Question

The Gilded Hoop, Inc. has been solicited by an owner of five stores within the greater Los Angeles area who is contemplating the sale of

The Gilded Hoop, Inc. has been solicited by an owner of five stores within the greater Los Angeles area who is contemplating the sale

of his company and exploring the possibility of The Gilded Hoop as a potential buyer.

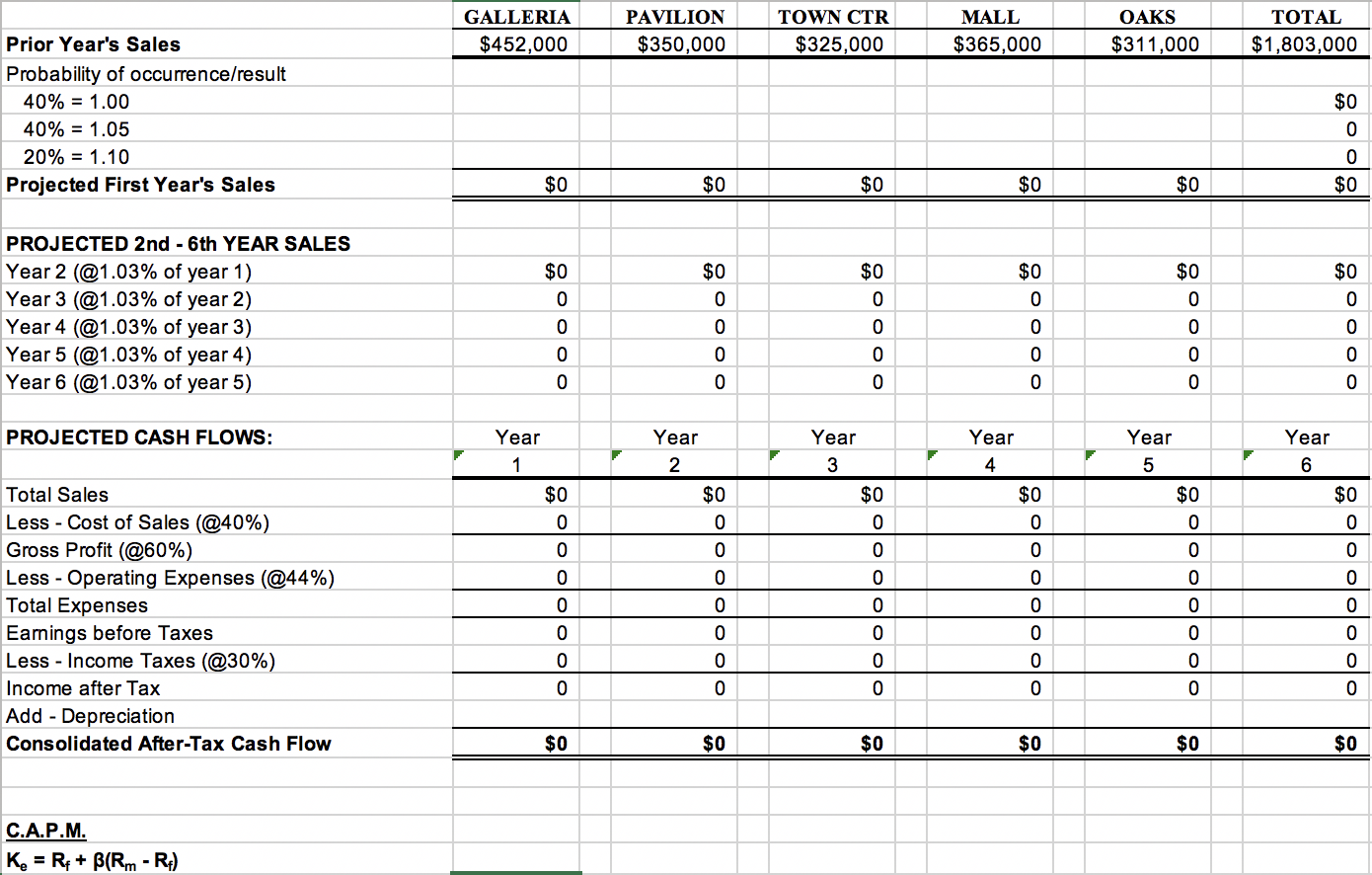

Listed below are the five stores and the sales volume for their most recent fiscal year:

GLENDALE WESTSIDE MONTEBELLO FOXHILLS SHERMAN

GALLERIA PAVILION TOWNCENTER MALL OAKS

$452,000 $350,000 $325,000 $365,000 $311,000

The Gilded Hoop feels that the annual sales volume most recently generated by the existing company is a basis for projecting its own sales. As a guideline, the merchandising department feels that there is a 40% probability that the stores will do last year's business....a 40% probability that they will do 5% more volume than last year...and lastly, a 20% probability that they will do 10% more volume than last year.

Given the projected first year's sales volume (from above) that The Gilded Hoop anticipates generating; it is projected that the sales of the five stores will thereafter experience a compound annual growth rate of 3% per year.

Each of the stores has 6 years left on their respective leases with no provision for renewing the leases at their intended expiry date. The Gilded Hoop feels that eachstore will initially require a $50,000 remodeling cost immediately upon purchase of the stores, as well as an immediate required inventory investment of $50,000 in each of the five locations, with an additional amount of required inventory in the following year of $20,000 for each of the locations.

The Gilded Hoop estimates that the Gross Profit will approximate 60% of Sales and Total Operating Expenses are estimated at 44% of Sales. Aggregate depreciation, for allof the stores, (the provision of which, isincluded in Operating Expenses), is estimated at $100,000 per year, once again included in the projected Operating Expenses. The combined Federal and State tax rate is 30%.

The Gilded Hoop, Inc. explores each potential location it opens through a "NetPresent Value"analysis. The acquisition, if

undertaken, will be allequityfinanced. Thus, as to its Cost of Equity Capital, The Gilded Hoop utilizes an industry"Beta"

of 1.32.Additionally, the prevailing 10 year U.S. Treasury Bond yield is 7.44%,and the market risk premium is estimated at 8%.

The owner of the five stores is seeking $650,000 for all the assets and rights of all of his five stores under the respective leases. It is assumed that The Gilded Hoop could immediatelysell off the present owners inventory (which has an estimated retail value of $150,000), for 50% of its original retail (you may disregard any tax considerations in connection with the disposition value of the sellers inventory). The deal is essentially all five stores or nothing at all.

With consideration to the above, should The Gilded Hoop undertake the acquisition? If it does not appear to be a justified price, would you propose an alternative settlement that you could support offering the present owner?

some hint:

1) the "market risk premium" referenced in the exam, is also known as an "excess market return" or "equity risk premium"; 2) I would expect that once the NPV analysis is obtained, I would look for the acquisition's embedded return from the purchase of the five stores.

I want to emphasize that it is absolutely unnecessary to derive an NPV for each store because it is an "all or nothing" acquisition, thus focus on the acquisition's NPV and the acquisition's IRR. For those who believe that a counter-offer is warranted, please advise, and support your counter-offer with its resultant NPV and performance return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started