Answered step by step

Verified Expert Solution

Question

1 Approved Answer

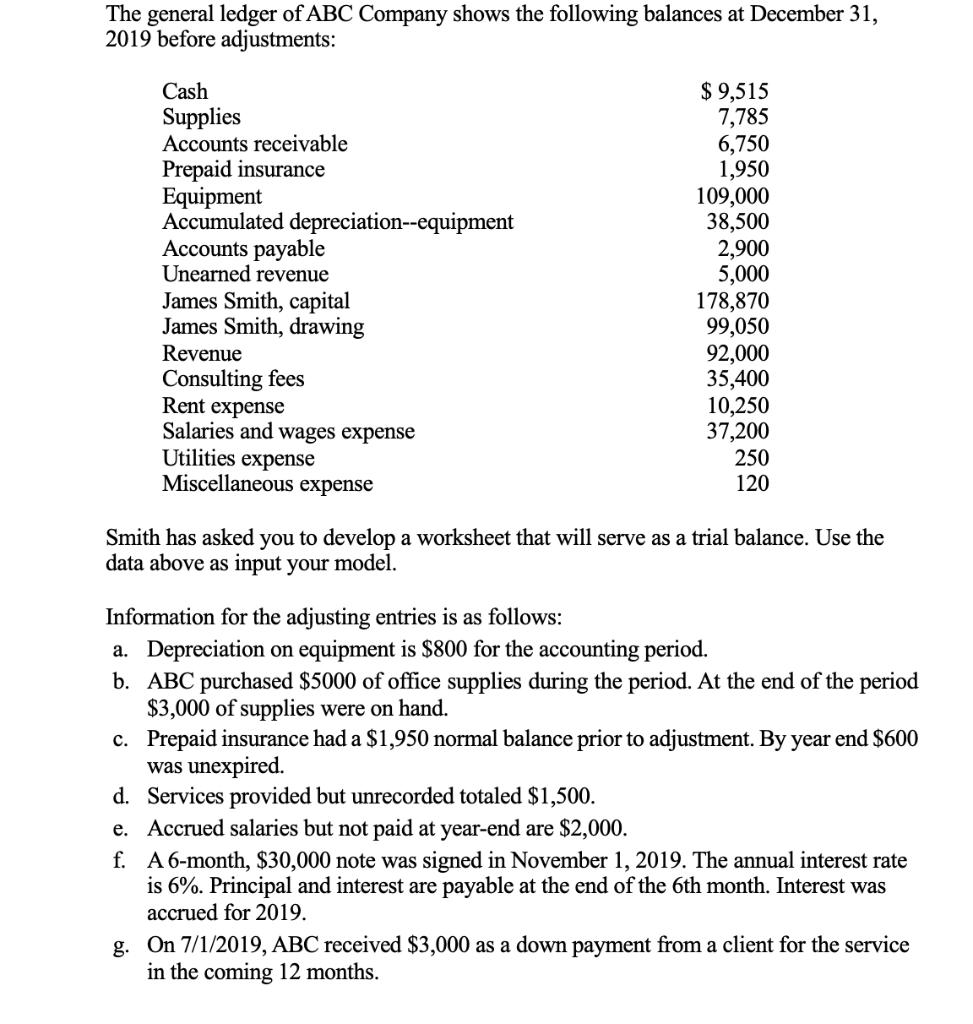

The general ledger of ABC Company shows the following balances at December 31, 2019 before adjustments: Cash Supplies Accounts receivable Prepaid insurance Equipment Accumulated

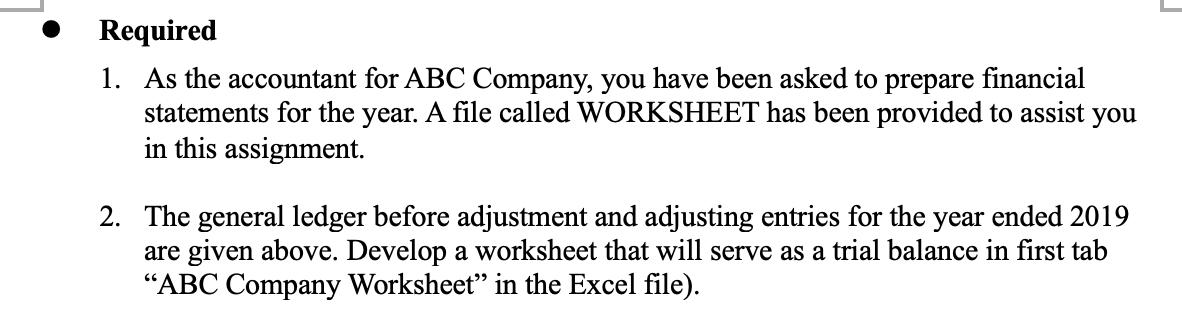

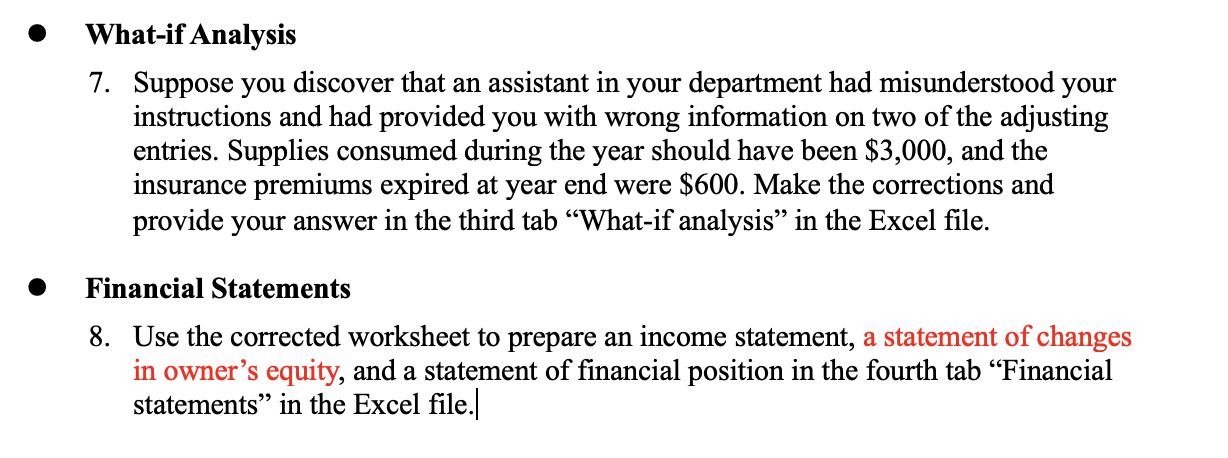

The general ledger of ABC Company shows the following balances at December 31, 2019 before adjustments: Cash Supplies Accounts receivable Prepaid insurance Equipment Accumulated depreciation--equipment Accounts payable Unearned revenue James Smith, capital James Smith, drawing Revenue Consulting fees Rent expense Salaries and wages expense Utilities expense Miscellaneous expense $9,515 7,785 6,750 1,950 109,000 38,500 2,900 5,000 178,870 99,050 92,000 35,400 10,250 37,200 250 120 Smith has asked you to develop a worksheet that will serve as a trial balance. Use the data above as input your model. Information for the adjusting entries is as follows: a. Depreciation on equipment is $800 for the accounting period. b. ABC purchased $5000 of office supplies during the period. At the end of the period $3,000 of supplies were on hand. c. Prepaid insurance had a $1,950 normal balance prior to adjustment. By year end $600 was unexpired. d. Services provided but unrecorded totaled $1,500. e. Accrued salaries but not paid at year-end are $2,000. f. A 6-month, $30,000 note was signed in November 1, 2019. The annual interest rate is 6%. Principal and interest are payable at the end of the 6th month. Interest was accrued for 2019. g. On 7/1/2019, ABC received $3,000 as a down payment from a client for the service in the coming 12 months. Required 1. As the accountant for ABC Company, you have been asked to prepare financial statements for the year. A file called WORKSHEET has been provided to assist you in this assignment. 2. The general ledger before adjustment and adjusting entries for the year ended 2019 are given above. Develop a worksheet that will serve as a trial balance in first tab "ABC Company Worksheet" in the Excel file). Account Title Cash Supplies Accounts receivable Prepaid insurance Equipment Accumulated depreciation-equipment Accounts payable Uneamed revenue James Smith, capital. James Smith, drawing Revenue Consulting fees Rent expense Salaries and wages expense Utilities expense Miscellaneous expense Depreciation expense Supplies expense Insurance expense Interest expense Interest payable Salaries and wages payable Totals Net income Totals Trial Balance Dr. Cr ABC Company Work Sheet For Year Ended December 31, 2019 Adjustments FORM1 FORM2 Dr. 0 Cr. 0 FORM3 FORM4 Adj. T/Balance Cr. Dr. FORM5 FORM6 Income Statement Cr. Dr. FORM7 0 0 FORM8 0 0 Balance Sheet Cr. Dr. FORM9 0 0 FORM10 0 0 What-if Analysis 7. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with wrong information on two of the adjusting entries. Supplies consumed during the year should have been $3,000, and the insurance premiums expired at year end were $600. Make the corrections and provide your answer in the third tab "What-if analysis" in the Excel file. Financial Statements 8. Use the corrected worksheet to prepare an income statement, a statement of changes in owner's equity, and a statement of financial position in the fourth tab "Financial statements" in the Excel file. ABC Company Income Statement For Year Ended December 31, 2019 ABC Company Statement of Changes in Owner's Equity For Year Ended December 31, 2019 Beginning Capital, January 1, 2019 Add: Investment by Owner Net Income Less: Drawings Owner Ending Capital, December 31, 2019. ABC Company Statement of Financial Position December 31, 2019

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Worksheet Accounts Title Cash Supplies Accounts Receivable Prepaid Insurance Equipment Accumulated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started