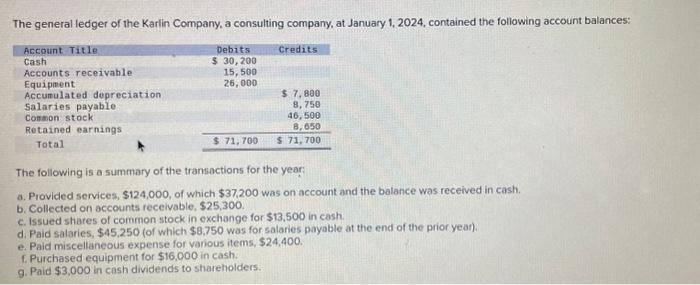

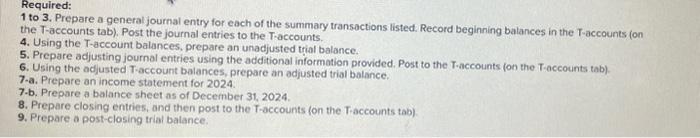

The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: The following is a summary of the transoctions for the year: a. Provided services, $124,000, of which $37,200 was on account and the balance was received in cash. b. Collected on accounts receivable, $25,300. c. Issued shares of common stock in exchange for $13.500 in cash. d. Paid salaries, $45,250 (of which $8,750 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $24,400. f. Purchased equipment for $16,000 in cash. 9. Paid $3,000 in cash dividends to shareholders: Required: 1 to 3. Prepare a general journal entry for each of the summary transoctions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the Taccounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024. 7.b. Prepare a balance sheet as of December 31, 2024. 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance. The general ledger of the Karlin Company, a consulting company, at January 1, 2024, contained the following account balances: The following is a summary of the transoctions for the year: a. Provided services, $124,000, of which $37,200 was on account and the balance was received in cash. b. Collected on accounts receivable, $25,300. c. Issued shares of common stock in exchange for $13.500 in cash. d. Paid salaries, $45,250 (of which $8,750 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $24,400. f. Purchased equipment for $16,000 in cash. 9. Paid $3,000 in cash dividends to shareholders: Required: 1 to 3. Prepare a general journal entry for each of the summary transoctions listed. Record beginning balances in the T-accounts (on the T-accounts tab). Post the journal entries to the Taccounts. 4. Using the T-account balances, prepare an unadjusted trial balance. 5. Prepare adjusting journal entries using the additional information provided. Post to the T-accounts (on the T-accounts tab). 6. Using the adjusted T-account balances, prepare an adjusted trial balance. 7-a. Prepare an income statement for 2024. 7.b. Prepare a balance sheet as of December 31, 2024. 8. Prepare closing entries, and then post to the T-accounts (on the T-accounts tab). 9. Prepare a post-closing trial balance