Answered step by step

Verified Expert Solution

Question

1 Approved Answer

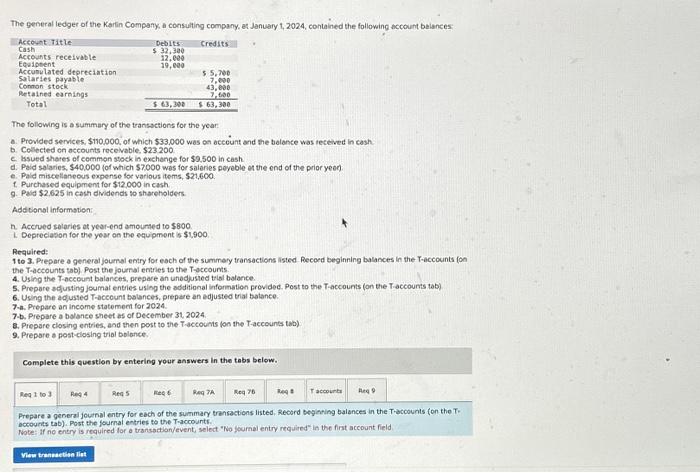

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: Account Title Cash Accounts receivable Equipment

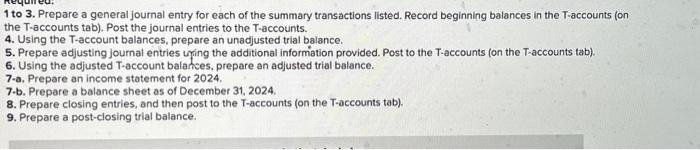

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: Account Title Cash Accounts receivable Equipment Accumulated depreciation. Salaries payable Common stock Retained earnings Total Debits $ 32,300 12,000 19,000 The following is a summary of the transactions for the year: a. Provided services, $110,000, of which $33,000 was on account and the balance was received in cash. b. Collected on accounts receivable, $23,200. $ 63,300 c. Issued shares of common stock in exchange for $9,500 in cash. d. Paid salaries, $40,000 (of which $7,000 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $21,600. f. Purchased equipment for $12,000 in cash. g. Paid $2,625 in cash dividends to shareholders. Additional information: h. Accrued salaries at year-end amounted to $800. L Depreciation for the year on the equipment is $1,900. Required: 1 to 3. Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the T-accounts. 4. Using the T-account balances, prepare an unadjusted trial balance. Req 1 to 3 Credits 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024. 7-b. Prepare a balance sheet as of December 31, 2024. Req 4 $ 5,700 7,000 43,000 7,600 $ 63,300 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Req 5 View transaction list Req 6 Req 7A Req 7B Req 8 T accounts Req 9 Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T- accounts tab). Post the journal entries to the T-accounts. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

how do i do this

The general ledger of the Karlin Company, a consulting company, at January t, 2024, contained the following account belances: The following is a summary of the transections for the year: a. Provided services, $110.000. of which $33,000 was on acceunt and the bolance was recteved in cash. b. Collected en accounts receivable, $23200 c. Bsued shares of common stock is exchenge for $9,500 in cash. d. Paid solaries, $40,000 (of which $7,000 was for saleries peyeble et the end of the prior yeen). e. Pald miscellaneous expense for various items, 521,600 . f. Purchased equipment for $12.000 in cash 9. Paid $2,625 in cash dividends to shareholders. Addconol informovion: h. Accrued salaries at year-end amounaed to $800 L Depreclasion for the year on the equipment is $1,900. Required: 1 to 3. Ptepare a general joumal entry for each of the summery transactions isted. Recoed beginning balances in the T-accounts fon the T-accounts tab) Post the journal erines to the T-accounts. 4. Using the T-account balances, prepare an unadjushed titsi balance. 5. Prepare adjusting jeumat entries using the additional information providec. Post to the T-accounts (on the T-accoums tab) 6 . Using the adjusted Taccount balances, prepare an adjusted vial batance. 7-a. Prepare an income statement for 2024. 7-b. Prepare a bolance sheet as of December 31,2024. 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab) 9. Prepare a post-ciosing trial bolence. Complete this question by entering your answers in the tabs below. Prepare a general joumal entry for each of the summary transactions listed, Record begiening balences in the T-accounts fon the T. occourts tab). Post the foumal entries to the T-accounts. Note: if no entry is required for a transactian/event, select "Wo foumal entry required" in the fint account field. 1 to 3. Prepare a general journal entry for each of the summary transactions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the T-accounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries uring the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balahices, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024. 7.b. Prepare a balance sheet as of December 31, 2024. 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started