Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The General Fund the trial balance of Masfout Village as of January 1, 2020, was as follows: Debits Credits Cash $50,000 Accounts Payable $70,000 Taxes

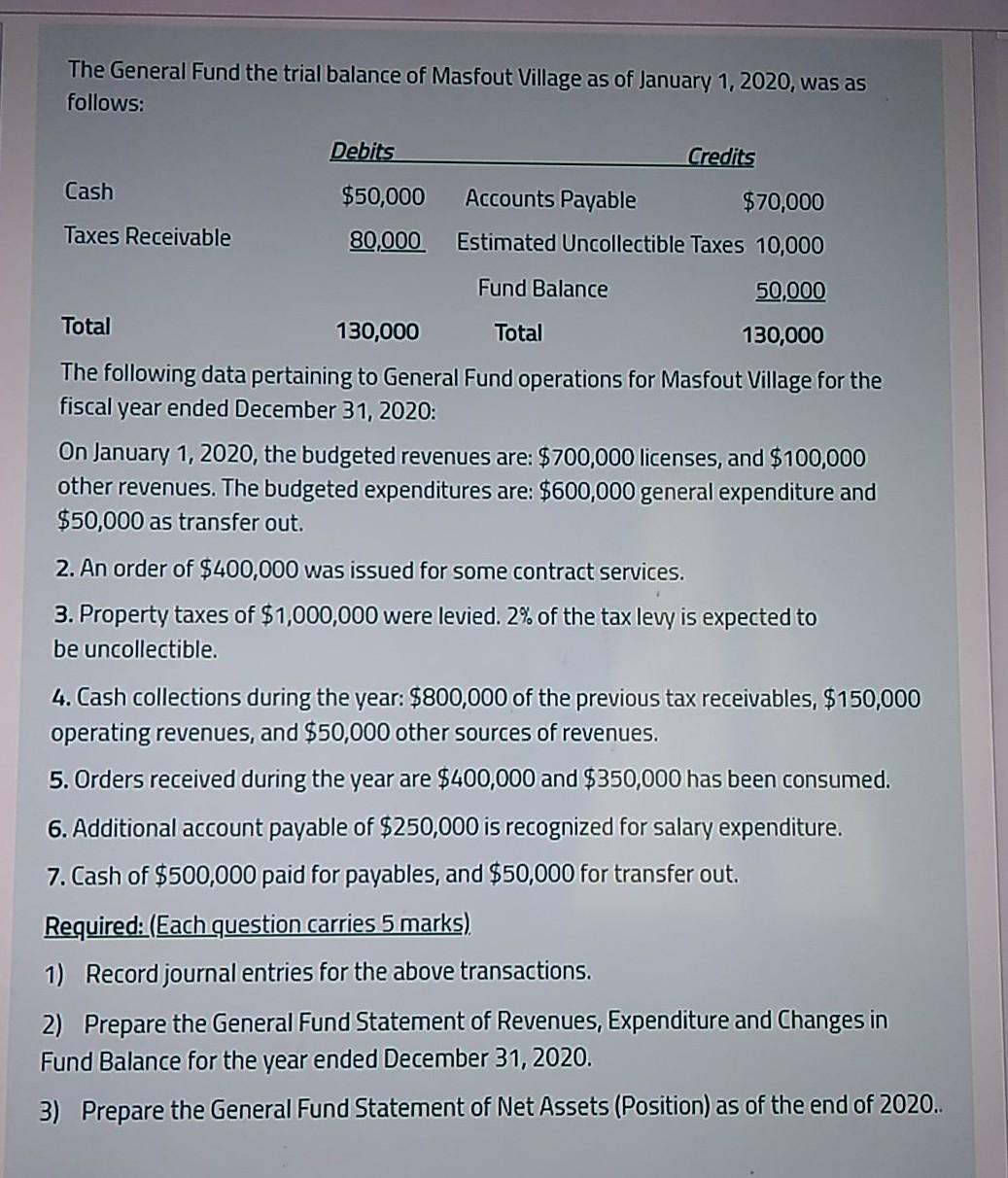

The General Fund the trial balance of Masfout Village as of January 1, 2020, was as follows: Debits Credits Cash $50,000 Accounts Payable $70,000 Taxes Receivable 80,000 Estimated Uncollectible Taxes 10,000 Fund Balance 50,000 Total 130,000 Total 130,000 The following data pertaining to General Fund operations for Masfout Village for the fiscal year ended December 31, 2020: On January 1, 2020, the budgeted revenues are: $700,000 licenses, and $100,000 other revenues. The budgeted expenditures are: $600,000 general expenditure and $50,000 as transfer out. 2. An order of $400,000 was issued for some contract services. 3. Property taxes of $1,000,000 were levied. 2% of the tax levy is expected to be uncollectible. 4. Cash collections during the year: $800,000 of the previous tax receivables, $150,000 operating revenues, and $50,000 other sources of revenues. 5. Orders received during the year are $400,000 and $350,000 has been consumed. 6. Additional account payable of $250,000 is recognized for salary expenditure. 7. Cash of $500,000 paid for payables, and $50,000 for transfer out. Required: (Each question carries 5 marks) 1) Record journal entries for the above transactions. 2) Prepare the General Fund Statement of Revenues, Expenditure and Changes in Fund Balance for the year ended December 31, 2020. 3) Prepare the General Fund Statement of Net Assets (Position) as of the end of 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started