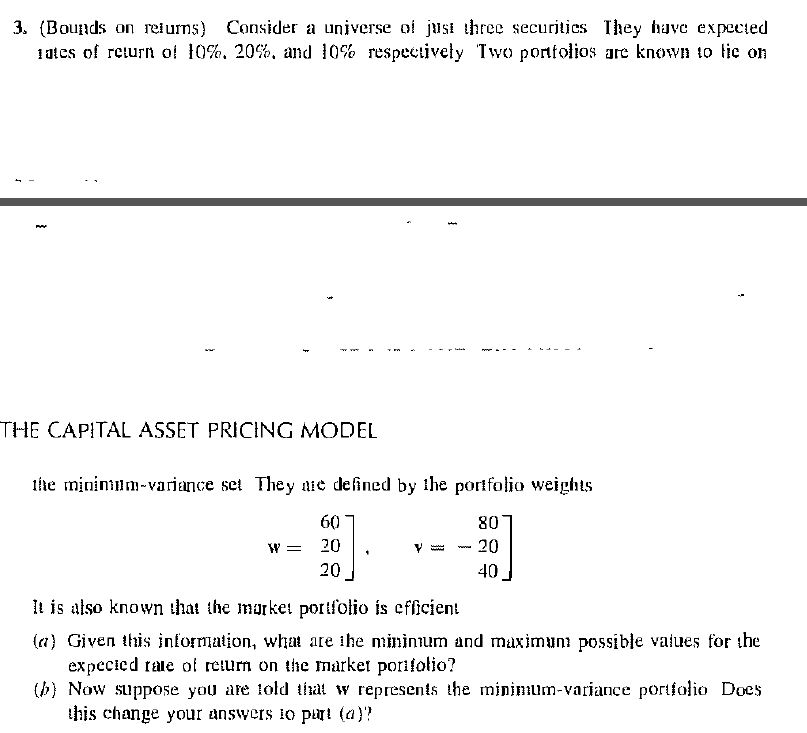

3. (Bounds on relurns) Consider a universe oi jusi three securitics They havc expeced 1 ates of return o! 10%, 20%, and 10% respectively Two portfolios are known to lie on THlE CAP!TAL ASSET PRICING MODEL fhe mininm-variance se They e defined by lhe portfolio weights 60 1 807 20 40 lt is also known that the market portfolio is eficient (a) Given this nomton, wha are ihe mininum and maximum possible values for the expecied rae o reurn on the markei porifolio? are told b) Now suppose you w represents the minimum-vaiance portfolio Does this change your answers lo pTt (a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started