The following information is available for the Albert and Allison Gaytor family. The Gaytors paid tuition and fees for both Crocker and Cayman to attend

The following information is available for the Albert and Allison Gaytor family.

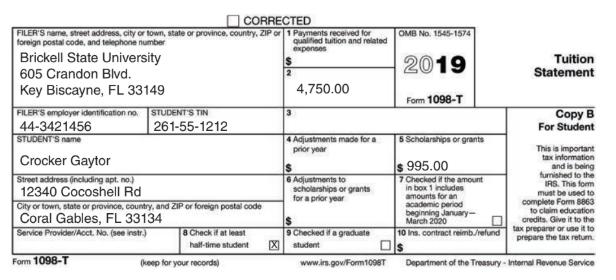

The Gaytors paid tuition and fees for both Crocker and Cayman to attend college. Recall that Crocker is a freshman at Brickell State and Cayman is a part-time student in community college. Crocker received a $995 scholarship from Brickell State. Crocker’s Form 1098-T is shown below. The Gaytors paid tuition and fees of $1,400 for Cayman in 2019.

In December 2018, Albert’s 82 year-old aunt, Virginia Everglades (Social Security number 699-19-9000), was unable to support herself and moved in with the Gaytors. She lived with them for all of 2019. The Gaytors provided more than one-half of Aunt Virginia’s support. Virginia’s only source of income is a small annuity that paid her $3,100 in 2019. While Albert and Allison were working, the Gaytors hired a nanny service from time to time to take care of Aunt Virginia. The Gaytors paid $3,400 to Nannys R Us in 2019. Nannys R Us (EIN 34-1234123) is located at 80 SW 22nd Avenue, Miami, FL 33133.

Required: Combine this new information about the Gaytor family with the information from Chapters 1, 2, 3, 4, 5, and 6 and complete a revised 2019 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded and completed with more tax information in Chapter 8.

(Book name :Income Tax Fundamentals 2019 (37th Edition))

CORRECTED FILER'S name, street address, city or town, state or province, country, ZIP or 1 Payments received for foreign postal code, and telephone number qualified tuition and related expenses Brickell State University 605 Crandon Blvd. Key Biscayne, FL 33149 FILER'S employer identification no. STUDENT'S TIN 44-3421456 STUDENT'S name Crocker Gaytor Street address (including apt. no.) 12340 Cocoshell Rd 261-55-1212 City or town, state or province, country, and ZIP or foreign postal code Coral Gables, FL 33134 Service Provider/Acct. No. (see instr.) Form 1098-T 8 Check if at least half-time student (keep for your records) X $ 3 4,750.00 4 Adjustments made for a prior year $ 6 Adjustments to scholarships or grants for a prior year 9 Checked if a graduate student www.irs.gov/Form1008T OMB No. 1545-1574 2019 Form 1098-T 5 Scholarships or grants $ 995.00 7 Checked if the amount in box 1 includes amounts for an academic period beginning January- March 2020 10 Ins, contract reimb./refund s Tuition Statement Copy B For Student This is important tax information and is being furnished to the IRS. This form must be used to complete Form 8863 to claim education credits. Give it to the tax preparer or use it to prepare the tax retur Department of the Treasury - Internal Revenue Service

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Albert and Allison Gaytors Revised 2019 Tax Return Form 1040 Personal Information Full Name Albert a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started